Moreover, a growing mismatch between supply and demand could erode the profits of the entire food industry within four decades: Global demand for agricultural production is expected to grow by 70 percent by the year 2050, and average per capita caloric intake globally is projected to increase by about 40 percent. The problem is that global food production already utilizes about 50 percent of the earth’s available arable land, and the global agricultural sector consumes about 70 percent of the freshwater available for human use.

Our research reveals a broad consensus among retailers who recognize that they will almost certainly face wrenching cost and availability problems as a result of the growing divide between food supply and demand. Most believe that they will also be confronted with very different demand patterns as customer priorities and regulations change. Ninety percent of the top 50 global grocery retailers market their own private-brand organic products. (See Exhibit 1.) In their annual reports, 82 percent of groceries retail chief executive officers cite sustainability as a key priority. More than one in three has opened “green” pilot stores.

Nevertheless, the reality behind these flagship initiatives continues to be largely “unsustainable.” While sustainability now routinely figures in evaluating investment decisions and corporate projects, it’s had little effect on the key commercial activities of the business – buying, store operations, or supply-chain decisions. In most cases, sustainable product lines account for only a fraction of sales revenues, and, with new product development and space decisions still dominated by other priorities, change will continue to be slow.

Although retailers’ advertising campaigns are increasingly built around green messages and products, their in-store price promotions largely ignore them – and these account for a very significant proportion of sales. The vast majority of new stores also have little to do with their “green” concept stores. More than 99 percent of all stores are still “traditional,” “non-green” entities.

WHY SUSTAINABILITY IS NOT “STICKING”

Retail is characterized by low margins, pressing daily challenges, and complex global supply chains. Where sustainability and climate change represent long-term challenges, retailers are focused on nearterm, urgent matters and leave sustainability in the backseat. Even deeply committed retailers struggle to achieve real impact.

In our experience, there are two reasons for this. First, retailers fail to incorporate sustainability into their daily decision making. At many retailers, decision making is spread out across hundreds of buyers, category managers, procurement managers, store associates, logistics specialists, and ordering managers.

Forty-two percent of the top 50 global grocery retailers have established a sustainability function, and 14 percent now have a “Chief Sustainability Officer.” But only 10 percent of these grocery retailers actually measure and incentivize personal performance against key performance indicators of sustainability. In this context, it’s not surprising that sustainability often remains limited to a few corporate “lighthouse projects,” and rarely trickles down into decisions, such as which products to carry or what to promote next month. If sustainability is not an important factor alongside sales, volumes, and margins, decision makers will tend to ignore it.

82% of groceries retail chief executive officers cite sustainability as a key priority.

The other challenge retailers face is that they cannot manage what they do not measure. In order to make their core business model sustainable, retailers must understand the financial impact of sustainability initiatives. But only eight of the top 50 grocers evaluate how sustainability efforts translate into financial outcomes. As a result, it is hard to define realistic targets, shape decision making, and measure progress. Identifying and generating the right key performance indicators can be a difficult undertaking. Often, there is insufficient data. Even when such data exists, disentangling the link, for example, between improving a company’s ecological footprint and its economics is far from straightforward.

