Collaborative combat, multiarmy and multi-platform collaboration, a new generation of technologies such as artificial intelligence (AI) and autonomy, and geopolitical collaboration have fostered an increasing exchange of data between equipment, weapons platforms, and armies. This flow of data represents a new area of investigation and paves the way, amongst other digital opportunities, to an increasingly important role for digital services.

These digital services will contribute toward improving aftermarket activities, such as performing maintenance and overhaul on defense systems, and address the current challenges for support activities. However, digital services will also reshape the future competitive landscape of the global defense industry.

New challenges for support services

Acceleration of digital services

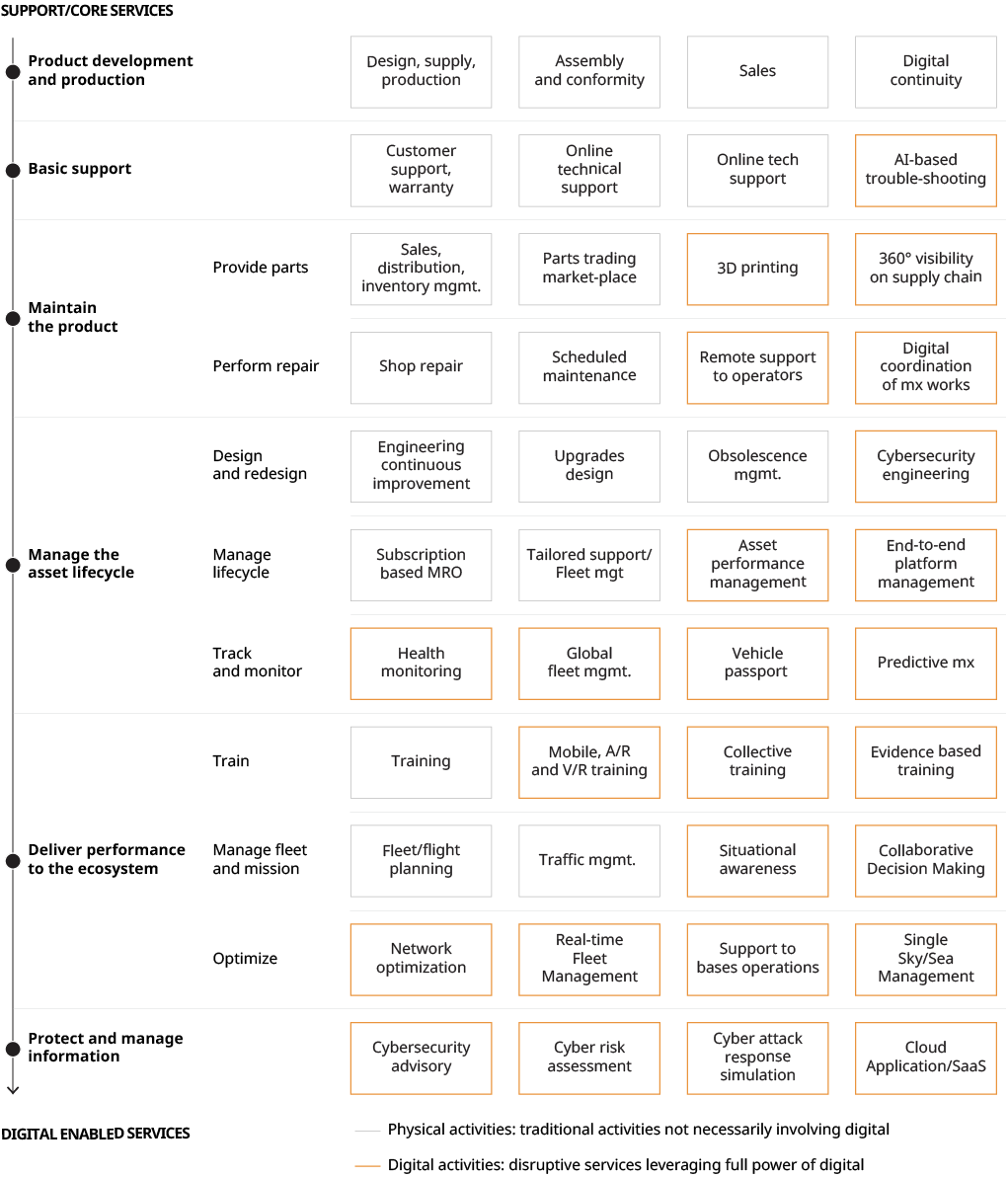

These challenges are reshaping the support services activities in the defense industry, and opening doors to digital-services providers. (See Exhibit 1.)

Digital services will help improve current maintenance activities and increase maintenance providers’ competitiveness and quality. The consolidation and analysis of data from different sources (equipment, mission, external factors, and more) will help anticipate failures and better address them when they occur. It will improve transparency and predictability of failures and give ministries of defense longer-term visibility on maintenance budgets. In parallel, digitalizing maintenance activities will foster the evolution towards condition-based maintenance, structured around the service-level agreement (SLA), giving the whole industry an opportunity to better manage costs. Air forces tend to be a bit further along in their journey toward adopting these services due to the experience from civilian aerospace industry, but land and naval forces are rapidly catching up.

Looking ahead, the consolidation of data from different stakeholders on the value chain (equipment, platforms, military bases, and operators) will create new value spaces, at the interface between the various players, such as armed forces, OEMs, suppliers, and maintenance providers. New services will emerge to optimize assets and deliver better performance to the whole defense ecosystem. Some examples of the new services include digital training of operational forces for maintenance on the ground, remote assistance for maintenance operations, better traceability of spare parts to optimize availability on the ground, optimization of military base operations by anticipating maintenance needs, or support to mission preparation thanks to 360-degree visibility on the fleet and configurations.

Exhibit 1: Example of a defense services value chain (non-exhaustive)

Source: Oliver Wyman analysis

Digital services will impact all aspects of the aftermarket activities and could represent revenues of up to $20 billion globally by 2030.

Three factors need to be set up to unlock these new services: first, developing robust digital platforms that are connected to the different sources of data to collect and analyze them, with the right level of cybersecurity protection; second, defining data governance amongst public and private stakeholders, with clear rules on data ownership and location; and third, creating business models generating value, to convince industrial players to invest in new technologies.

First-mover advantage: Industrial players must avoid intermediation

Defense players are moving to capture these new streams of value, but are also seeking to avoid intermediation and loss of value: aftermarket services represent up to 50 percent of most industrial players revenues and generate strong margins.

Platform OEMs are leveraging their prime position to capture maintenance verticalization contracts and extend the scope of their support activities at the expense of other suppliers. As a result of such contracts, Tier-1 players find themselves caught in the middle, losing a valuable part of the contract to OEMs. To avoid that outcome — and to compete with platform OEMs — they are enlarging their scope of data via partnerships to achieve critical mass and offer maintenance verticalization services. In this context, being a first mover is vital.

Incumbent industrial players are also challenged by the entry of new competitors into the sector: Information system/information/information technology (IS/IT) providers are building on their software expertise in the civilian realm and army IS/IT expertise to collaborate with defense players and develop/integrate digital platforms and operational services. Service providers are leveraging their presence on the battlefield with end clients to digitalize their offerings and are in a strong position to mobilize technical maintenance operations on military ground. Plus, startups are entering the market through data, niche services and software-as-a-service offering, exploiting the slower digitalization of incumbents.

In this complex and evolving environment, the status quo on the competitive landscape is up for grabs, and value can shift rapidly. To survive and thrive, industrial players must define their digital strategy, developing a win-win business model to attract partners and positioning themselves as the architects of future defense ecosystems.