Taking short-term reactive measures are inevitable. But, as the financial crisis 2008/2009 has shown, companies that deployed sustainable cost reduction programs significantly outperformed the competition. In fact, they emerged as strong and profitable winners.

Currently nobody can predict with confidence how the COVID-19 crisis will unfold. Forecasts from renowned institutions and governments change from week to week and provide little certainty. But there are various fundamental scenarios that differ in depth and length worth looking at. How will these scenarios affect manufacturing firms in particular?

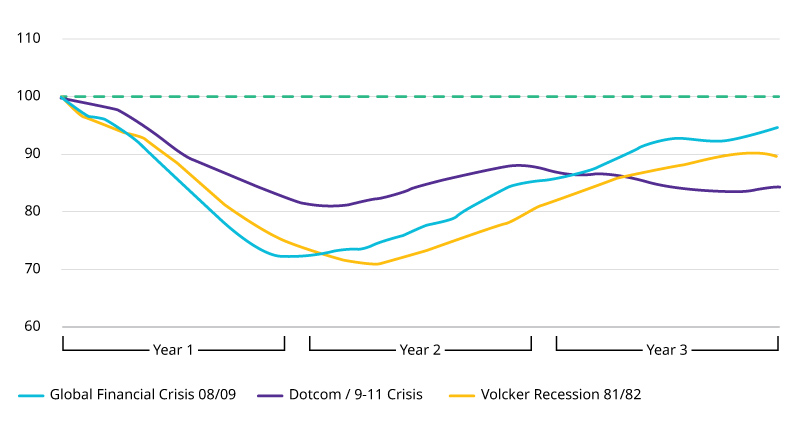

As one of the largest manufacturing regions in the world the United States manufacturing sector serves as a good proxy to illustrate the two archetypes of economic crises: Economic shocks like the Severe Acute Respiratory Syndrome (SARS) epidemic in 2002 or the Fukushima incident were both regionally contained and relatively short. United States manufacturing companies saw only a minor change in production and were not broadly impacted across the industry. Broader recessions like the global financial crisis in 2008/09 or the dot-com bubble in combination with 9/11 led to a decline in production by up to 30 percent and it took more than three years to recover. (See Exhibit 1.)

Exhibit 1. Broad crises take more than three years to recover

Monthly production index in the USA (normalized to 100 = average of 12 months prior to crisis)

Source: Federal Reserve Bank of St. Louis, Oliver Wyman analysis

COVID-19 Recession: Neither Short Nor Shallow

As of May 2020, billions of people all over the globe have been affected by some form of a lockdown. Stock markets are in turmoil and unemployment is on the rise: In the United States alone, the unemployment rate rose to over 15 percent, the highest number since the great depression. Thus, COVID-19 will likely follow the pattern of a broad crisis, resulting in a rather deep decline and a lengthy recovery. The main scenarios on the course of the pandemic itself can be translated to scenarios for manufacturing firms: a one-quarter recession (“V-shape”), a two-quarter recession (“U-shape”), and a four-quarter recession (“L-shape”). (See box for details)

