By leveraging innovation, equipment manufacturers will become the key enabler for CO2 reduction: a €1 trillion business opportunity fueled by regulation as well as public and private money. To take advantage of this opportunity and become winners in the next decade, equipment manufacturers need to develop a clear strategy now.

The COVID-19 pandemic has displaced the decarbonization debate over the past few months. Nonetheless, reducing global warming remains a critical objective, and the goal will soon find itself high on the agendas of decision-makers in every economic sector.

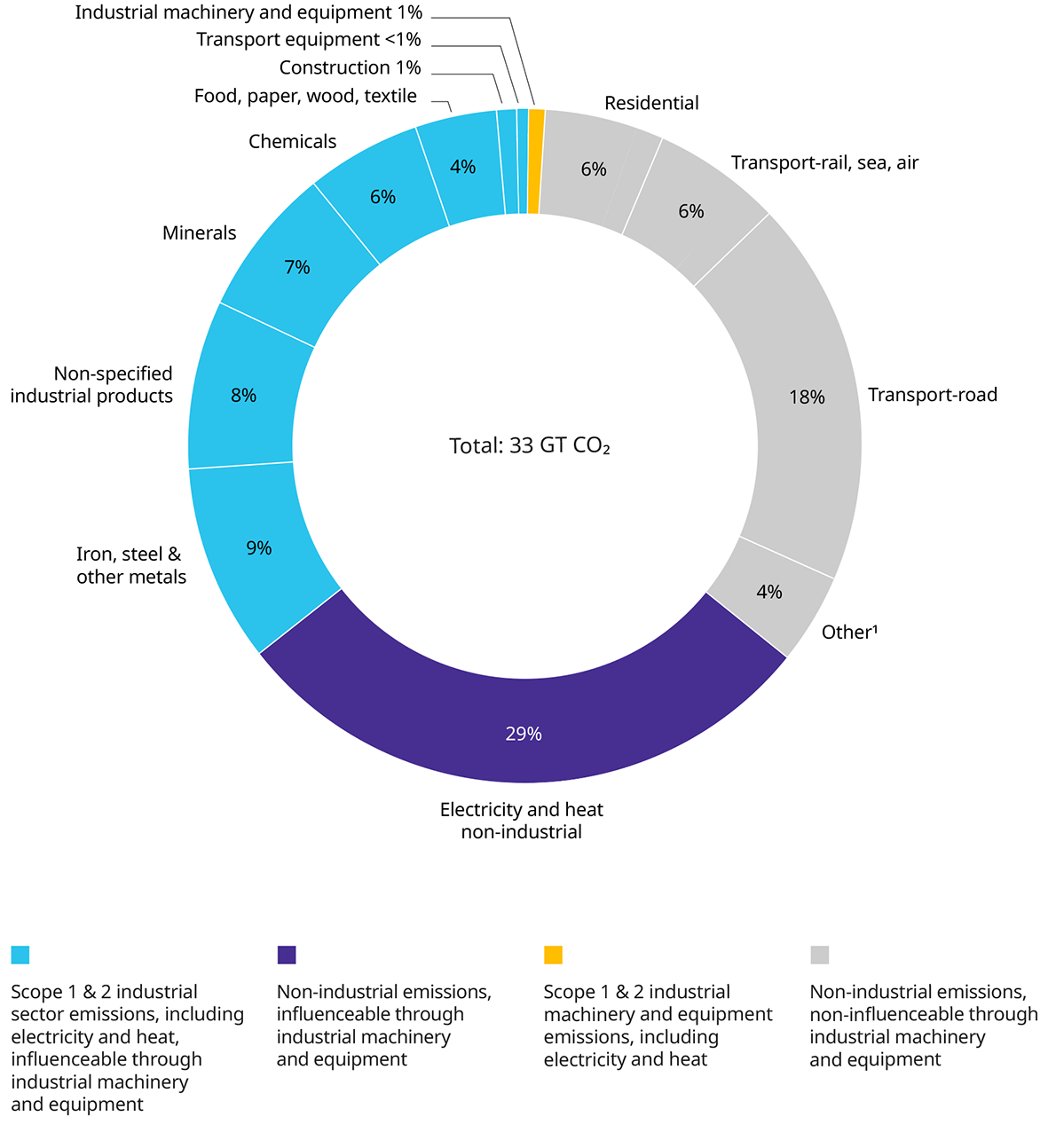

Currently, industrial machinery and equipment manufacturers account for approximately 1 percent of total global emissions. (See Exhibit 1.) As a result, achieving internal carbon neutrality at equipment manufacturers will have little impact on the big picture.

Exhibit 1: Industrial machinery and equipment sector with small lever for itself, but with big lever for other sectors

Worldwide CO2-emission by sector 2017

1) Other includes commercial and public services, agriculture/forestry, fishing and non-specified other

Note: Industrial electricity and heat allocation on industry sectors based on 2016 figures

Source: IEA, Oliver Wyman analysis

Industrial machinery firms are typically the ones who deliver equipment into numerous sectors that produce energy, materials and goods — emitting CO2 themselves when using that equipment. Those sectors, in total, are responsible for almost 70 percent of the emissions that could be affected through decarbonization technology. This reflects a huge lever — and business opportunity — for equipment manufacturers.

Big Funding

Paving the way toward this opportunity is unprecedented funding: The European Union Commission has announced €1 trillion in public spending and financing support across all sectors as part of the "Green Deal,“ which was presented in December 2019. In addition, many global investment funds stated — and reiterated during the COVID-19 crisis — their intention to funnel private money into the winning business models of the decarbonization era.

