Restructuring Study 2017

Economic growth in Europe has been positive in recent years – fueled in part by favorable macroeconomic trends and lower lending costs. Nonetheless, Europe as a whole has not fully recovered from the financial crisis, and non-performing loan ratios in many European countries remain high.

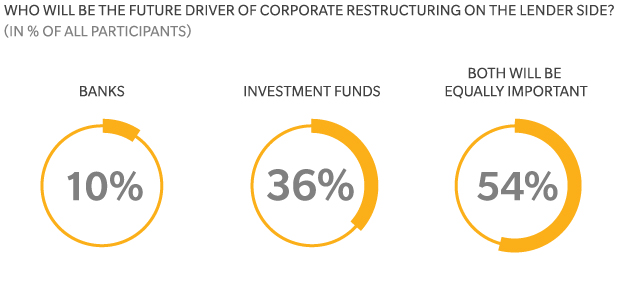

Until recently, banks that provided the financing have been the driving force behind most turnaround and restructuring processes. But this is changing. The restructuring of non-performing loans is becoming increasingly difficult for banks, as holding on to the loans places increased pressure on their balance sheet from regulators and supervisors. The changed landscape, however, represents an opportunity for investment funds, which possess a large amount of “dry powder” and an appetite to take over and restructure the loans.

A New Era in Corporate Restructuring

The restructuring study 2017 analyzes this changing landscape. According to the key finding of the study, the majority of experts believe that in the future banks and investment funds will be equally important in driving restructuring processes. Furthermore, they expect investment funds will place greater emphasis on achieving a sustainable strategic and operational turnaround of the debtor, rather than seeking a short-term solution.