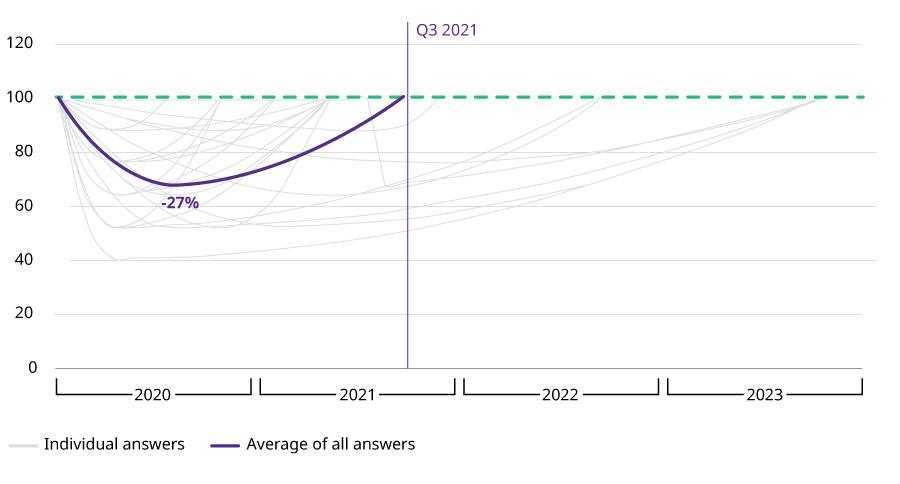

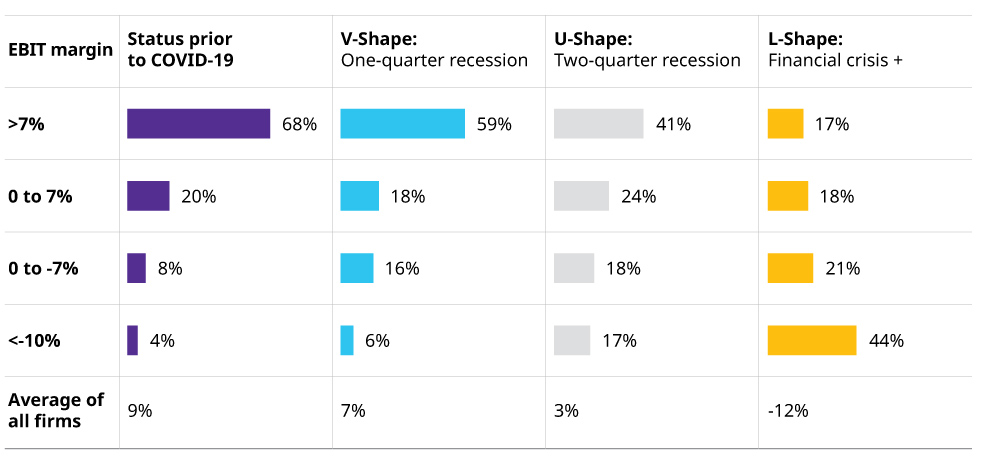

Before COVID-19 broke out, United States manufacturing firms yielded nine percent in earnings before interest and tax (EBIT) in average. The impact on bottom-line results will be significant but dependent on the exact shape of the crisis. Oliver Wyman recently surveyed top-level executives of globally-acting manufacturing firms and found that most expect a “U-shape” scenario. (See Exhibit 2.)

The shape of the crisis

Oliver Wyman has modeled three different COVID-19 scenarios for manufacturing firms: In the “V-shape” scenario, public health measures contain individual outbreaks and COVID-19 lasts for three to four months. The revenue decline mainly shows in Q2 and the economy recovers quickly in Q3 and Q4. In the “U-shape” scenario, the pandemic will break due to seasonality of the virus or virus mutation and COVID-19 will last for six to-a year. This would lead to a revenue decline in Q2 and an even more severe decline in Q3 before revenues recover in Q4. In the most severe “L-shape” or “financial crisis +” scenario, COVID-19 will last more than 12 months and not be affected by seasonality or hard to fight due to mutation. In the result, the revenue decline would persist throughout four quarters starting in Q2 2020.

Exhibit 2: Expected revenue development

Based on expected revenue slump, lowest point in sales and recovery to pre-crisis levels

Source: Survey of executives with globally-acting manufacturing firms, Oliver Wyman analysis

In this case, approximately 35 percent of United States manufacturing firms would experience a negative EBIT in 2020 despite a successful first quarter. In the “L-shape” scenario, this would be significantly worse with more than 60 percent of firms in the red and causing carry-over effects well into 2021. (See Exhibit 3.)

Exhibit 3. Approximately 35 percent of US manufacturing firms would experience a negative EBIT in 2020

