In most bid pricing cycles, organizations are faced with tough trade-off decisions, but this year, increased uncertainty from the COVID-19 pandemic created additional unknowns affecting expectations of the future market dynamics. Oliver Wyman Actuarial had three major expectations ahead of Annual Election Period (AEP); two of which were confirmed and one which was not.

- Most Plan Offerings Will Not Increase Premiums from 2020 – Aggressive pursuit of membership by increasing or maintaining a product’s attractiveness through competitive premium rates

- Increased Prevalence of $0 PPOs – In recent years the market has increased the offering of low dollar plans, beginning with HMOs but ultimately expanding to PPOs

- Static Star Ratings – With CMS announcing numerous measures for 2021 Star Rating for 2022 payment were “paused” due to COVID-19, it was anticipated that fewer contracts would receive a different score than the prior year

Within this blog Oliver Wyman used publicly available information to analyze the validity of these hypotheses as they unfolded in the market.

Most Plans Will Not Increase Premiums

COVID-19 has put financial constraints on many Americans lives, particularly affecting the senior population on a fixed income. To maintain competitive products, we expected plans to not increase premium rates as consumer demand would likely not accept a premium increase in return for the same benefits. Several key observations were evident in this year’s landscape file regarding non-SNP, MAPD plans:

- Almost five times as many plans (95) dropped their premium to $0 in 2021 than added a premium to what was formerly a $0 plan in 2020 (20)

- Over 70% of plans maintained their premium or were within +/- $2 of the 2020 premium

- The overwhelming majority of members will have the choice to maintain their 2020 plan into 2021, as less than 0.5% of members are currently enrolled in a plan that was not filed for 2021

As planning for 2022 begins, MAOs should take note that seniors are likely to continue expecting flat premiums and may start anticipating premium decreases as part of the competitive Medicare Advantage business.

Increased Prevalence of $0 PPOs

Coming into 2020 there were more $0 PPO plans offered in the country than ever before, with 32% of all counties adding at least one of those plans. Prior to the COVID-19 pandemic the market was expected to increase the penetration of these types of plans. As the COVID-19 pandemic developed, Oliver Wyman Actuarial anticipated plans would remain committed to launching or expanding these products. With the release of the 2021 landscape data, the market is anticipating the increased popularity of these products as over 50% of counties added at least one $0 PPO plan for 2021, and at least 20% of all counties added a $0 PPO plan in both 2020 and 2021.

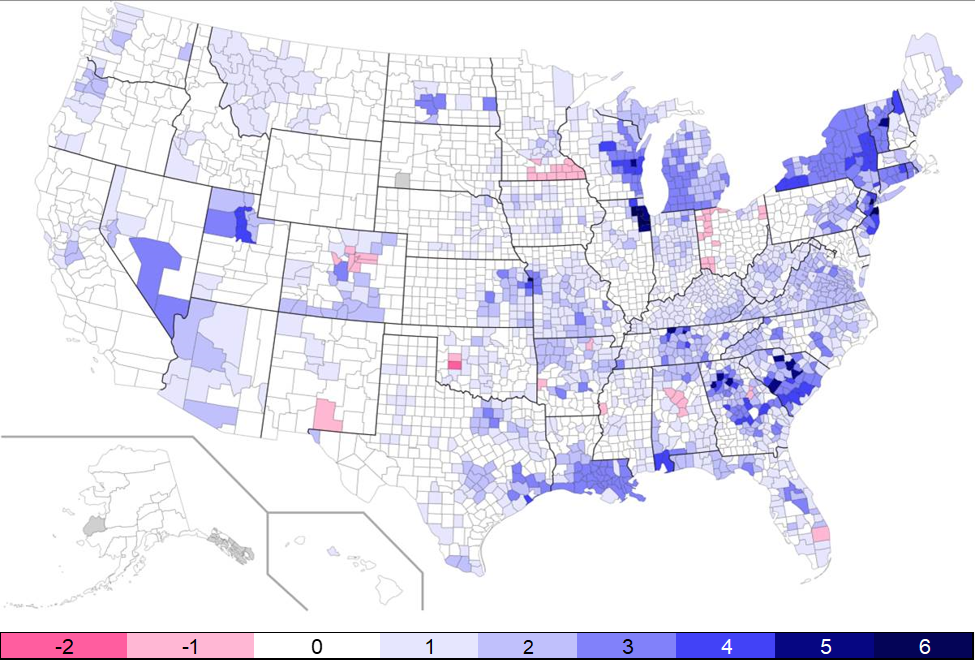

Prevalence of New $0 PPO Plans (2020 to 2021)

As the national graphic above shows, there are areas of the country that have seen the addition of more $0 PPO plans than ever before, with some counties in Illinois and New Jersey adding up to six new $0 PPO plans. From 2019 to 2020, approximately 26% of new MAPD non-SNP plan benefit offerings were $0 PPO plans, but that number has increased to 36% going into 2021. Most of the populous areas of the country, with the exception of California, have added several $0 PPO options ahead of 2021 (shown in shades of blue above) with only a small number of select counties removing $0 PPO plans (shown in pink).

