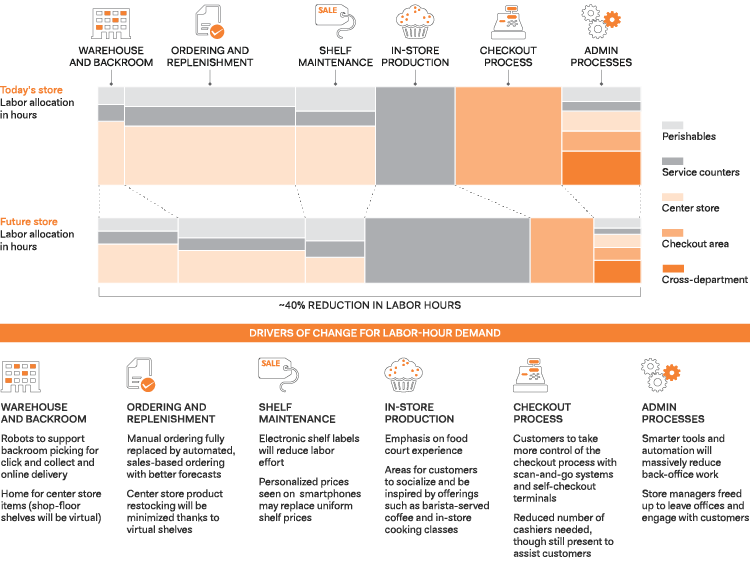

That raises an important question for supermarkets: How many people will be needed to operate the stores of the future? At the Amazon Go concept store, shoppers first register and can then remove items from shelves and leave without going through a checkout process; the payment is automatically deducted via smartphone. Checkout is not the only store operation that can be automated, though. Overall, a high degree of digitization could reduce the labor hours needed to run a future supermarket by around 40 percent.

THE ROLE OF STORES IN AN OMNICHANNEL WORLD

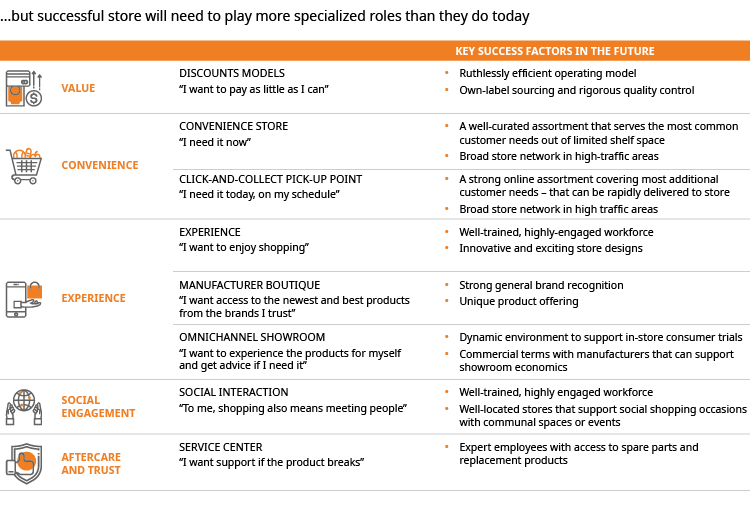

As shopping migrates online, brickand- mortar stores will need to respond, in particular by turning shopping from a transaction into a pleasurable lifestyle activity. Our publication “Retail’s Revolution” shows how physical stores will play an important role even in a world of rapidly growing online sales. However, given the convenience of online shopping, if physical stores are to survive – let alone thrive – they will need to give customers new reasons to visit them.

Exhibit 1: Stores have a clear role to play in retail’s future…

Source: Oliver Wyman analysis

We think that people are likely to remain an essential feature of stores because of their role in creating social engagement and an enjoyable experience. Well-trained, knowledgeable service staff members are the best way for grocers to connect with their customers and give them a memorable and differentiated experience.

FOOTFALL FROM EXPERIENCE AND SOCIAL ENGAGEMENT

The supermarket of the future will need to inspire customers and improve their overall experience. Upgrades could include superior fresh-food offerings, food courts, gastronomic areas, and cooking classes. Each of these features will need to be combined with expert advice; this will be labor-intensive and, therefore, expensive. To fund this investment, stores will need to deploy modern automation technologies that free up staff from routine operations. These freed up hours can then be invested in activities that add greater value for the customer.

While the most visible changes to supermarkets will be these new customerfacing features, digital tools will transform operations in less obvious ways. Before customers arrive in a store, they will have assembled their shopping lists using online apps informed by artificial intelligence, which could recognize their consumption patterns. As they sample products in-store, they will flip through recipes on a tablet or smartphone and make online orders for home delivery or for picking up as they leave the store.

