This article was first published on April 16, 2020

The outbreak of COVID-19 has led to increased volatility across global financial markets and will undoubtedly impact a broad range of industries—including the energy and power sector. With containment measures and stay-at-home orders being enacted in order to slow the spread of the pandemic in countries around the world, businesses and individuals have been forced to adapt to what has become the new normal.

As a result of corporations shifting to remote working and businesses and other organizations temporarily closing their doors and, in some cases, ceasing operations, there is reduced consumer demand for power and global energy production. Subsequently, refinancing and trading activities have also been impacted, making it necessary for energy companies to take hold of their cash flow and margins in order to respond to market dynamics.

Understanding The New Normal For Liquidity

Given the high market volatility and increased uncertainty, there will eventually be higher margin calls and increased collateral requirements in trading. With shareholders and debtholders experiencing uncertainty with regards to what will happen next, the outlook for access to sources of liquidity from banks and various government programs is unclear. As such, liquidity buffers that were previously considered appropriate will need to be revisited, as they may no longer be enough. Likewise, higher net-debt ratios will result in increased risk of covenant violations for energy companies.

The outlook for access to sources of liquidity from banks and various government programs is unclear

On the business side, those with weak liquidity and those in stressed sectors are likely to require financing immediately, as cash flow from operations will decline due to the drop in demand for energy. On the other hand, banks will need to improve their equity position and increase their risk buffers, leading to more reluctancy related to lending activities. The appropriate means of maintaining liquidity—including holding cash in checking accounts and obtaining committed credit lines—also need to be revisited.

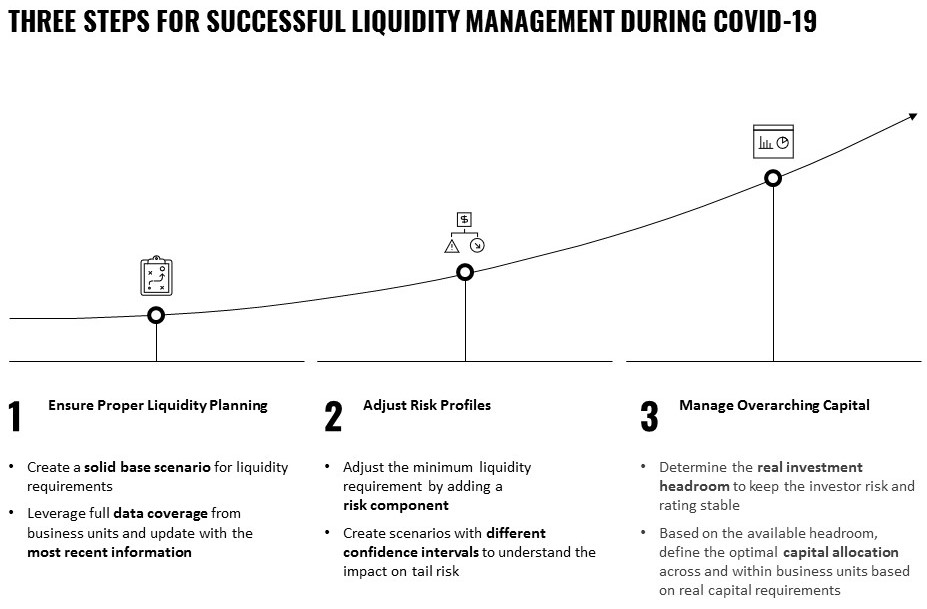

Ensuring Proper Liquidity Planning

While the general best practice for liquidity planning is to leverage historical data, the nature of the pandemic being so vastly different than other global crises—be them economic turndowns, natural catastrophes, or other viruses—warrants an entirely new way of thinking. The use of historical data from most previous instances is largely insufficient for deriving hypotheses for liquidity forecasting, as a result. Where sufficient enforcement of accountability is not present, the forecast quality may be impacted due to the unclear economic situation.

