Greenfield: A New Approach

Transforming the business and technology of a corporate bank is slow, costly and complex. Greenfield is an attempt to break free from the constraints of existing systems, business models and talent models. It is a lower cost, faster way to get new propositions into the market. Corporate banking providers – both new entrants, and incumbents looking to reinvent their businesses – are now experimenting with greenfield approaches. The motivations for doing so – and the scale of ambition – are varied, ranging from those who are looking to build new products or features, to those who are looking to build an entirely new bank and switch off the legacy.

Exhibit 1: GREENFIELD COMBINES THE ADVANTAGE OF AN EXISTING FILM WITH THE AGILITY AND COST BASE OF A CHALLENGER

Source: Oliver Wyman Analysis

For greenfield to be adopted at scale in corporate banking two questions need to be answered. First, is it possible to build a corporate banking platform from scratch in a cost-effective way. And second, is the business case – and urgency to act – sufficiently compelling compared to traditional transformation approaches.

Hari Moorthy, Global Head Of Transaction Banking, Goldman Sachs, Discusses The Bank’s Greenfield Project

Building New In Corporate Banking

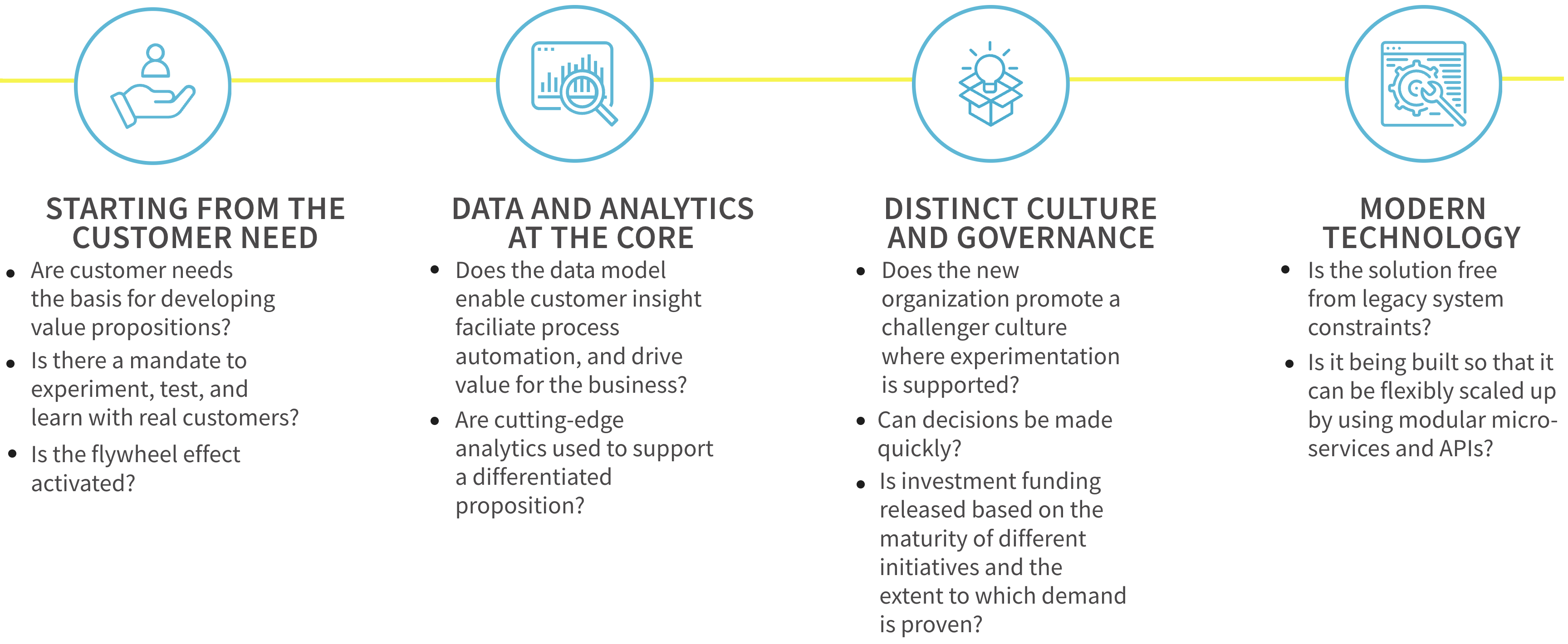

New technologies, vendors and development approaches now make greenfield a viable strategy to transform the business model in corporate banking. There are four key success factors for greenfield builds.

