In late September and early October of this year, Oliver Wyman conducted its second global survey of travelers to capture how views of travel are changing as the COVID-19 pandemic — and responses to it — evolve. Our prior survey was conducted in April/May and those results can be found here.

Our ”Edition 2” survey involved more than 4,600 people across nine countries (Australia, Canada, China, France, Germany, Italy, Spain, United Kingdom, United States), all of whom had flown at least once in 2019. A third also have traveled by air and/or rail in the past six months. Our first survey was conducted after the initial peak in COVID-19 cases, border closures, and lockdowns; the second was conducted as COVID-19 cases began to grow to a new peak in the US and Europe.

In deciding when they will be ready to travel, survey respondents are putting less weight on government and public policy and more on personal risk assessment, as compared to the May survey. Despite cases being on the upswing during the survey period, some 30 percent of respondents in France and Italy and 25 percent in the United States think it’s okay to travel now.

Exhibit 1: “When do you think it will be okay to start your first trip after the COVID-19 outbreak?”

First choice, % of total survey respondents

Source: Oliver Wyman 2020 Traveler Sentiment Survey, Oliver Wyman analysis

LEISURE TRAVEL

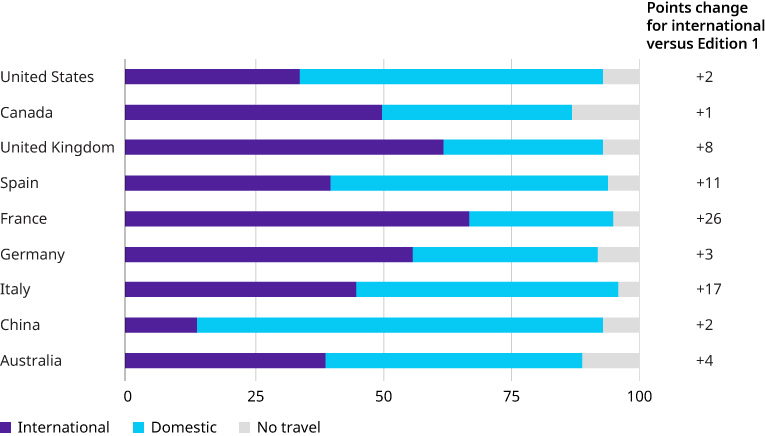

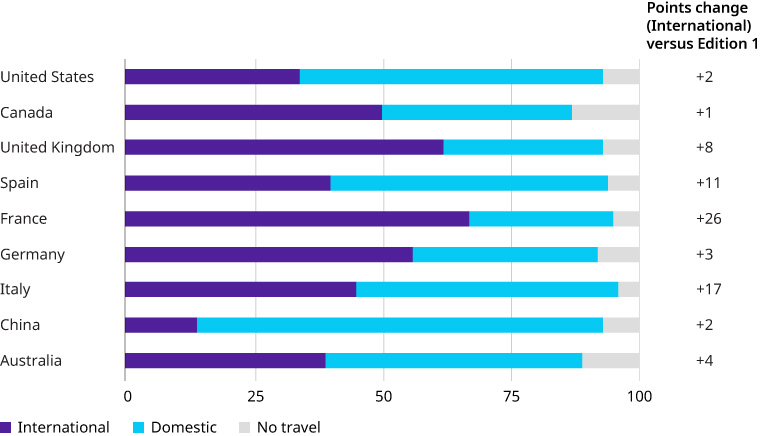

Interest in leisure travel remains strong, with 63 percent expecting to travel the same amount or more post-pandemic. Half or more of leisure travel respondents in Canada, United Kingdom, France, and Germany expect their next leisure trip post-pandemic to be international (Exhibit 2). In Europe and Asia/Australia, leisure travelers largely expect their next international trip to be within their own regions. More than half of Americans planning an international next trip, however, want to go to Europe.

Exhibit 2: “Leisure travel: When COVID-19 travel restrictions are lifted, what is your likely destination for your next leisure trip?”