The money will be well received: According to a recent CDP/Oliver Wyman study of firms representing about 75 percent of European market capitalization, vast amounts of capital are needed to achieve climate goals — especially in power generation and production of materials like steel and cement. In 2019, the European firms covered by the study reported €60 billion of low-carbon capital investments. But for Europe to achieve CO2 neutrality by 2050, this investment at least needs to be doubled, to €120 billion annually — which is quite a stretch.

Now more than ever, it is important that European countries invest in renewable energy and other low-carbon technologies to build back better after the COVID-19 pandemic, creating new jobs and rebooting their economies. Embracing renewable energies and energy efficiency policies will not just protect our planet, but will also create a healthier and resilient world for all. Already today we offer leading-edge solutions to combat climate change. Moreover, our parent company was the first global industrial company to commit towards carbon neutrality by 2030.Miguel Ángel López, Chairman, Siemens Gamesa Renewable Energy

Machinery Makers: Internal Carbon Neutrality As "Hygene Factor"

The EU Commission set the target to reach carbon neutrality by 2050. Until then, tighter regulations and significantly higher CO2 prices can be expected. European firms are obliged to minimize their own internal emissions. For equipment manufacturers, achieving carbon neutrality by the 2050 goal will be more a matter of a "hygiene factor“ driven by public pressure rather than a strategic differentiator. A more ambitious strategy of reaching carbon emission goals would accrue some benefits to machinery manufacturers like greater appreciation in capital markets and among employees. Those gains for the most part would, however, be reputational and bring only minimal economic advantages to manufacturers.

Regardless, European machinery firms still have much work to do. Driven by a relatively low price of CO2, firms on average have reduced their emissions only by around 2 percent annually in the last three years. Looking ahead, only 43 percent of examined European industrial equipment makers have announced any CO2 goals. Their declared objectives are only “halfway“ (that is, they represent a reduction of about 50 percent of today’s emissions) or follow the 2050 timeline of carbon neutrality. US firms have been even more conservative: Only 19 percent have made announcements, with an average reduction target of 25 percent.

Three Paths For Seizing A €1 Trillion Opportunity

Assuming that capital investments of €120 billion annually are needed to achieve carbon neutrality in Europe by 2050, more than €1 trillion will have to be spent on green solutions relevant to equipment manufacturers over the coming decades. That is a huge value pool waiting to be drawn on by companies investing in low-carbon technology and by industrial equipment manufacturers developing that innovation. How do industrial equipment makers go about seizing the opportunities? There are three distinct paths: Three distinct paths lie before manufacturers:

Path 1

involves incremental hardware improvements via regular research and development (R&D) cycles, for instance a much more powerful wind turbine. Additional improvements could be realized by offerings based on software and industrial Internet of Things solutions that allow for more efficient energy use of existing hardware through data analytics.

Path 2

includes groundbreaking solutions and reinventions of entire production processes, with substantially lower emissions than baseline "legacy“ solutions. The decarbonization impact — as well as necessary R&D investments and risks — will be much greater than in Path 1. Examples of innovative solutions are the use of hydrogen technologies in steel or cement production or decentralized, integrated power generation systems based on renewables that are deployed in production factories.

Path 3

incorporates carbon capture, utilization, and storage (CCUS) technologies that allow for the capture of existing CO2 and its use for new purposes Those technologies can focus on storing CO2 in underground reservoirs via compression/injection or converting CO2 from the atmosphere or production processes into raw material for new products such as chemicals.

Equipment manufacturers must decide on what role they want to play, what their ambition is, and how to position themselves to succeed in accessing the available funds.

We are a global engineering company. Therefore, we want to deliver meaningful impact not only by reducing our own CO2 footprint but especially by supporting our customers to significantly reduce their emissions. To achieve this, our goal is to further boost and expand our corporate portfolio of energy efficient, low-carbon production technologies.Dr. Jochen Weyrauch, Deputy CEO, Dürr AG

A Decarbonization Strategy To Catch The Opportunity

Top management at machinery manufacturers can start this process by providing a clear vision and guiding themes around decarbonization. The strategy should be comprised of two interlinked pieces:

Internal decarbonization: Firstly, create transparency around the areas for taking action: Map out the stakeholder landscape, and assess the risks of delaying or going slow. Secondly, develop a target picture on internal de-carbonization that includes a decision on whether to be proactive or reactive regarding the CO2 ambition. Thirdly, quantify targets and define an action plan.

Harnessing opportunities from low-carbon products: Firstly, quantify potential decarbonization “value pools” in customers’ industries. Maturity and pre-conditions of future technologies need to be understood along with in-house competencies and the competitive situation. Secondly, develop a low-carbon business portfolio, including assessment of business cases and funding opportunities. Thirdly, inorganic moves are likely to be required: Along internal actions, M&A strategies will need to be developed in this last step.

It is hard to drive the strategy single-handedly. To succeed, corporates will need an effective ecosystem of partners, including customers, suppliers, rating agencies, startups, and advisers. Equipment manufacturers should start crafting their decarbonization strategy now — the COVID-19-induced downturn could be a good time for a green reinvention.

At INDUS Group, we have set clear CO2 reduction targets and pursue an ambitious emissions reduction path in order to maintain an above-average speed on our way to CO2 neutrality. As a holding, we support our portfolio companies in further developing the current strategy as well as financially, by means of our internal sustainability development bank, which helps to facilitate required investments and adjustments in production processes.Dr. Jörn Großmann, Board Member, Indus Holding AG