By Tom Cooper, Brian Prentice, and David Stewart

This article first appeared in Forbes on March 28, 2019.

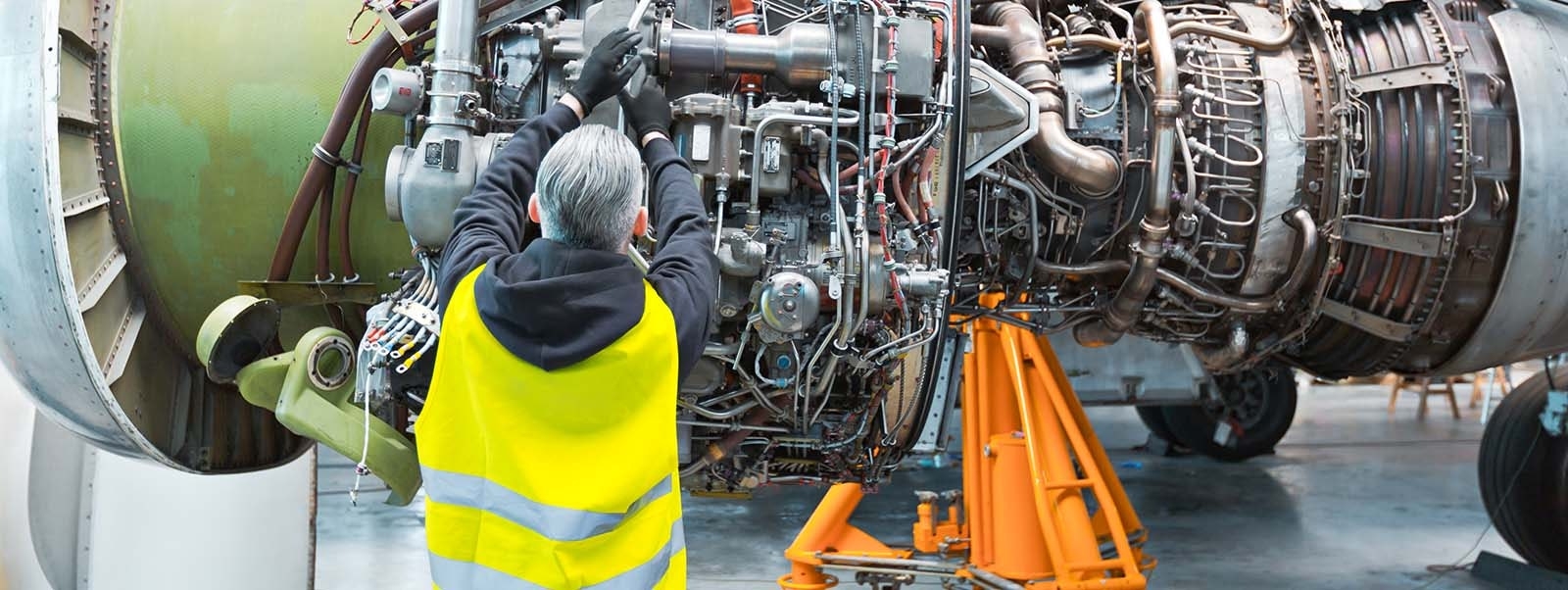

Since the mid-1990s, there has been a consistent, almost inexorable trend for airlines to outsource their maintenance needs. Today, the state of the maintenance, repair, and overhaul (MRO) sector in aviation is encouraging some carriers to rethink that decision.

A growing number of airlines are looking to build MRO capability and pursue more insourcing. The main drivers behind this strategic about-face include a desire to assure the availability of adequate capacity and, for some, an interest in building out MRO capability as a commercial activity in what is a fast-growing market with inadequate capacity.

The shortages facing MRO can be seen to varying degrees in line, engine, component, and airframe maintenance, depending on the geographic region. Besides the difficulty in keeping up with demand in select market segments, there is also a looming shortfall across most geographies in the number of trained aviation technicians. At a time when the number of available seat miles is on the rise and a failure to provide on-time performance can carry costly penalties, airlines want to ensure that they can keep their aircraft serviced, and in the air, as much as possible.

As the aftermarket consolidates, airlines are growing wary of the rising market position of aircraft and engine manufacturers in MRO

Shortfalls in capacity as fleet grows

As a result, the aftermarket — as the MRO sector is often called — is starting to see announcements, such as the recent ones by Air Asia and Malaysia Airlines, about airline investments in new or additional in-house maintenance capabilities. This trend has been particularly evident in much of Asia and the Middle East, where burgeoning middle classes want to travel and airline fleets are growing rapidly and have done so for the last decade. For example, more than 40% of the 11,680 aircraft to be added to the global fleet between now and 2029 will be added in those two regions, according to the latest Oliver Wyman Global Fleet and MRO Market Forecast. And with this 42.5% growth in the fleet, there is naturally a concomitant increase in aftermarket spend: Oliver Wyman’s 2019-2029 Forecast projects a 41.4% rise to $116 billion by 2029 in MRO expenditures, up from today’s $82 billion.

To read the rest of this article, click here.