% of country’s respondents

Source: Oliver Wyman 2020 Traveler Sentiment Survey, Oliver Wyman analysis

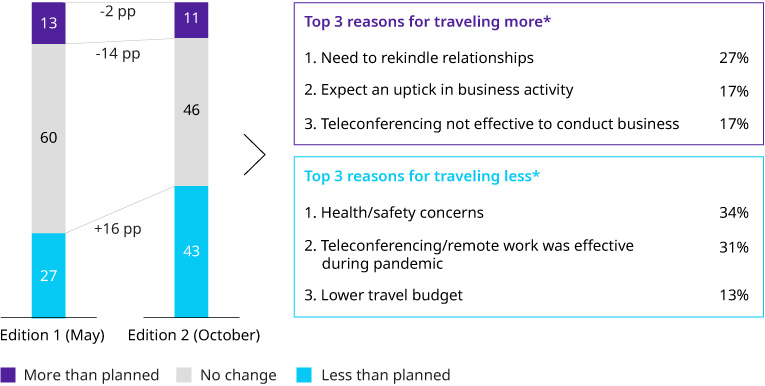

BUSINESS TRAVEL

Forty-three percent of all respondents who travel for business plan to travel less in the future – up from 27 percent in our prior survey (Exhibit 3). An increasing number of respondents have gotten comfortable working remotely – and of note for the travel industry, this is particularly true for airline and hotel elite members.

Exhibit 3: Business Travel Plans Post-Pandemic

Note: Business respondents are only those who traveled for business when air travel was required prior to the pandemic

Source: Oliver Wyman 2020 Traveler Sentiment Survey, Oliver Wyman analysis

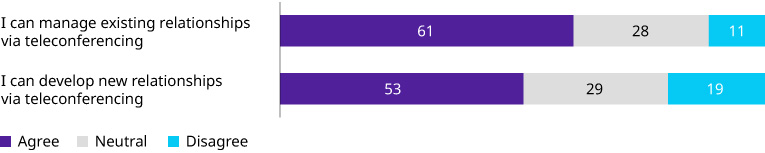

Teleconferencing is becoming the communications tool of choice, but business travelers are less convinced that teleconferencing is effective for building relationships (Exhibit 4). For travel companies, these findings suggest that messaging to customers will need to focus more on the importance of people coming together to forge or maintain relationships.

Exhibit 4: “Do you agree or disagree with the following statements on teleconferencing?”

% of respondents, only those that travel for business

Source: Oliver Wyman 2020 Traveler Sentiment Survey, Oliver Wyman analysis

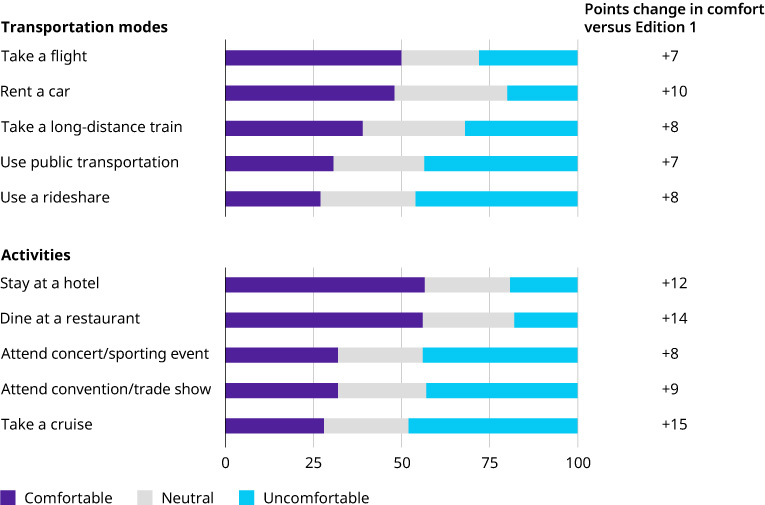

TRANSPORTATION CHOICES

Survey respondents overall are more comfortable with various transportation options and activities than they were in May, with half now comfortable taking a flight and 56 percent comfortable staying at a hotel. But less than a third are comfortable using public transportation or ride sharing (Exhibit 5). Activities involving large groups continue to be problematic, although comfort with cruising has more than doubled since the prior survey (from 13 to 28 percent). Post-COVID, more than a quarter of respondents overall say they will drive more than before.

Exhibit 5: “After the COVID-19 outbreak ends and travel restrictions are lifted, how comfortable will you feel doing each of these activities?”

% of respondents

Note: Uncomfortable = “Very uncomfortable” or “Somewhat uncomfortable”; Comfortable = “Very comfortable” or “Somewhat comfortable”

Source: Oliver Wyman 2020 Traveler Sentiment Survey, Oliver Wyman analysis

PANDEMIC TRAVEL EXPERIENCES

A new feature of the Edition 2 survey was that we asked people about travel they have undertaken during the pandemic. Overall, 31 percent of respondents have traveled by air and 24 percent by train (2+ hours) since March of this year. About two-thirds of these trips were for leisure, primarily to visit family and friends or for a change of scenery.

