This article was first published on October 29, 2020.

Editor's note: For the latest insight in our Future of Finance series, please visit our articles on Improving Financial Planning and Analysis (FP&A) and Finance Workforce Transformation.

When a group of chief financial officers (CFOs) were recently asked to describe their role, 70 percent of the CFOs said, “as a true strategic advisor to the business.”

Today, CFOs have a critical seat at the senior leadership table, with organizations reaching to Finance not only for survival, but to also look ahead, forecast, and drive future growth.

This value-added shift has allowed financial institutions to become more efficient and ultimately more cost effective. However, many organizations are not completely well positioned yet — the business may not have the right infrastructure in place, the necessary talent or the essential forecasting data and analytics.

COVID-19 has further accelerated these initiatives. Many assumptions and needs that were made prior to the pandemic have become stronger realizations. What follows is our first insight in “The Future of Finance” series. Here, we take a deep dive into the evolving role of the CFO and offer success factors for how Finance teams within the banking and insurance industry can thrive, drive growth, and better position the company for the future. Although this report focuses on financial institutions, the insights we share can be leveraged by non-financial companies. Below is the web version of "Unlocking The Strategic-Minded CFO," for the PDF version, please click here.

Building a Finance function that is positioned to strategically support the business can be instrumental in making the right types of decisions required for this environment

WHAT HAVE WE LEARNED IN THE LAST SIX MONTHS?

For one, COVID-19 has reinforced the broader, strategic advisor role that chief financial officers and their teams are taking on within the business. With many competitive forces and challenges in the marketplace, having a Finance function that is positioned to strategically support the business can be instrumental in making the right types of decisions required for this environment. Especially now, it’s paramount for businesses to have faster, smarter, and more dynamic forecasting tools and capabilities than previously — along with talent that has greater technical knowledge and a strategic-oriented skill set. Finance teams need the ability to dive in deeper and link their actions into what is going on in the market. This requires the investment dollars to build a better and more effective infrastructure, however it may not always align with cost control initiatives.

During our discussions with Finance teams, we have found that only 25 percent of chief financial officers feel that their Financial Planning and Analysis (FP&A) function is driving effective business decisions, and only 19 percent feel that it is efficient. There is a significant need for FP&A performance improvement by using better, seamless technology, more agility, and strategies driven by dynamic, real-time data.

Second, given the shifting market dynamics, cost remains a core focus for CFOs, and Finance will need to continue to lead the way in cost control. Cost management and protecting margins was already challenging for financial institutions due to the low interest rate environment and COVID-19 has exacerbated this issue. For example, banks are under increased pressure due to the revenue shortfall related to decreased interest rates; as such, costs continue to be a strong focus. And with the pandemic’s uncertain grip on the economy, banks are setting aside loan loss provisions to cover potential increases in defaults. Today, businesses need to build greater cost transparency within their organizations to enable better decision making and improve cost management over the long term.

Today, businesses are reaching to CFOs and Finance not only for survival, but to also look ahead, forecast, and better position the company for a post-COVID world

Third, there is an imperative to make investments in areas such as digital, leading to the need to free up capital through cost cutting initiatives. Now, companies are quickly innovating, and projects of this nature are being prioritized and targeted for an accelerated start. Companies looking to gain market share are having to invest heavily in building out better interaction tools that consumers are craving, including websites and new apps that rival disruptors and make the customer experience easy, convenient and seamless.

At Oliver Wyman, we have been working with clients to solve these issues and to help them take practical actions to thrive in this market. With our first insight in this series, we offer our perspectives and market insights from working with leading global financial institutions; present the challenges and trends ahead; and weigh in on the success factors you will need to remain competitive and gain market share in this new normal.

