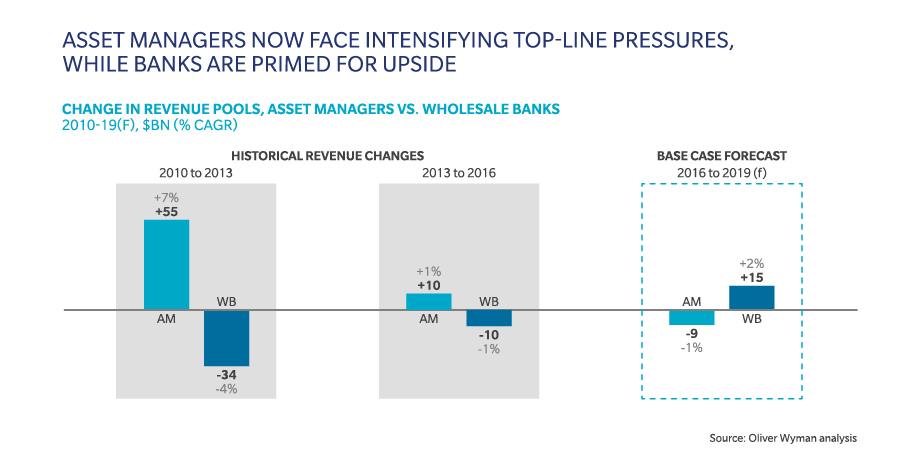

We see a reversal of fortunes for wholesale banks and asset managers. The effects of Quantitative Easing (QE) and bank regulation drove a $100BN divergence in revenue performance in favour of asset managers since 2011. This now looks set to go into reverse as asset managers face growing fee pressures and wholesale banks benefit from shifts in policy, technology, and operating leverage. The gulf between winning and losing firms will widen.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Key Implications for Asset Managers

Sustained fee pressure is a growing threat for Asset Managers; the shift to passive is well understood, but the market may have underestimated the extent of change underway in active, hence downside risks outweigh the potential upside. The core proposition is evolving, blurring traditional product lines; for example, asset allocators using ETFs, and traditional asset management encroaching on alternatives. Operating model reform will be required to defend profits – specifically cost reduction.

Key Implications for Wholesale Banks

Policy shifts have radically improved the outlook for wholesale banks and they can now see a clear path to above hurdle returns; however, uncertainty remains. Technology transformation will gather pace and has the potential to transform the cost base, while simultaneously opening the door for new competitors. As capital pressures ease, structural shifts in the client base will redraw the battle lines for wholesale banks and we expect the spread of returns across banks to remain wide as the effects of operating leverage and capital play through.

Christian Edelmann, co-author, on the key messages of this year's report

Asset managers have benefited from a long period of revenue growth and risk underestimating the scale of the challenge ahead. Acting on costs is critical now but asset managers would be mistaken to believe that this is sufficient. Many will have to reinvent the core proposition in portfolio management which will lead to blurring product lines as traditional managers branch out both into private assets or ETF structures and embrace new approaches such as risk factor investingChristian Edelmann, Partner and Head of Oliver Wyman's global Corporate & Institutional Banking and Wealth & Asset Management practices, Financial Services

We take a much more positive view on the wholesale banking sector this year, reflecting the big changes in the policy landscape that have taken place. Rising interest rates and robust valuations should help revenues, and it looks like there will be a softening of some of the capital pressures. If this holds, we will probably see some more capacity come back into the industry, and a real fight for share. There is huge uncertainty however, and we think banks will continue to push hard on the technology transformation agenda where we think there are still major cost savings to be had. We discuss the growing pressures asset managers are facing and that are likely to have a big impact on the banks – squeezing the buy side wallet, as well as creating some new opportunities in how those clients are servedJames Davis, Partner in Oliver Wyman’s Corporate & Institutional Banking Practice