Exhibit 2: THERE ARE FOUR KEY SUCCESS FACTORS FOR GREENFIELD BUILD

First, it needs to start with a specific customer need, in an area that is already strategically important, or to kick-start expansion. It needs to develop compelling customer solutions and evolve them quickly. Early movers will need to contend with widely varying digital sophistication of corporates; just like banks, corporates face many challenges in driving digital innovation. For leading banks this will require them to partner with the most digitally savvy corporates to pilot initiatives, as well as to broaden their coverage beyond the treasurer to understand the agenda of procurement, technology and business heads.

Second, data and analytics need to be at the centre, both in terms of understanding customer needs, and in delivering rich and differentiated propositions. The technology architecture is built around data: all data captured digitally at source; internal data enriched with external sources, delivered via API; stored in cloud-based data lake; and manipulated using advanced analytics software. This can enable better identification of customer needs, seamless customer experience or value-added analytics to help customers grow their businesses.

Third, they require a different way of working and skillset. Small, multi-disciplinary teams, combining product, design and technology, working to agile methodologies. Work is structured in short sprints, ensuring priority features are delivered quickly, tested in the market and refined. It relies on a new set of skills including design, human insights, data science and modern development skills – some of which may be seconded from the legacy bank, others of which may need to be sourced externally.

Finally, greenfield builds are underpinned by modern technology. Greenfield should deliver a technology platform that is scalable, has a variable cost base, enables fully digital experiences, provides flexibility to swap components out, and can be iterated to meet the needs of both customers and the business users. The technology is built by bringing together modular microservices (rather than a single vendor platform). The microservice systems are cloud-based, scalable, and generally offered as software-as-a-service, and are provided from a combination of best-of-breed vendors, fintechs and selected in-house development (where that provides competitive edge).