CHALLENGES AND TRENDS AHEAD

Key Challenges that CFOs are facing today

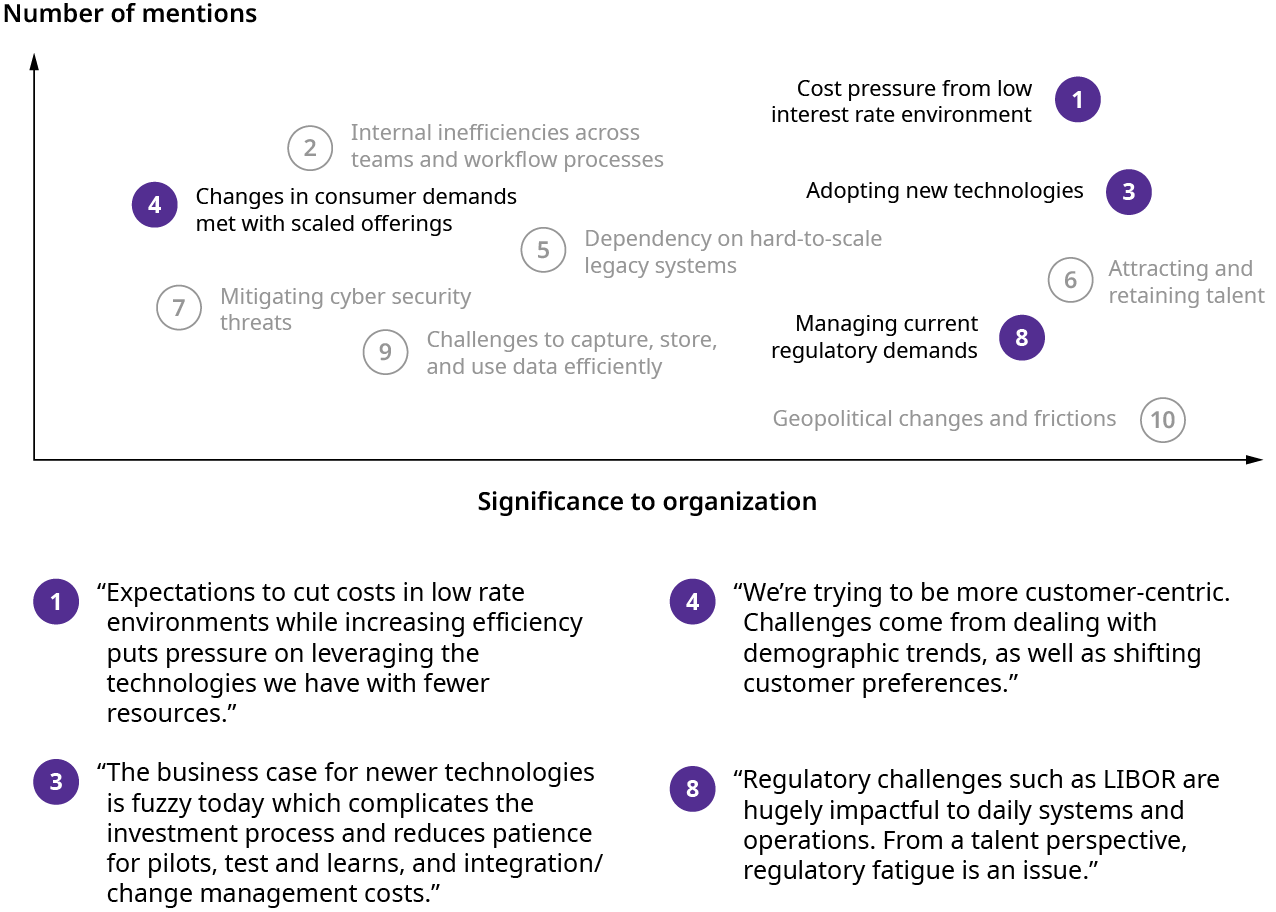

Prior to the pandemic, Finance teams faced barriers and COVID-19 has exacerbated these challenges. The most significant universal issues for banks and insurers are cost pressures from the need to protect margins in a sustained low interest rate environment and difficulties with adopting new technology.

We have found that many of these challenges are connected. For example, changing regulatory pressures and compliance fatigue are directly impacting Finance operations as well as contributing to issues with attracting and retaining talent.

CFOs identified cost pressure from low interest rates as the top challenge

THE MODERN DAY CFO

"I'm not a controller, but a strategist"

Approximately 70 percent of the CFOs we had discussions with in banking and insurance said they now have responsibilities outside of the traditional Finance mandate and are taking on more strategic and operational responsibilities.

For example, functions such as Strategy/M&A and Procurement may now fall under the CFO’s responsibilities. Many institutions are finding that having their Strategy/M&A function operate within Finance creates a beneficial synergy for their organization — allowing them to more effectively maintain alignment between financial forecasts and planned actions by the business to expand or contract; and helping them to holistically position the company post-crisis more effectively.

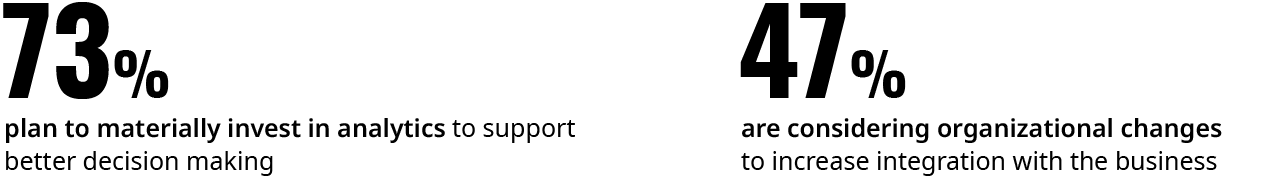

With this shifting dynamic towards strategy, Finance teams said they need better data and analytics to support the analysis of risks, customer segments/behavior, and customer needs. In the following section we present the success factors to get there.

GET STARTED.

The road ahead is uncertain and now is the time to future-proof your business. With many competitive forces and challenges in the marketplace, having a Finance function that is positioned to strategically support the business can be instrumental in making the right types of decisions required to thrive in this environment. Well-planned actions taken today can help drive growth and win goodwill with customers, especially once the crisis fades.

The pandemic has reinforced the broader, strategic advisor role that chief financial officers and their teams are taking on within the business. At Oliver Wyman, we can help you to find your strategy and achieve it in a way that is market relevant. We know the types of pressures that exist across the board and can collaborate with your team to strengthen your Finance capability on a number of dimensions — whether it’s accessing your current capabilities; identifying business-wide transformation opportunities; becoming an efficient data-driven business; or building operating models both within Finance and across the organization.

The time to start is now.

RELATED INSIGHTS

-

Read More

Read MoreOliver Wyman Our "Future of Finance” series is a collection of content to help CFOs and Finance areas position themselves as better business partners.Transform Your Finance Workforce

-

Read More

Read MoreOliver Wyman Our Future of Finance insight helps firms to improve the effectiveness and efficiency of financial planning and analysis and seize emerging opportunities today and in the post-COVID world.Improve Financial Planning And Analysis

-

Read More

Read MoreOliver Wyman We advise our clients on corporate finance and treasury strategy, integrated planning, cost takeout strategies, and operations, data and technology transformation.Finance And Treasury Management