This is a FMI authored article.

Health is a much more important topic in food retail today and for good reason: Consumers have placed it front and center. Consumers are passionate about embracing health in many aspects of their lives, and food is a big part of this.

However, shoppers are often confused about how to improve their health, and typically can’t even agree on how to define it. A new report from the Food Marketing Institute Foundation takes a multidimensional view of consumers, health, and retail. The Power of Health and Well-Being in Food Retail leverages insights from a wide range of industry thought leadership, articles, and data.

TODAY’S CONSUMERS ARE MOVING TARGETS ON HEALTH

The word “health” is defined by Oxford Dictionaries online as follows: “the state of being free from illness or injury.” That may be accurate, but the reality is far more complex when it comes to consumers. Health often means different things to different people, varying by generation, income, and other life circumstances. Consumers tend not to agree on what kinds of foods or lifestyles will keep them well. Many are confused because of conflicting advice from a wide variety of sources.

- “Wellness” vs. “well-being”: The overall topic of health and wellness is gradually expanding into “health and well-being.” Wellness is still a highly relevant term and is used throughout this report. However, well-being has a much broader definition, including aspects such as emotional health, energy levels, and sleep behaviors. That is why the term thinking about “wellbeing” is increasingly important.

- New expectations from retail: Consumers look to their food retailer as an ally in supporting their health, and retailers have stepped up with impressive and exciting initiatives. However, even as they build a positive story, retailers face ongoing challenges in understanding the changing, diversifying expectations of shoppers.

SHIFTING CONSUMER APPROACHES TO EATING AND SHOPPING

Consumer perspectives on wellness have changed dramatically, and the shifts continue. Food is now identified with a wider variety of health benefits and concerns. However, the story isn’t uniform because consumers range widely in their attitudes and behaviors, based on variables that include age and income level, and more.

