B2B industrial manufacturers have enjoyed a period of significant growth, but the time is ripe for a shift in focus, given the potential for an economic downturn. Where previous strategies would suggest market expansion and greater risk exposure to bolster the top line, rising trade-barrier risks and government financial instability should drive firms to employ strategies to focus on the bottom line and bolster their procurement programs.

The firms likely to be most affected by the downturn will be customized or “build-to-order” manufacturers, where production complexity and volatility make continued growth exponentially more difficult. In light of this, procurement has a substantial role to play in ensuring that these manufacturers emerge as winners through the next recession.

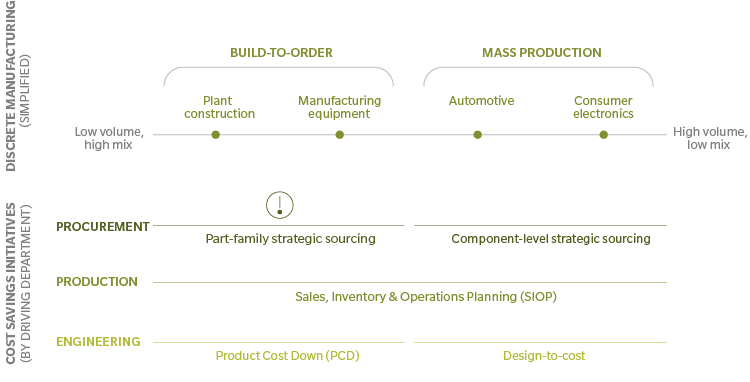

Exhibit 1: Low volume strategic sourcing is often neglected in a BtO environment

Source: Oliver Wyman analysis

A UNIQUE PROBLEM FOR BUILD-TO-ORDER INDUSTRIAL MANUFACTURERS

Not all industrial manufacturers enjoy the benefits of high volumes in a mass production setting, with clear, minimized demand variability. Such high-volume manufacturers – namely automotive or white-goods makers and suppliers – are generally well-equipped to flex scalability in the face of an economic contraction with traditional cost-reduction activities: e-auctions for components, market testing, as well as deeper design-to-cost activities.

However, firms with limited foresight into demand and highly customized product offerings – build-to-order industrial manufacturers – will not be as well- positioned. The inability to translate revenue forecasts into inventory and operations planning (SIOP) forces the burden of cost-savings strategy onto procurement and engineering teams. Traditional component-level procurement strategies yield limited benefits due to the inability to offer accurate volumes to the market, hindering negotiating leverage in a build-to-order environment. (See Exhibit 1.) Furthermore, product cost down (PCD) and design-to-cost initiatives are undermined by customer-driven specification requirements.

Internal procurement teams and supply-chain organizations note that as a result of demand variability, limited steps can be taken to cut costs. Furthermore, a mentality of “too small – too fragmented – too complex” pervades the sector, further hampering the effort and results from sourcing activities. Our experience with a variety of mid-market BtO industrial manufacturers has enabled us to identify two pragmatic methods of increasing margins by changing sourcing tactics.

ADDRESSING THE COMPLEXITY OF MATERIAL FORM FACTOR

Traditional procurement programs for high-volume, predictable materials – especially build-to-stock or commoditized items – are able to support a component- level sourcing strategy. For the BtO industrial manufacturer, however, a more aggregate view of volume is required to entice suppliers, and can be achieved through an assessment of “material form factor.” Form factor is a component segmentation strategy that buckets parts of similar size, material, function, or application to aggregate volumes. These aggregated segments can be offered to the market to source by “share of wallet” or demand/supply capacity.Combining known aggregate demand (comprised of multiple segments of variable demand) helps to overcome the inherent dilemma of part-level forecasting accuracy.

Rather than component-level pricing, suppliers showcase competitiveness through a formulaic costing approach based on volumetric or parametric inputs. They are then awarded part families based on manufacturing expertise, and identification of key cost drivers alleviates the opaqueness of custom or complex part requirements. Other benefits of the approach include strengthened procurement information on material cost pressures, allowing manufacturers to hedge or budget for anticipated increases. Finally, buyers have increased negotiating power for components that deviate from traditional pricing matrices, to ensure rationalization for price premiums on complex or custom parts.

Case Study 1: A manufacturer of custom steel molds is able to segment its machined parts into parametric characteristics (cylindrical, multi-cavity, etc.) and thus can negotiate capacity at strategically located and cost-competitive machining shops to meet demand. By aligning on controllable inputs (raw material, labour, and tooling activity by volume), procurement gains greater control over pricing and achieves transparency on leading cost drivers. Furthermore, having multiple suppliers helps to minimize the risk of volatile trade barriers and ensure continuity of supply. Leveraging a capacity sourcing strategy, this manufacturer achieved over six percent cost reduction on segmented components.

DEALING WITH THE VOLATILITY OF DEMAND

BtO procurement functions typically focus on the easier categories, such as raw materials and components (despite the difficulties described earlier). The more complex categories – for example, contract manufacturing as well as installation and commissioning services – often exhibit a highly fragmented supply base and little or no cost transparency. This is the result of a decision-making process based on short-term availability of capacity, rather than a structured, forward-looking procurement strategy.

The volatility of demand is a key characteristic of BtO manufacturers and will not go away. However, through supplier tiering and disciplined processes, they can smooth some of the volatility: Two or three prequalified and preferred “gold suppliers” receive roughly 80 percent of the business (base demand), while the remaining 20 percent go to prequalified “silver suppliers” (peak demand and special application).

In addition to the general benefit of being assured a certain level of demand, “gold suppliers” can be enticed by potentially increasing their share of wallet – even in the face of a looming recession – and being positioned to take advantage of opportunities once the market picks up again. For this to succeed, however, there need to be processes in place for maintaining competitiveness between gold suppliers.

Case study 2: An industrial equipment manufacturer is leveraging external service providers for installing equipment at end-customer plants. The nature of the project- based business has resulted in supply shortages and a high correlation with market pricing: In an up market, capacity is low and prices high, and vice versa. By establishing tiers for suppliers and enforcing strict process discipline, costs can be fixed at down-market levels for the majority of their demand. Additionally, manufacturers can increase cost transparency, improve lead times, and deepen relationships with their “gold suppliers”.

NOW IS THE TIME TO REFOCUS ON COST

Regardless of a manufacturer’s size or standardization, a recessionary period calls for new thinking and prioritization. While high volume manufacturers may deploy traditional methods to “sail through” the next recession, build-to-order industrial manufacturers need to look at the downturn as an opportunity to optimize or transform their procurement function.

Whether these strategies represent an optimization of procurement practice or full transformation from current practices, shifting to a more equitable and transparent formulaic costing approach allows for effective capacity sourcing and margin bolstering in turbulent times.

Furthermore, it is an opportune time for developing a robust supplier-tiering framework to attract vendors and ensure competitiveness for the next economic growth phase.