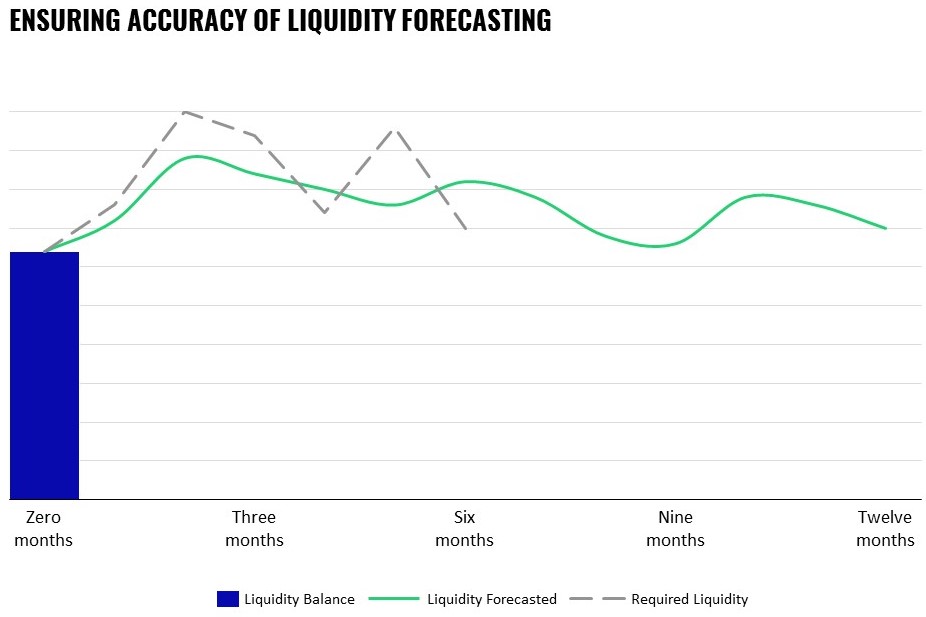

In order to rethink their liquidity planning methodologies, it is essential for businesses to closely monitor the situation. This entails monitoring not only current liquidity needs, but also the pandemic in its entirety as well as its expected economic and industrial repercussions. And while planning will need to be done in the short-term, it is essential to regularly update the liquidity forecast based on the individual liquidity balance as well as the continued development of external economic factors.

In order to develop a reliable liquidity forecast, companies should first define the current situation using high-quality data inputs. These include an analysis of all relevant entities and activities, a validation of and backwards-looking view into data feeds, and following the first month, an update based on recent developments. To ensure that all data and information is transparent, it is essential to continually communicate management decisions across the organization.

Continuous review of the liquidity forecast requires not only end-to-end transparency, but also ownership of the situation. By enforcing compliance with established requirements, companies can assign accountability for the quality of the liquidity forecast. And in order to ensure that forecasted liquidity continually meets levels of liquidity required, companies are advised to review any deviations from between the actual and forecasted levels and readjust forecasts going forward.

Adjusting Risk Profiles

Similar to how liquidity forecasts need to be revised as a result of the pandemic’s impact, risk profiles need also be revisited to properly plan for the short- and long-term. In terms of the risk factors that are considered, the current situation and its associated effect needs to be reviewed and incorporated into adjusted risk profiles. For instance, while risk forecasts made over the past several years may have accounted for an eventual economic depression, they likely failed to consider the fact that employees may not be able to be onsite for an extended period of time, or that overall demand would decrease.

To overcome this, companies should begin by identifying external drivers associated with the COVID-19 crisis—which include remote work needs and governmental restrictions—and their relation to the individual liquidity balance. Once the qualitative impact has been taken into account, measuring the quantitative impact of external drivers on liquidity balance is necessary. While the long-term impact of the pandemic is ultimately yet to be defined, companies can simulate different stress test scenarios as a function of external drivers.

Managing Overarching Capital

While access to favorable sources of capital is generally tied to rating, covenants such as the Funds from Operations to Net-Debt ratio (FFO/Net-Debt) may be impacted by the pandemic from profit and loss as well as debt perspectives. This makes it essential for companies to understand the available investment headroom while maintaining their existing rating. Previously calculated contingencies and liquidity requirements may no longer be sufficient, warranting the need for additional capital. Given the depth of the pandemic, rating agencies may also decide to temporarily adjust rating factors and thresholds.

In order to determine investment headroom, the first step is to calculate the top rating key performance indicator—for instance, the FFO/Net-Debt ratio—as an adjusted figure by accounting for liquidity requirements as well as performance contingency. Such liquidity requirements are generally a direct result of trading activities, while performance contingency reflects the downside risk of business activities—including failures of new investments, shifts in customer demand, and unexpected operating costs, to name a few.

From a capital planning perspective, short-term goals are likely to differ from medium- and long-term goals, as a result of the initial impact and downstream effects of the pandemic. Therefore, ensuring access to capital and cash flow is likely to become more inherently relevant than the return view in the short-term. Existing scenarios are also likely to change in terms of how they impact rating covenants.

Ensuring access to capital and cash flow will become more relevant than returns in the short-term

As a result of differing priorities for the short-term in comparison to the medium- and long-term, downside risk prevention and rating covenants may become more important than potential profit maximization. To account for this, capital requirements need to be revisited from a portfolio perspective to determine factors such as which capital requirements are likely to be influenced and which non-essential activities can be put on hold. Furthermore, considering which activities do not contribute to liquidity improvement in the interim, yet are essential to future growth, is key.

The impacts of COVID-19 are unique with regards to the impact that they have on businesses across all functions, and the energy industry has taken a hit from the direct changes in supply and demand. Businesses that succeed in the long-term will not only be able to adapt to the current situation but will also adjust forecasts and risk profiles to ensure adequate liquidity.