Food eyed as “medicine” to boost health

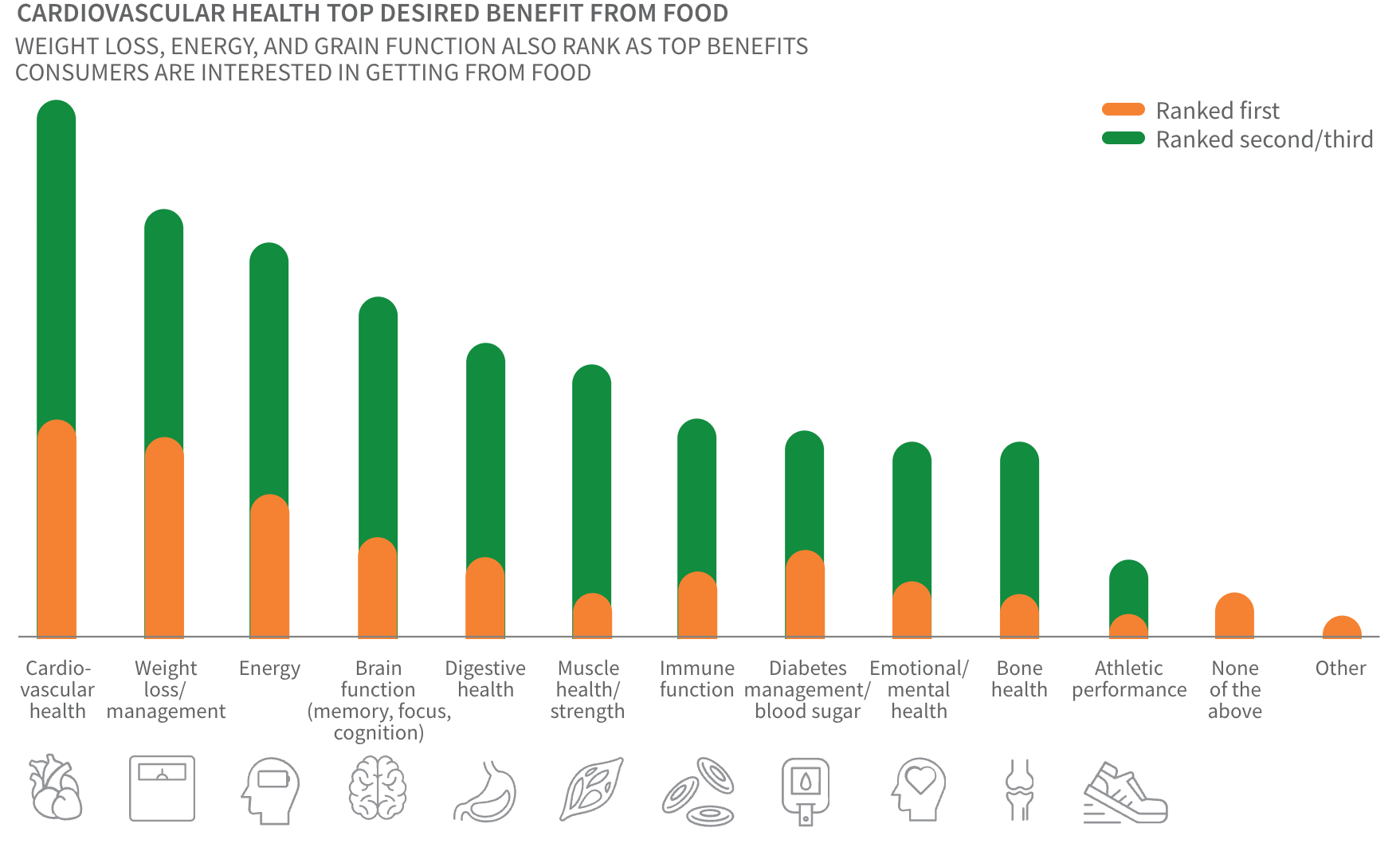

Consumers today increasingly look to specific foods for health benefits, against the backdrop of rising healthcare costs and a growing attention to self-care strategies. About two-thirds of shoppers view foods as “medicine for their body,” according to research from FMI and Rodale. Cardiovascular health ranks highest on the list of desired benefits from food, based on findings from International Food Information Council Foundation, followed by weight loss/ management, energy, brain function, and digestive health.

In addition, most consumers believe that fresh produce has positive health benefits. Many consumers identify produce as a category that supports health. About two-thirds of Americans believe fresh produce is a crucial part of a balance diet, based on findings in FMI’s The Power of Produce report. (See Exhibit 1.)

Exhibit 1: Food eyed as “medicine” to boost health

Source: IFIC’s 2018 Food & Health Survey

Different lenses for different generations

In assessing how consumers view health and wellness today, it’s important to consider how trends differ by generation. For example, a lot of comparisons are made between baby boomers, born between 1946 and the mid1960s, and millennials, born between the late 1970s and mid-1990s

- Boomers are more likely than millennials—51 percent to 36 percent— to look at calorie/nutrition icons and graphics, IFIC found

- Boomers also more frequently check expiration dates, ingredients lists, and brand name, according to IFIC

- Younger adults, in contrast, are more likely to embrace nontraditional attributes, such as transparency about a product’s impact on the environment and humane treatment of animals

Consumers equate family meals with health

Shoppers believe that food prepared at home is more likely to have a health halo. Eighty-eight percent of U.S. adults say they eat healthier at home than when they eat out, a recognition that home preparation allows for more control over aspects that range from ingredients to food safety, according to FMI’s Power of Family Meals.

Consumers also believe in the importance of eating meals together at home with family, and that can contribute to their sense of wellbeing. For example, among shoppers with children, 84 percent say it’s either “very or extremely important” to eat at home together with family.

The FMI Foundation’s National Family Meals Month™ campaign aims to “encourage one more family meal – breakfast, lunch, or dinner – at home each week.” The annual campaign in September garners participation from retailers, suppliers, and community collaborators. Key messages have reached consumers via in-store programs, social media, traditional media, and community activities.

Food safety ranks high on consumer radar

Even as consumers embrace new definitions of health, they are concerned about traditional food safety threats. The top concerns are contamination by bacteria or germs; residues, such as pesticides or herbicides; and product tampering. Lesser concerns include food handling in supermarkets and eating foods past the use-by or best-by dates.

Nevertheless, the overwhelming majority, 88 percent, are mostly or completely confident that the food in their grocery store is safe, a number that has edged up in the past couple of years, according to FMI’s Trends research.

Eating well/shopping well and health

What’s the difference between eating healthy and eating well? Health is a crucial component of eating well, but it’s not the only factor. Consumers have evolved their concepts of eating well, according to research by the Hartman Group for FMI Trends 2018.

Years ago, eating well focused on “sustenance” and “eating enough.” In recent times, it added the component of “health and nutritious.” Today, the definition has broadened to include “enjoyment, discovery, and connection.” These motivations tie into the bigger picture of well-being. Consider all the ways that consumers describe eating well:

- The health aspect includes eating nutritiously and in moderation, including the balancing of healthy and indulgent foods, and consuming foods and beverages with specific benefits

- The enjoyment component takes in tasty foods and beverages, eating with family and friends, and experimenting with preparation methods

- The connection part involves eating foods and beverages that were produced sustainably and ethically

FOOD LABELS, HEALTH, AND TRANSPARENCY

It’s important to understand that shopper wellness perspectives and behaviors are changing, and the details are all-important. There are more variables than ever on how this is playing out, including shopper decisions based on ingredients, nutrition content, labels, organic, and transparency. Retailers need to take deep dives into all of these variables in order to formulate their strategies.

