Companies from almost all sectors and of all sizes are being challenged by disruption. The challenges come from technological innovation, competition, regulation, and customer behavior. For example, large travel companies were hit hard by travel-booking websites that changed the way customers search for, and buy, leisure and business trips. Travel agencies had to redesign their business models and develop new capabilities to survive.

Likewise, e-commerce companies are pressuring traditional grocery retailers in a low-margin business. Environmental regulations and testing procedures (WLTP) are pressuring automotive original equipment manufacturers (OEMs) to invest in electric vehicles. Penalties for not meeting CO2 fleet targets for 2020, or the expense of doing so, can cost automakers billions of Euros. Alongside increasing competition, commoditization, pricing pressure, and the need to provide innovative digital offerings.

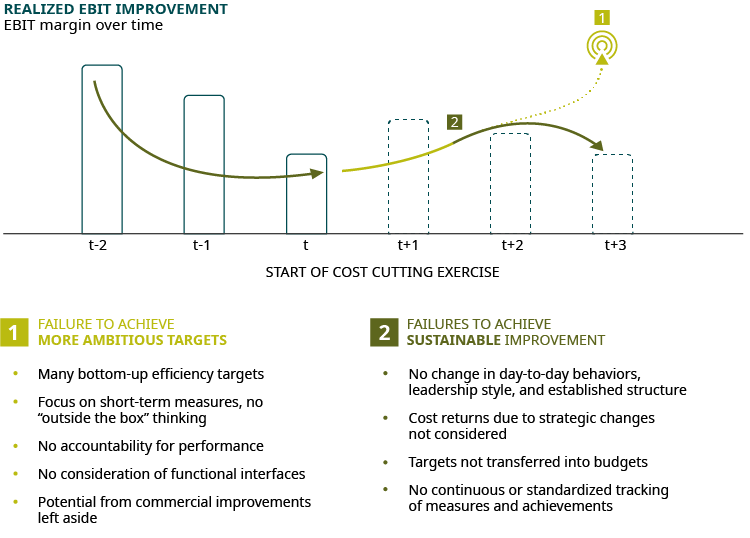

Two years after announcement of a given program, more than half of the companies analyzed had improved margins by less than 10 percent and some had even lost ground

A recent Oliver Wyman analysis found that traditional approaches to performance improvement are often not effective or sustainable. Two years after announcement of a given program, more than half of the companies analyzed had improved margins by less than 10 percent and some had even lost ground. There are five major reasons why such performance programs typically fail. First, corporates often start a transformation program too late and, when they do, they do not address the company’s real issues.

Instead, they give a “haircut” to growth areas that actually slows future development. Second, if corporates focus exclusively on cost measures and not on improving quality of earnings or margin, the scope of programs is often too narrow. Third, these initiatives are often not well aligned with the future strategy and target picture of the firm, and thus measures may contradict the future target picture. Fourth, middle and top managers are often not sufficiently engaged in the program or held accountable for meeting defined improvement targets. Thus, ambitious performance-improvement programs do not have enough “powder” to make major improvements. Finally, many programs are not well managed, resulting in inefficiencies and missed opportunities.

HOLISTIC APPROACH TO PERFORMANCE IMPROVEMENT

A holistic, forward-looking approach to performance improvement should address the issues above to protect profit margins before they erode further. Early change can fundamentally impact improvement. (See Exhibit 1.)

For example, after many rounds of cost cutting, European telco companies are still confronted with competitive pressure. To achieve significant and sustainable improvements in performance and prepare for future competition, several telcos defined a lean target operating model (TOM). This TOM methodology has delivered savings of 25-40 percent in OPEX costs, representing billions of dollars. It has also served as an impetus to abandon antiquated practices. To stay in the driver’s seat, companies need to consider two broad areas. One, is there disruption ahead? A regular and thorough review of potential changes in the ecosystem, whether driven by regulators, technology or customer behavior, needs to be conducted and potential impact assessed. Two, observe key indicators – such as increasing cost-of-goods-sold (COGS), and declining market share or customer satisfaction – to get a sense of areas where performance needs to improve. For example, for automotive suppliers, a steadily declining EBIT margin – it has been above 7 percent since 2013 – is a clear indication that performance needs to change. A realistic analysis of the expected financial impact of performance changes helps identify the additional gap to target.

Exhibit 1: Failures of traditional cost reduction exercises to sustainably improve EBIT

Source: Oliver Wyman analysis

ACHIEVING SIGNIFICANT PERFORMANCE LEAPS

Performance-improvement initiatives should not only focus on bottom-line impact, through product or cost initiatives, but also look to improve the top-line, considering, for example, product and service pricing.

A pragmatic and thorough diagnostic of the current cost position, organization structure, or key operative KPIs, provides an improved understanding of the company’s current situation and helps to identify its key problems. The complementary target operating model (TOM), defined through key principles, provides clarity about future requirements and helps identify more radical levers for achieving significant profitability improvements. Combining the diagnostics with an outlook of future operational needs provides input on measures that yield profit potential beyond top-down defined targets.

EFFECTIVE AND SUSTAINABLE REALIZATION

To realize performance gains, ensuring top-management buy-in and accountability is key. Therefore, integrate savings targets into budgets that top management approves, to ensure their clear traceability. With senior leadership “speaking with one voice,” leading the initiative and making clear decisions, employees will also buy into and engage in the transformation.

An underestimated but key ingredient is governance. This focuses on functional and procedural issues, manages main stakeholders, continuously aligns with other corporate initiatives, and keeps a close eye on meeting measurable goals to avoid falling behind. For example, setting up an effective change program will strengthen the organization’s cost readiness by raising awareness of the issue. With leadership calling attention to day-to-day cost behaviors, successful programs will hit ambitious improvement targets and avoid new costs that would hinder P&L impact.

Companies need to continually review and challenge their profitability situation, the impact of industry disruption, and of the expected downturn. Proactively setting up a performance-transformation program before margins are badly affected will help to maintain competitiveness and prepare the company for future growth.