Financial services institutions have increasingly defined and differentiated themselves not just by the products and services they provide to customers, but by the technology that underpins their establishments. While financial services institutions see these investments as critical to compete against newcomers, update business models, and meet shifting consumer expectations; substantiating the funding to management and boards has been historically difficult.

COVID-19 has made these problems more acute. Now, business leaders must ask themselves tougher questions than ever before to understand the connection between technology spend and productivity. One thing is certain - where technology was once difficult to justify, it is now essential for survival.

If companies are to overcome cost inefficiencies and become more resilient, it’s vital that they optimize their technology investments to realize their full value.

Although the industry has spent over US $1 trillion on technology investments over the last four years, there’s often a lack of clarity caused by factors such as organizational red tape delaying modernization projects, data locked in silos which can hamper innovation, and a lack of alignment surrounding product development. Mastering technology investments will play an essential role for businesses if they wish to maintain a competitive edge.

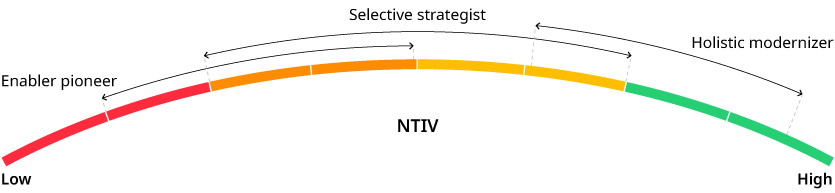

Oliver Wyman is collaborating with Amazon Web Services (AWS) to combine our strategy expertise, industry capabilities, and deep technical knowledge. Together, we have developed a robust methodology to help financial services institutions evaluate, prioritize, and communicate their technology investments. Our Net Technology Investment Value (NTIV) is a comprehensive approach for measuring the business value of technology investments, factoring in profitability, productivity, operational efficiency gains, and consumer value.

How our Net Technology Investment Value (NTIV) approach works

Source: Oliver Wyman and Celent research

Our new report “Rethink, Reboot, Recoup” looks at how financial services institutions can garner a holistic understanding around the value of technology investments, so C-suites and boards can better evaluate and prioritize spending to achieve business performance. We demonstrate that businesses now have a methodology to track, prioritize, and communicate the value of technology investments. Instead of wondering if their digital roadmaps hold the answer, financial services institutions can use the NTIV to measure value in real terms to help them make the crucial decisions that will enable their survival in an evolving industry.