The Actuarial Practice of Oliver Wyman surveyed its clients regarding discounting of casualty reserves for financial reporting. This survey is intended to answer the following questions:

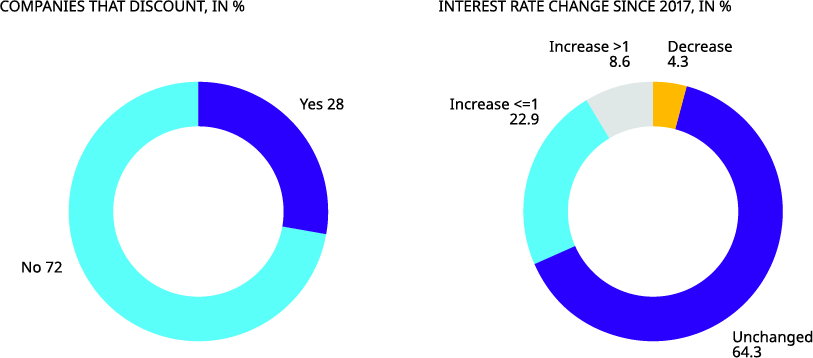

a. What percentage of companies elect to discount their unpaid losses?

b. What interest rate do companies most commonly use, if they do discount?

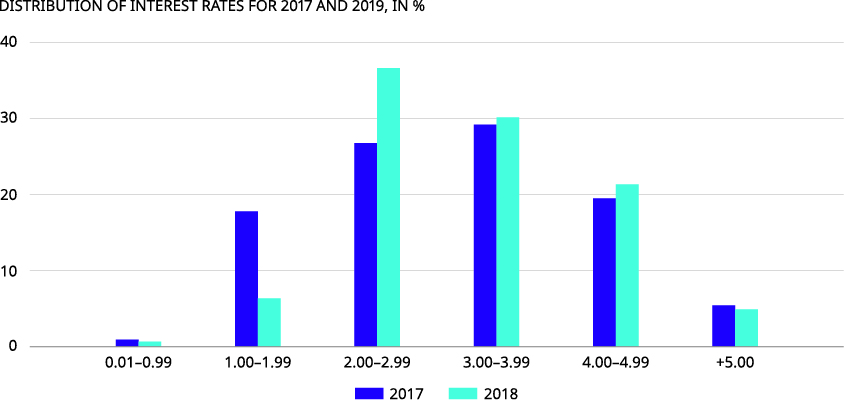

We compiled the percentage of clients that discounted during the past year. For those companies electing to discount their reserves, we present the distribution of interest rates used and provide a comparison to the results of our prior study conducted in 2017.

Observations

During the past year, the average interest rate used to discount was 3.04%. The average discount rate in our prior study was 2.86%. As a point of reference, the yields on three-year U.S. Treasury Securities increased 1.25 percentage points during the same time period.

The greatest overall shift in interest rates was from the 1.00% - 1.99% range, which decreased from an 18.1% share to a 6.4% share. Interest rate decreases were seen in 4.3% of clients, 31.4% had increases while 64.3% used the same interest rate for 2017 and 2019. 8.6% of survey participants used interest rates that were more than a full percentage point higher than the prior.

Please note that the survey above is intended for informational purposes only. Moreover, this survey is not intended as a recommendation on the part of Oliver Wyman as to the appropriate rate to discount casualty insurance unpaid losses.

For more information, please contact us at actuaries@oliverwyman.com.