Half of travelers were excited to travel; only a quarter reported being reluctant (Exhibit 6). In addition, more than three-quarters of those who traveled recently were satisfied with most components of the travel experience in terms of convenience and safety (such as check-in, security, boarding process, passenger and crew PPE, etc.). Food and beverage and airport/station retail were slightly less satisfactory.

Exhibit 6: “What was your sentiment toward your recent travel experience(s)?”

% of respondents, by country

Source: Oliver Wyman 2020 Traveler Sentiment Survey, Oliver Wyman analysis

CLEANLINESS AND SAFETY

As in our first survey, stated cleaning policies and treatment of travelers during the pandemic rank just below price as top factors driving purchase decisions for flying and lodging, although respondents seem slightly less worried than they were in May. A majority of respondents also report that they trust their primary airline and hotel brand cleaning policies.

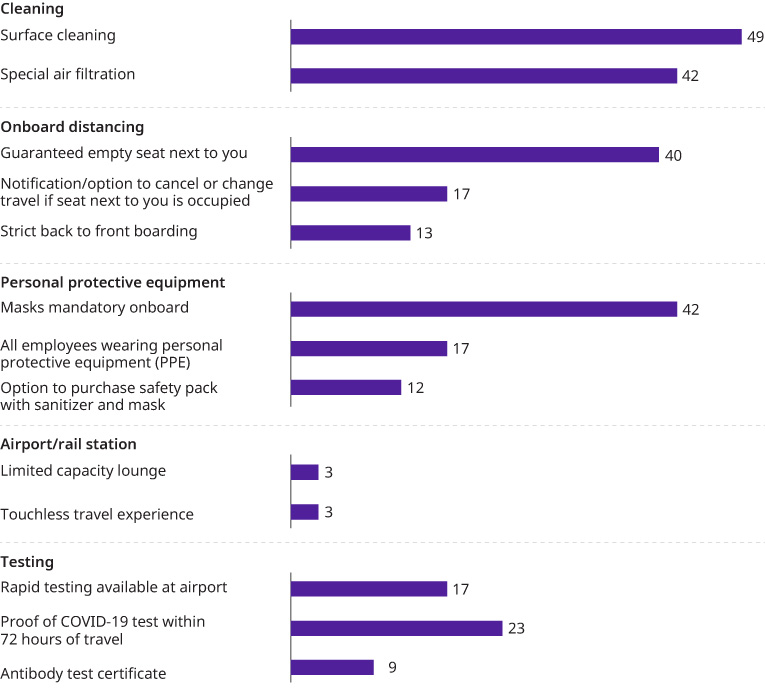

Travelers view cleaning and mask mandates as the most important travel health and safety measures, and 40 percent would still like to see an empty seat next to them on planes and trains (Exhibit 7). Rapid testing received little attention but could be an important tool in reducing onboard contagion – so travel providers should be ready to articulate to their customers how their evolving responses will keep travelers safe.

Exhibit 7: “Which of the following measures to ensure traveler health and safety are most important to you?”

Top three choices, % of respondents

Source: Oliver Wyman 2020 Traveler Sentiment Survey, Oliver Wyman analysis

OUTLOOK FOR TRAVEL

Extended global events such as pandemics have the potential to drive a faster pace of disruption and innovation. In the present case, for example, online shopping and teleconferencing have seen a large and rapid uptick in adoption that is likely to become permanent. Across most countries, half or more of survey respondents expect that their long-term travel habits will change.

Airlines, hotels, rail, and other travel companies are likely to see a shift in their core customer base due to reduced business demand, with leisure travel driving the recovery. Even then, long-distance international travel and extended trips may take longer to recover in some markets, and customer expectations are likely to be higher than ever for cleanliness, safety, and convenience.

Our full report offers an in-depth and detailed analysis on how travelers’ views have evolved during the pandemic. Early in 2021, we plan to conduct our third and final survey in this series. It will examine ongoing, pandemic-driven structural changes in the travel industry and whether there are early signs of a return to normalcy as vaccines are distributed.

Webinar Replay

On December 1, Oliver Wyman’s transportation and travel experts shared findings and insights from the second edition of the survey. See the full webinar recording here.