Percent of firms, per EBIT range

Source: Oliver Wyman financial database, Oliver Wyman analysis

Short-Term Efforts Are Focused On Organizational Flexing And Cash-Generation

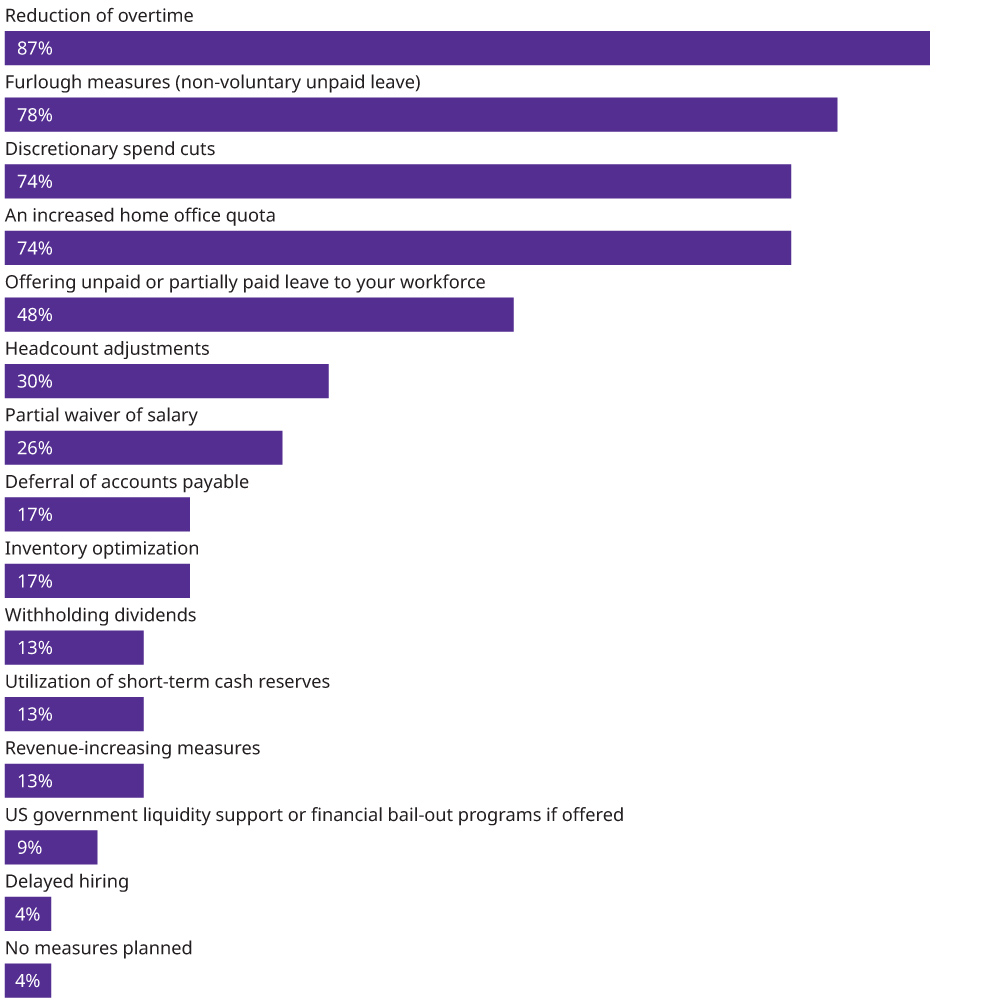

Most manufacturing firms have reacted remarkably quickly after the potential magnitude of the pandemic became visible and governments have taken strong countermeasures. Firms initiated short-term liquidity and structural measures like discretionary spend cuts, temporary, and/or permanent workforce reductions. Similarly, cash management and forecasting have, rightly so, moved into the focus (see Exhibit 4.)

Exhibit 4. Short-term liquidity measures implemented or planned

Next four to six weeks, as percentage of survey responses

Source: Survey of executives with globally-acting manufacturing firms, Oliver Wyman analysis

But all these measures will only stop the bleeding but not start the healing. Leaders should assume that these short-term measures will be not enough. Instead, they should focus on addressing structural and sustainable measures now.

Oliver Wyman’s analysis shows that manufacturing firms which responded to the financial crisis with structural performance improvement or even transformation programs significantly outperformed those which only focused on short-term cost-cutting. Focusing on the longer-term efforts paid off far more: Many returned to pre-crisis EBIT levels in less than two years and even exceeded them shortly thereafter.

To overcome the recent COVID-19 crisis quickly and respond to the ‘new normal’ of lower revenues in the mid-term, most firms will need to deploy structural performance improvement programs. For these programs, leaders will first have to develop a clear target picture for the firm in three to five years. This should include the future core business model and operating model, but also define profitability targets and profit and loss goals.

Based on this target picture, the performance program will deploy levers such as value sourcing, production footprint optimization, and overhead cost reduction, but also top-line levers like introducing new pricing mechanisms or similar. An integrated governance model will ensure laser-focused delivery of such a holistic program.

Using the crisis as a catalyst for change, strong and forward-looking firms should additionally consider transformation programs to adjust business fundamentals through portfolio optimization, merger and acquisition activities, and re-organization. These transformational activities should be in close sync with the structural performance improvement program and be focused towards the target picture.

Focus On The Long-Term Game Plan

Short-term COVID-19 responses like supply chain continuity, liquidity assurance, furlough programs and first cost containment have been implemented. They should be continuously monitored and adjusted where needed.

Company leaders who want to emerge from the crisis more profitably need to start working on structural performance improvement or even transformational programs now. To avoid that the urgent constantly overrules the important, this will require dedicated teams for the short-term cure and the structural, sustainable solution. This way firms will start to experience the positive effects more quickly and gain a tactical advantage over their competition.