Growing momentum for “clean” and “clear” labels

Consumers have traditionally focused on the ingredients in products. However, as perspectives change, many are increasingly interested in what ingredients are not in products.

Consumers seek products with fewer and more recognizable ingredients, and products that are free from artificial ingredients, chemicals, and preservatives. They view these as healthier, even if their belief is not backed up by science. The food industry refers to this trend as “clean label,” a subject explored in an FMI white paper on this topic. While clean label is widely used as an industry term, it’s also somewhat misleading because it could be interpreted as implying that certain products are not clean.

“Clear label” points to what many believe is the next stage beyond clean label. Clear refers to the consumer’s increased demands for more transparency and authenticity about ingredients and products across the supply chain.

Shopper demands regarding labels and ingredients are changing quickly, according to the FMI Trends 2018 report. Some 71 percent of shoppers attempt to “avoid negatives” by seeking out claims such as low sodium, low sugar, no added hormones, and antibiotic-free.

Organic’s allure

Organic is a huge draw for consumers, even if the exact reasons have been debated over time. U.S. organic food and nonfood sales reached a new record of $49.4 billion in 2017, a gain of 6.4 percent from the prior year, according to a 2018 industry survey from the Organic Trade Association.

Given those figures, it’s not surprising that some 16 percent of shoppers specifically seek certified organic claims, FMI Trends found.

The motivations for choosing organic are multi-layered, according to an article in the Hartbeat Newsletter. “While the absence of pesticides and other farm-based ‘chemicals’ is the primary motivator for organic purchase in store, the package of organic meanings has allowed consumers to use organic as a simple heuristic for ‘better food.’ They believe they can feel good about their organic purchases from a nutritional and ethical perspective.”

Understanding the transparency imperative

Consumers are seeking more information about their food than ever before, and part of the reason is a lack of trust. Consumers still trust supermarkets, but for many that faith is no longer as unconditional as it once was. That’s because consumers have become more skeptical about the actions of stakeholders across the supply chain, from farm to store.

All of this relates directly to health and wellness at retail. “Shoppers, for the most part, believe that packaging satisfies their needs for seemingly concrete facts about what is WITHIN products—fiber, sugar and sodium content, calories, and other nutritional elements,” according to FMI’s Trends 2017 report. “However, shoppers want stores to provide more information and clarity about the meanings and implications of what lies BEYOND products. Complicated notions of product sourcing and animal treatment that speak to ethical practices and fuzzy definitions of product purity (such as nonGMO, ‘natural’) that communicate minimal processing are areas where packaging tends to fall short.”

Consumers seek greater transparency from food industry companies, and that transparency in turn drives trust.

SMARTLABEL® AND TRANSPARENCY

Where can consumers turn when they need more information than is available on a package? Many products enable consumers to scan a QR code for deeper information. Among shoppers likely to scan a QR code, the top product claims sought are, in order of importance, sourcing of ingredients, country of origin, manufacturing processes, and animal welfare, according to FMI’s Trends 2017 research.

The SmartLabel® digital transparency initiative is a high-profile food industry effort. It was created by Grocery Manufacturers Association (GMA) and FMI as part of the industry’s Trading Partner Alliance. SmartLabel® provides information to consumers on a wide range of attributes that could never fit on a package label, ranging from purposes of ingredients to details on production to treatment of animals, as outlined in a GMA white paper on this topic. SmartLabel® information can be obtained in multiple ways, such as online, via smartphone scans of products using QR codes, and through toll-free phone numbers.

REINVENTING RELATIONSHIPS WITH RETAILERS

Consumer attitudes are changing regarding the ways retailers should support their health needs. Retailers are expected to be health allies that provide education, personalized focus, and a plethora of wellness solutions in all departments. Shoppers in this day of radical personalization won’t take no for an answer. They have too many other choices.

Wellness drives consumer perceptions of retail channels

Some 47 percent of shoppers said providing healthier choices is a way for food retailers to support consumers in eating well, according to FMI Trends. Here’s a look at some shopper behaviors and perceptions regarding wellness at retail.

- Health channel choices: The top retail channels used regularly for health and wellness products, according to the Hartbeat Newsletter, are supercenter/ discount stores (36 percent); grocery stores (34 percent); drugstore/pharmacy (32 percent); club store (17 percent); and natural/health food store (16 percent).