As $0 PPO plans increase their prevalence in the marketplace, we expect that membership will continue to migrate into these plans and away from plans requiring a premium.

Static Star Rating

For 2021, CMS had previously announced three fundamental changes in its calculation of health plan sponsors’ Star Rating

- Member experience measures would increase from a 1.5 to 2.0 weight (examples of member experience measures include getting appointments and care quickly, and customer service)

- All-cause readmissions would be temporarily removed as a performance measure

- Statin use in persons with Diabetes would increase from a single-weighted measure to being triple-weighted

As a result of the COVID-19 public health emergency, CMS paused 19 metrics compromising ~40% of the total 2021 weight (excluding improvement measures) on the overall Star Rating, while also applying the weight changes noted above.

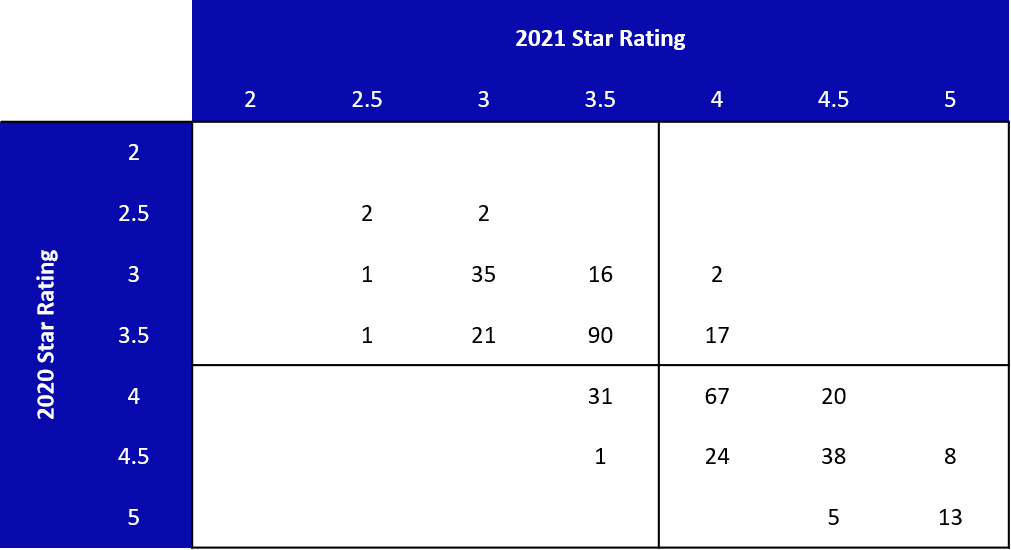

Our a priori expectation was that few MAOs would see changes in their Star Rating from 2020 to 2021 because CMS only applied weight changes to a small subset of measures while freezing performance levels across most measures. The recently released CMS information confirms fewer plans experienced a change in their Star Rating; however, as the table below indicates for the 395 contracts eligible to receive a Star Rating in both 2020 and 2021, only 4.8% of contracts experienced an increase to their Star Rating from below 4 to at or above 4, while the converse was true for 8.1% of contracts.

Overall, 38% of contracts saw changes in their Star Rating between 2020 and 2021 compared to 54% between 2019 and 2020. With the paused measures, there were fewer changes to the Star Rating than in the prior year, but this year’s level of change was still higher than expected.

Conclusion

While the AEP continues through December 7th and the final membership numbers will not be known publicly until January, plans should rely upon the public portfolio offerings in the marketplace as a leading indicator of where membership is expected to move. For plans with a large portfolio, this may mean continued pressure on margins as members shift to lower premium and lower margin plans. For plans able to offer attractive supplemental benefits with their zero-dollar premium offering, this year’s AEP may be quite favorable. In order to continue offering attractive benefits, plans will need to focus resources on maintaining or improving Star Rating in order to achieve the 5% bonus.