1. Warehouse and backroom

The backroom will house the center store assortment and serve as a picking area. Some online orders will be picked here for home delivery or in-store pickup. Shop-floor replenishment teams can be relocated here. Potential increase of labor hours: 100+%

2. Fresh counters and in-store services

An addition to today’s meat counter and fresh bakery, this area will be very important. A food court will offer expert advice, a place to socialize with barista-served coffee, and tastings of meals for home delivery or pickup. Potential increase of labor hours: 40+%

3. Ordering and replenishment

Forecasting errors will be reduced by machine learning algorithms, making stock management much easier. Center store products will be bought online or from virtual shelves. The stocking of perishables will be a higher priority. Potential reduction of labor hours: 50+%

4. Shelf maintenance

Electronic shelf labels will enable automatic price updates and reduce effort – especially for discounted products. Personalized prices seen on a smartphone may even replace unified shelf prices. But tasks such as fresh and quality controls will stay relevant. Potential reduction of labor hours: 50+%

5. The workforce of the future

Taking advantage of new tools and technology requires staff to develop a new skill set. Managers need to leave their offices and engage with customers, as good restaurant owners do. Staff at new areas like the food court will require a customer-centric mind-set and a new training approach.

6. Administration

Smarter tools and automation will massively reduce back-office work. Streamlining and digitization will mean managers won’t have to work through long paper lists and daily reports. The new checkout experience will also minimize hassles such as cash management. Potential reduction of labor

hours: 60+%

7 .Checkout

No lines, one-click payment: The future store will offer a much better checkout experience than today. Most customers will use scan-and-go systems, others self-checkout terminals. Potential reduction of labor hours: 60+%

8. The customer of the future

The future customer will want to shop anywhere, anytime. A trip to a store will need good reasons. These could include services such as recipe tastings and lunch in the store, or a highly personalized offer and price. Shopping will need to be fun, hassle-free, and experienced through multiple channels.

MANUAL TASKS NEED TO BE AUTOMATED

Some stores have already introduced automatically updated electronic price tags for display shelves, saving the bother of swapping paper tags. The electronic tags can also facilitate dynamic pricing, to discount overstocked products or those about to reach expiry date, for example. In the future, customers’ smartphones may display personalized prices. This would allow supermarkets to make tailor-made offers that take into account a customer’s profile, shopping history, and current location in the store. Interaction with customers will become highly individual, both in stores and online.

THE CENTER STORE GOES VIRTUAL

Floor space for the new features can be freed up by shrinking the space currently allocated to canned and packaged products. Detergent, washing-up liquid, and paper towels form part of “chore” shopping and provide little to attract consumers to a store.

Supermarkets could create a virtual version of the center store, where customers scan items on a wall of barcodes to add to their virtual baskets. They would then pick up the items later or have them delivered. The products themselves will mostly remain in the backroom storage areas, simplifying the picking process.

To smooth the flow of goods through their stock rooms, stores will need more effective picking systems. Depending on lead times and customers’ use of digital shopping lists, some orders will be picked in centralized warehouses in different locations. These items will then be combined with products that shoppers add in the supermarket, providing a seamless experience across every shopping channel.

Stores’ forecasting and ordering decisions will be fully automated, using machine- learning algorithms and realtime out-of-stock alerts. Smart tools and algorithms will help to plan just the right level of convenience food production. At the food court, employees will use standardized meal kits to maintain high levels of product consistency and operational efficiency.

JD.com aims to launch one million stores across China over the next five years. Alibaba aims to turn six million convenience stores into smart service centers.

CHECKOUT WILL BE CUSTOMER-LED AND SUPPORTED BY TECH

Automation is already changing the supermarket checkout process. In the future, customers will expect no lines, no transaction time, and one-click cashless payments. Amazon Go uses a combination of digital technologies to check which items each customer has taken from the store’s shelves. This kind of system will be too expensive for most supermarkets, at least for now. However, scan-and-go systems that greatly simplify the checkout process are gaining popularity among shoppers. Many retailers offer selfcheckout terminals, a number of which can be overseen by a single member of staff.

FUTURE STORES WILL BE ABLE TO OPERATE WITH A 40 PERCENT REDUCTION IN LABOR HOURS

A number of these store upgrades will be costly, but technology presents huge opportunities to save money by simplifying basic tasks, while also providing a better customer experience. We think retailers could free up 20 percent of their labor using existing technology and by systematically optimizing and simplifying day-to-day processes.

By adding the cost savings from massive automation and the transformation of supermarket sections, such as the center store, the future store will be able to operate with labor hours reduced by 40 percent from their levels today. (See Exhibit 2.)

Highly efficient digital operations will thus enable supermarkets to create a superior customer environment that will be well placed to compete against online stores.

CONCLUSION

The growing share of online grocery continues to draw much attention from both the retail industry itself and broader coverage by the press and the analyst community. Even as that share grows, physical grocery stores are undergoing a quiet revolution of their own. Brick and mortar stores will continue to meet most of the demand for food for the foreseeable future. Retailers who invest in the future supermarket now will find their stores likely to continue to thrive as an important part of the omnichannel future.

Exhibit 3: O2O business contribution in majory grocery retailers

1. Not all stores operate O2O

2. The online order # only accounts for c.5% in Yonghui Bravo Luban Rd. Store in Shanghai

3. A new format store located in Yangpu, Shanghai

Source: Primary research, store visits, desktop research, Oliver Wyman analysis