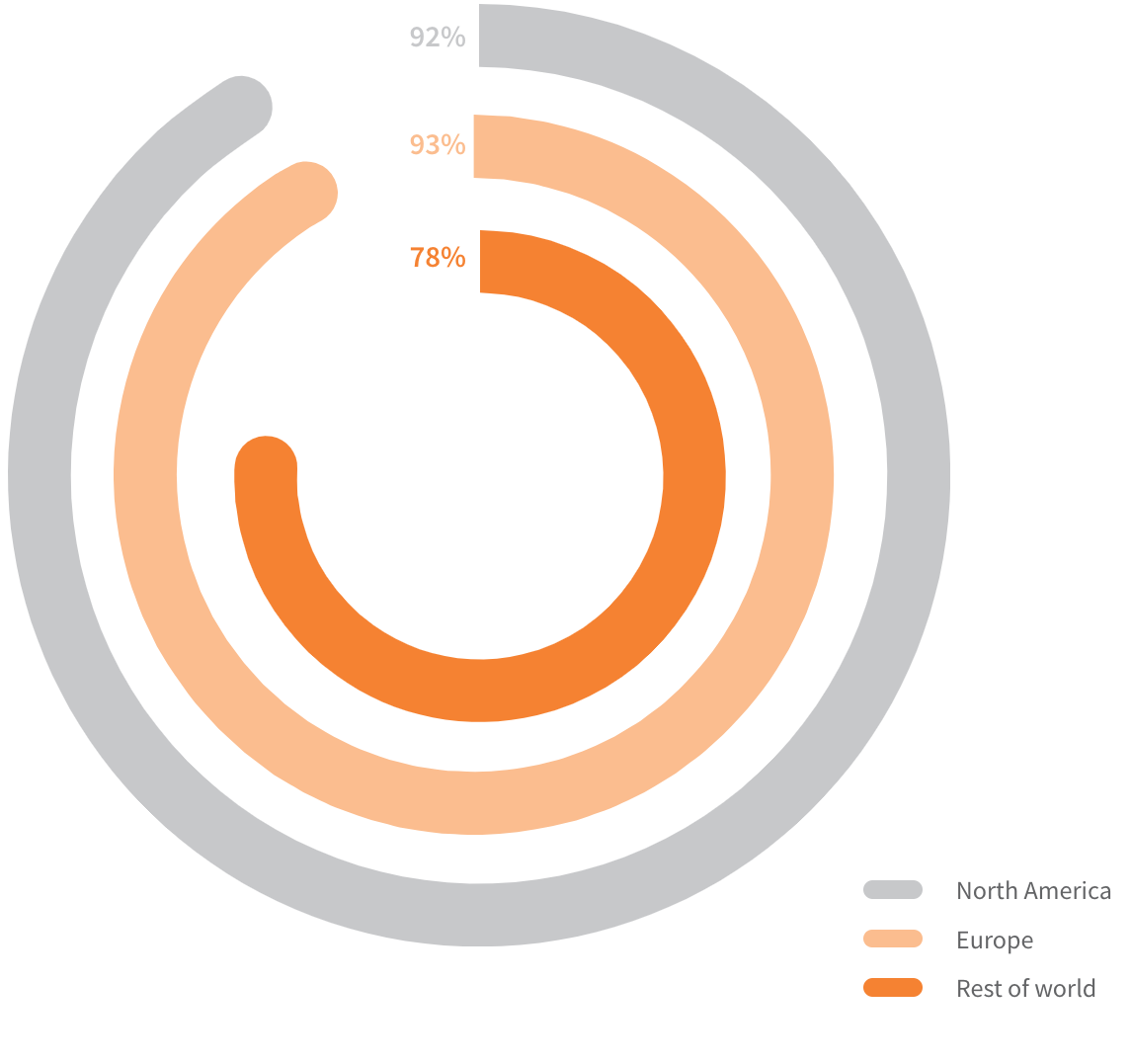

Exhibit 1: Share of top 50 grocers worldwide

MAKING SUSTAINABILITY HAPPEN

Nonetheless, leaders in sustainability have shown that it is not only possible to find ways to measure the impact of their efforts, but also to use this knowledge to achieve their ambitions. Given how decentralized decision making is in a typical retailer, making sustainability a reality requires getting “into the bloodstream” of the whole organization, particularly those working in trading and operations.

Our work with clients points to five important success factors:

1. Clear, strategic intent.

Organizations must establish a clear strategic plan that is regularly reinforced over multiple years. Achieving this requires continuous and unambiguous top-level support. A company’s management team must acknowledge the organizational and cultural challenges involved in targeting longer-term and more holistic objectives – while not losing focus on short-term sales, costs, and margins.

2. Greater transparency.

Measuring the ecological and social footprint of an organization’s products and operations is difficult, especially on the product side, as most resources are used earlier on. But the task is not impossible. To date, most retailers have focused on availability, cost, and time-to-market in their attempts to better understand upstream supply chains. In the future, supply-chain management and supplychain collaboration will need to put as much, if not more, emphasis on resource usage, renewable resources, and social standards.

3. Defined targets.

Realizing a sustainability strategy requires quantified, operationalized objectives for functions and individuals, for both the short and long term. For sustainability to become a reality, decision makers need to place it on par with financial performance. This requires setting specific goals.

4. Inclusion of sustainability in daily decisions.

Sustainability needs to be incorporated into daily decision making in a dispassionate, transparent, and quantitative way. To be effective, there needs to be a detailed understanding of how, when, and by whom decisions are being made, as well as how to influence and change them. Just throwing more data at buyers and at category and operations managers is not enough.

5. Measuring the impact.

Organizations must be vigilant in measuring detailed and quantified results delivered against the targets set. As described earlier, ongoing measurement using key performance indicators is a vital part of embedding sustainability into the organization. Without that, it is very difficult indeed to know how successful the strategy has been, or to ensure that sustainability remains top of mind for those making day-to-day decisions.

CONCLUSION

Building a sustainable retail business model is not easy. It costs money, and is not without risk. The argument for becoming sustainable is fundamentally underpinned by a need: coping in a world of finite resources and increasingly stark trade-offs. The business case for sustainability is fundamentally long term, driven by the need to address emerging but foreseeable realities – ones that only become obvious over time.

However, sustainability offers immediate tangible opportunities to drive growth and reduce costs. In Switzerland, sales of the Coop Group’s private-brand sustainability brands and quality labels have reached $2 billion – more than 18 percent of its food revenues. Coop Group’s market share in Switzerland in organic products exceeds its overall market share by more than 100 percent. Initiatives like this are driving changes in all aspects of supply chains, including fleet transportation and operational energy use. Similar to adopting energy efficiency initiatives, Marks & Spencer in the United Kingdom has generated more than $168 million in net benefits by reducing packaging, decreasing landfill waste, and improving transportation efficiency systems.

These and other pioneers have shown there is a path to profitability in sustainability. Over the coming decades, companies that follow in the footsteps of these early and intrepid leaders, as opposed to those that do not, may find the key to prospering in an increasingly harsh landscape lies in doing the “right thing” and building climate resilience.