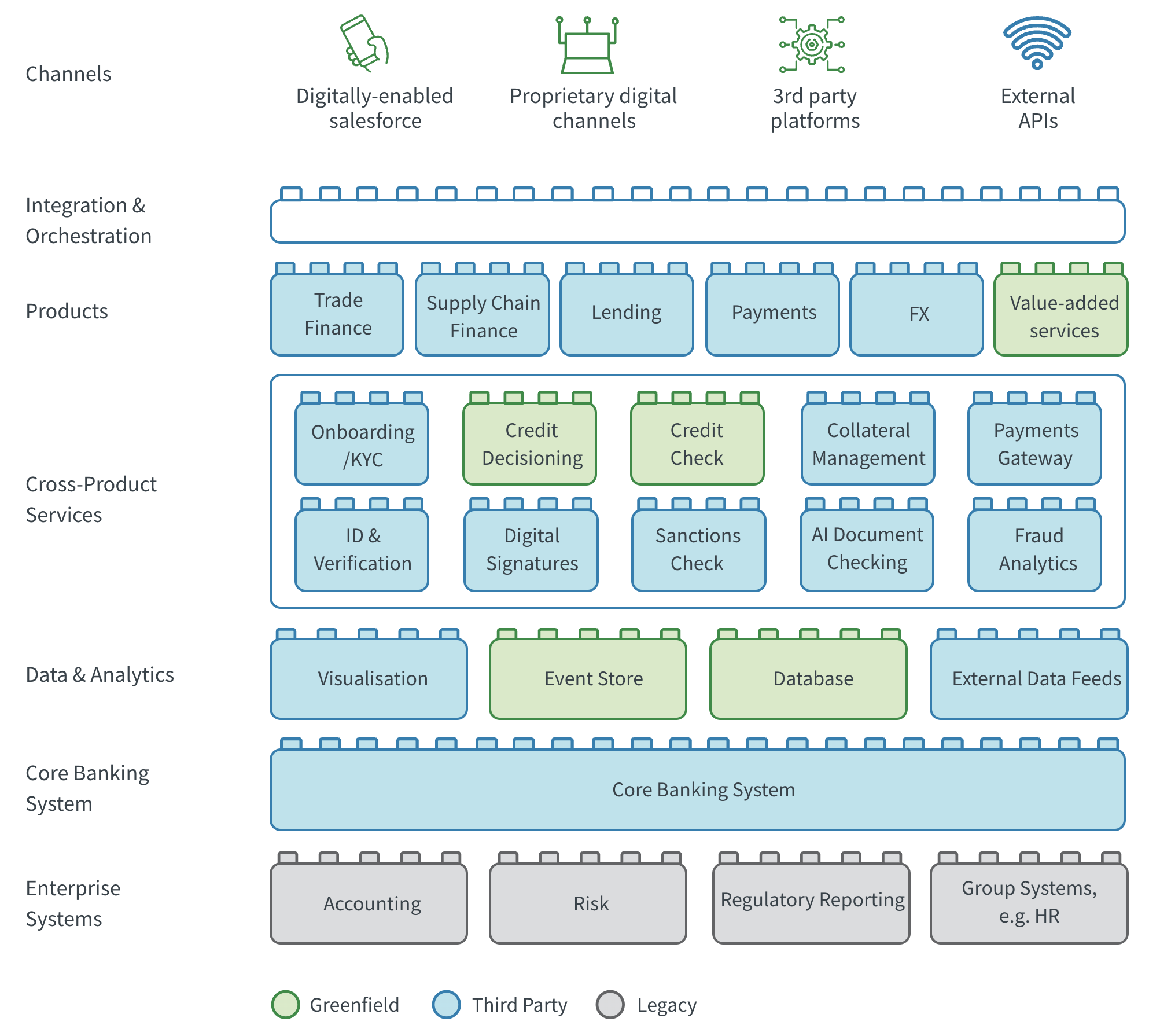

Below is an illustrative corporate banking modular architecture. Together, this approach allows for a low cost, agile infrastructure that can enable differentiated customer propositions and product innovation in a way that legacy infrastructure cannot.

Exhibit 3: ILLUSTRATIVE GREENFIELD CORPORATE BANKING ARCHITECTURE

The Business Case For A Greenfield Build

The case for using greenfield is rooted in the challenged economics of the corporate banking business.

While greenfield is not, in itself, the answer to any of these challenges, it is a method for corporate banks to respond and transform their businesses quickly, cheaply and at lower risk than traditional transformation approaches.

Motivations for embarking on a greenfield build in corporate banking are varied, as is the scale of ambition. We can see four broad objectives – these use cases are not mutually exclusive, and indeed, one may lead to another.

Developing new customer propositions to solve customer problems and defend against market structure change. There is a range of use cases for specific sectors or client needs. The key is that the solution is anchored on a real client need or pain-point, and that it goes beyond traditional banking products to meet those needs, including development of new platform business models. For example, HSBC launched Serai as a standalone business focused on digitising the import/export value chain, from sourcing of goods to payment and shipment.

Vivek Ramachandran, CEO, Serai By HSBC, Discusses The Success Factors Of Greenfield

Entering new markets or segments as a challenger. A number of players are looking to adopt greenfield approaches to grow their businesses in non-traditional areas. This might be entering an entirely new market (e.g. Goldman Sachs entering cash management) or expanding into a new geography or customer segment where the bank has no footprint. The motivations for doing this range from accessing new revenue pools, through to developing a test-bed for digital businesses without cannibalising the home market business. There are some notable differences to legacy businesses developing greenfield which present challenges.

Transforming technology to reduce the cost and time to deliver innovation and product enhancements to market. For many banks, legacy infrastructure and processes have become a real burden on the cost-base, and on the pace of innovation. Approximately two thirds of technology spend at global transaction banks is consumed by maintaining legacy infrastructure, as opposed to building new systems or solutions. The cost of adapting to market structure change – such as enabling real-time payments or SWIFT gpi – is often prohibitively high due to complex legacy integrations, legacy systems relying on batch updates, or fragmented systems across markets. Moving – at least in part – to a modular, micro-services architecture requires banks to break apart monolithic legacy systems, decompose systems into services, and integrate services via a common orchestration layer.

Building entirely new digitally-led business with the ambition to demise the legacy infrastructure and operating model, and migrate clients over. For some banks, the end game of greenfield may be to decouple from legacy infrastructure and build a new modern, infrastructure that can meet the long-term needs of the business. While many banks have taken an incremental approach to replacing components of their architecture, greenfield advocates have concluded this will be too complex, too costly and take too long.

They favour a bolder approach: to build a new bank and migrate customers and data over, and then decommission the legacy infrastructure. The benefits include a faster time-to-market (12-18 months), a lower-cost infrastructure, and the clean slate technology enabling a host of new functionality.

Is Greenfield A Faster Route To The Same Destination?

It’s early days for greenfield in corporate banking. The vendor landscape is not mature and the barriers to change within the organisation can be considerable.

But the benefits could be potentially transformational for corporate banking businesses at a time of revenue stagnation and market disruption. As our case studies above show, early adopters can make a step change in customer experience, access new business models, deliver cost efficiency and transform their cultures by adopting a greenfield approach.