- Channel choices equate with “effort”: Certain retail channels—including natural/ organic stores, farmers’ markets, and specialty food shops—are more likely to be frequented by consumers who put more effort into healthy eating.

- Emerging players: Consumers are getting more exposure to a growing number of innovative, upstart food brands with wellness-focused product attributes. This trend was chronicled in a Consumer Goods Innovators Index created by consultancy Oliver Wyman. Many of the brands included in this index are targeting highly popular trends, including plant-based products, healthy meals and snacks, and environmentally friendly propositions. The business models range from delivery to subscription.

Consumers trust their primary store as a health ally

For decades pop songs have extolled the virtues of friendship and support, with standards such as, “You’ve Got a Friend,” and “Lean on Me.” As it turns out, these sentiments also are relevant in describing how consumers rely on retailers for health, wellness, and well-being.

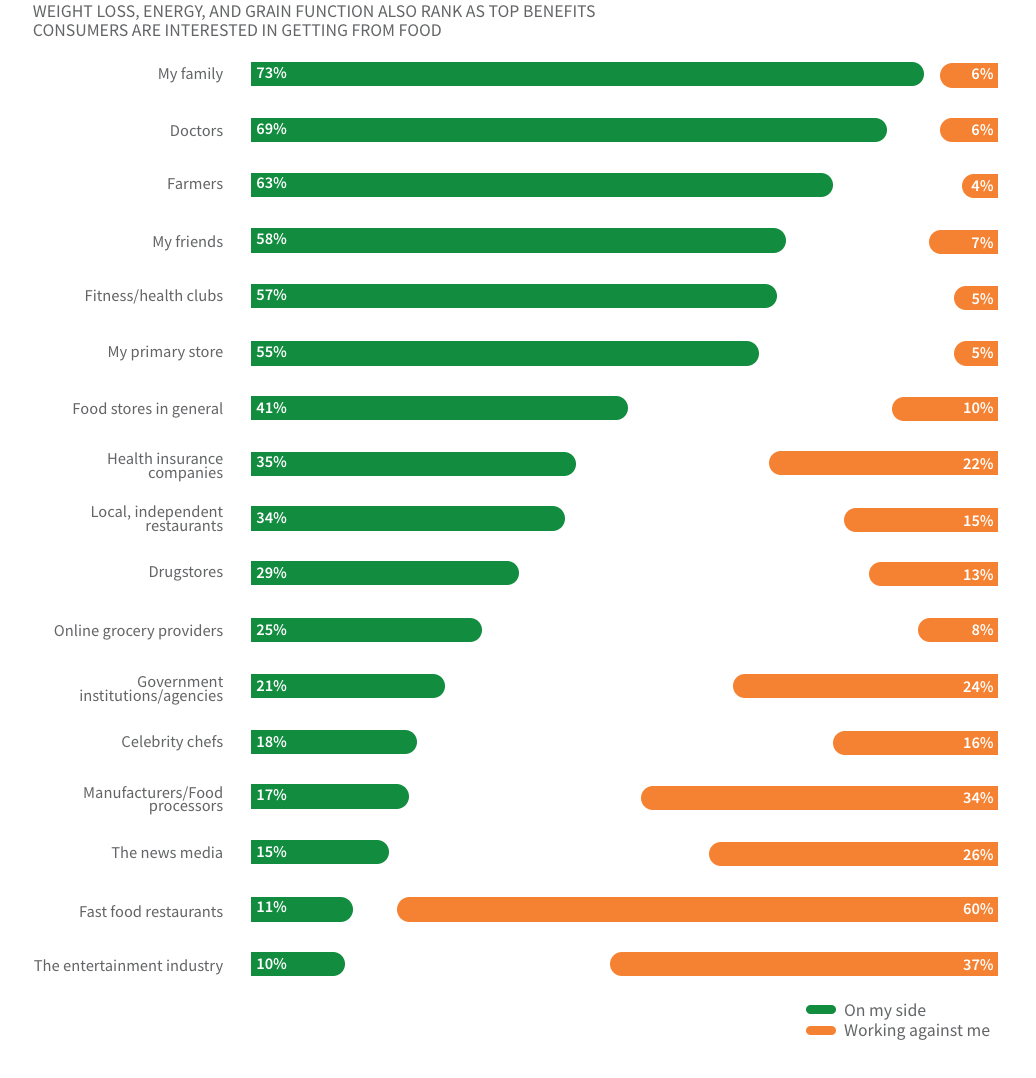

Consumers view their primary store as an ally in their wellness, a perspective that has been gaining momentum, according to FMI Trends research. Asked to name their key allies in wellness, 55 percent of consumers surveyed in 2018 pointed to their primary store, up from 45 percent the year before. Moreover, 41 percent cited food stores in general, a jump from 33 percent the year before. (See Exhibit 2.)

