While the performance of European banks has recovered from the lows of 2008 the average return on capital of 4.4 percent remains well below the hurdle rate. This average masks large geographic differences; banks in some EU markets have completed this restructuring process, while other markets continue to struggle.

However all of Europe’s banks now also find themselves having to deal with a rapidly changing environment. New customer preferences, digital interfaces and platform businesses are changing how customers bank – a trend that will be accelerated by regulators’ push for “open banking”. Automation and data tools are creating the opportunity and imperative to significantly cut cost bases.

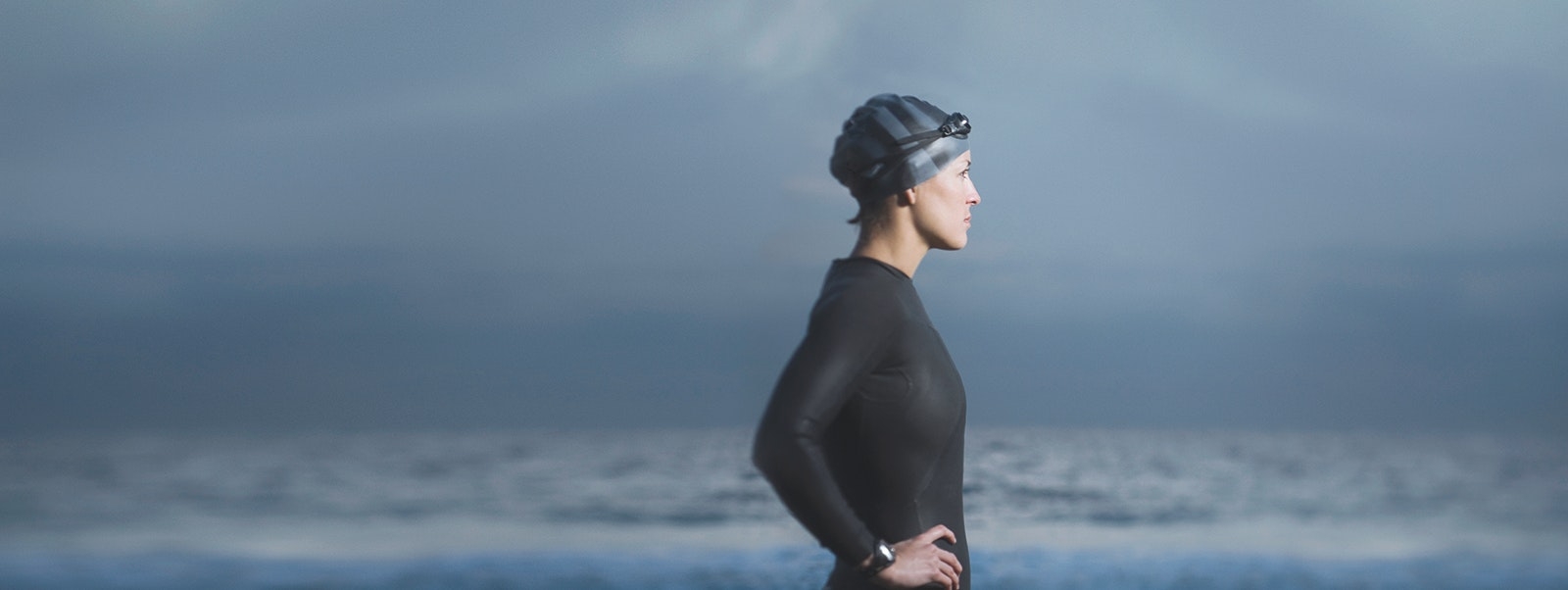

In short, Europe’s banks may emerge from the crisis only to face a whole new set of challenges. The new agenda is going to require boldness of a kind: going beyond restructuring and making changes to the banking business model itself. To date, only a few organizations are taking action to fully address these new challenges.

We believe the incumbents in the sector still have major structural advantages and can thrive if they make the bold moves necessary.