Putting this in perspective, retailers don’t rank quite as high as family, doctors, farmers, friends, and fitness/health clubs. However, the primary store outranks a range of other retail and foodservice channels, including drugstores, online grocery providers, and restaurants.

Private brands play bigger role

Private brands have experienced a growing connection to the wellness trend. Here’s how this was explained in the 2017 FMI Power of Private Brands report: “Health has become mainstream. Ideas like clean label, antibioticfree, and grow your own are no longer fringe— they are ubiquitous.

Private brands with health and wellness focus are gaining share. And it’s not just about food. The health and wellness trend is impacting all industries, including personal care, fashion, household products, and even general merchandise. This includes a focus on hyper-targeted medical conditions.”

FMI has further spotlighted this topic with a new report called, Delivering Health and Wellness with Private Brands. About threequarters of retailers view health and wellness as a significant growth opportunity for these brands, according to FMI’s 2017 Report on Retailer Contributions to Health & Wellness.

Exhibit 2: Consumers trust primary store as ally in health

Source: FMI U.S. Grocery Shopper Trends, 2018.

Q: “When it comes to helping you stay healthy, which of these people and institutions would you say tend to be on your side (helping you), and which tend to be working against you (making it more difficult to stay healthy)? (Select one response for each row/institution)” n=1.035.

Q: “All things considered, how would you rate the job each of these stores are doing in meeting your needs?” n=2,136.

Q: “How confident are you that the food in your grocery store is SAFE?” n=1,035

Omnichannel health preferences: Bricks vs. clicks

In an omnichannel environment, are consumers likely to find better health solutions in physical stores—or online? Consumers do not point to one format as superior in supporting wellness, but instead believe each provides different advantages.

Brick-and-mortar shopping stands out for freshness of perishable items, according to FMI’s Trends. The top categories that 90 percent or more of consumers prefer to buy in person are fresh produce, deli foods, refrigerated dairy foods, fresh meats and seafood, fresh bakery items, and milk or dairy substitutes.

Online is viewed as helping to support sustainability and transparency. In the latter case, consumers gave considerably higher marks to online for attributes including access to detailed product information, selection of natural product offerings, selection of organic product offerings, and openness and honesty.

STEPS FOR ONGOING RETAILER COMMITMENTS

Consumer health needs are clearly on the radar of retailers. Food retail executives cited consumers’ focus on health and wellness (81%) and leveraging food to manage and avoid health issues (72%) as the top two opportunities that could positively impact sales and profits, based on an industry survey conducted for FMI’s The Food Retailing Industry Speaks 2018.

Retailers have made impressive strides, but it’s important to keep adapting solutions for a range of requirements, including food safety, health and wellness, social good, and inspiration and discovery.

Retailer strategies need to be based on knowledge about individual markets and customer bases. That said, a number of strategies have been widely successful and are likely to grow in importance. FMI’S Best Practices and Excellence in Fresh Department Health & Wellness Programming is one of the many FMI reports that outline successful strategies.Here’s a brief look at some proven approaches that will be useful as consumers continue to raise the bar on health and wellness.

- Emphasize food as medicine: Consumers realize categories such as produce are healthy, but retailers can further educate shoppers on how specific items can address various disease states.

- Embrace transparency: Retailers should make efforts to satisfy consumer transparency needs, including through a digital transparency initiative such as SmartLabel®.

- Play up convenience: Consumers are embracing both convenience and health, so offering creative solutions to both needs can produce winning solutions. These could include, for example, “preseasoned meat, poultry and seafood, or premade kabobs with fresh vegetables.”

- Prioritize portions: Shoppers sometimes want to indulge in a department like bakery, but they also appreciate options for smaller portion sizes. Retailers can be an ally by offering a range of package sizes.

- Promote local: Consumers are often interested in the sources of food and sometimes prefer items from local producers. Retailers should accommodate this need and explain how “local” is defined in their marketing.

- Boost private brands: There’s a big opportunity for store brands to further embrace wellness trends. These brands already have a strong head start on the organic front, and they have gained the attention of millennials.

- Enhance trust: Shoppers already trust their primary store as an ally in health. Retailers have the opportunity to further advance that status, using a range of solutions that enhance the proposition of total store wellness.

This Boardroom article is a condensed, customized version of FMI Foundation’s The Power of Health and Well-Being in Food Retail, which can be found here. Readers interested in obtaining the report in its entirety can also contact FMI. The complete report includes a comprehensive list of sources and footnotes.