This article was first published on July 13, 2021, and is part of Oliver Wyman's "Future of Finance series," a collection of content to help CFOs and Finance areas position themselves as better business partners.

COVID-19, along with a colossal tech shift has increased the urgency to reskill Finance talent and for teams to become more digitally-savvy.

COVID-19, along with a colossal tech shift has increased the urgency to reskill Finance talent and for teams to become more digitally-savvy.

The Opportunity: Why now is the time to transform your workforce

The new normal has accelerated the need for organizations to go digital, and head into new frontiers with advanced technologies, AI and big data analytics. These pressures are fueling greater urgency to enhance Finance talent and capabilities — which businesses are struggling to fill.

The increase of digitization now requires chief financial officers (CFOs) and Finance operations to invest in new skill sets, automate processes, make faster decisions (with larger, more complex information), and step up on business change processes.

Covid-19 has reinforced the broader, strategic advisor role that chief financial officers (CFOs) and their Finance teams are taking on within the business — for example, they were at the heart of retaining enterprise agility throughout the crisis. As CFOs embrace these changes and organizational transformation, they need the right mix of talent, agility, and a broader business acumen across the enterprise.

What follows is our next installment in “The Future of Finance” series, a collection of content developed by Oliver Wyman to help CFOs and Finance areas position themselves as better business partners. Below is an excerpt of the report, for the full PDF version, please click here.

Finance needs to develop a culture that embraces change and transformation.

Finance needs to develop a culture that embraces change and transformation.

Here, we discuss three forces that are impacting Finance teams and driving an urgency for change. We take a look into the next generation of skills your Finance workforce will need to prioritize, and discuss our latest research on how the pandemic has changed employees’ work-life visions. We share five key success factors to help CFOs and Finance areas improve their talent models, attract new recruits, and develop a sustainable, flexible workforce approach. Although this paper focuses on financial institutions, the workforce and talent insights we share can be leveraged by non-financial companies.

Three forces fueling an urgency for change

In our most recent client work, we have found three forces impacting Finance areas and fueling the urgency to enhance skills and capabilities.

Finance roles continue to evolve

It’s no secret that Finance and Accounting roles have broadened. Finance operations still need to maintain their task-based, standardized utilities (Accounting, Treasury, Financial Planning and Analysis, Tax, Compliance, Internal audit controls, etc.), but in 2021, CFOs have a critical seat at the senior leadership table, with organizations reaching to Finance not only for survival, but to also drive decision making, plan future growth, and become stronger advisors to the businesses.

This value-added shift — moving from solely task-based workload and number crunching to operating as strategic advisors across the enterprise — is now a cornerstone for leading financial institutions to retain strategic agility and become more effective. However, many Finance teams are not well positioned yet, and may not have the right operating and human capital model in place (including attraction, development and retention of key talent).

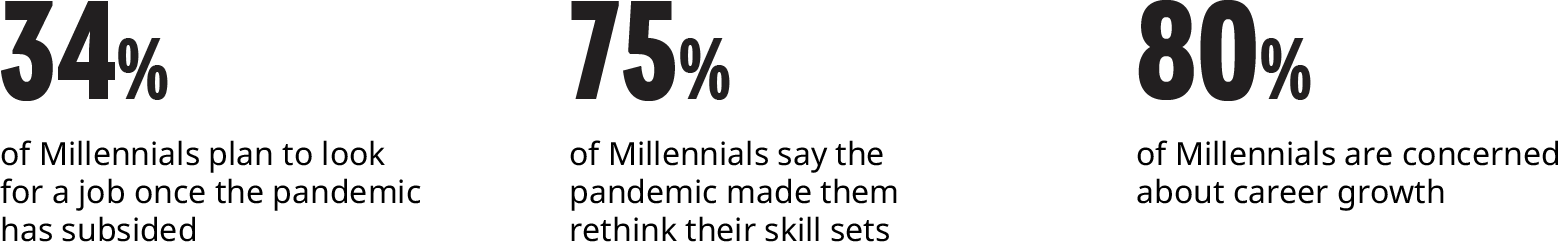

During our discussions with Finance teams, 43 percent of CFOs we spoke to feel their workforce is not well positioned to support this shift. This is due to compounding factors such as difficulty in attracting talent; changing career attitudes of younger employees that want broader more flexible career paths; and difficulties in upskilling the more tenured employees.

The challenges and demands ahead

Key Finance capabilities that require growth and development

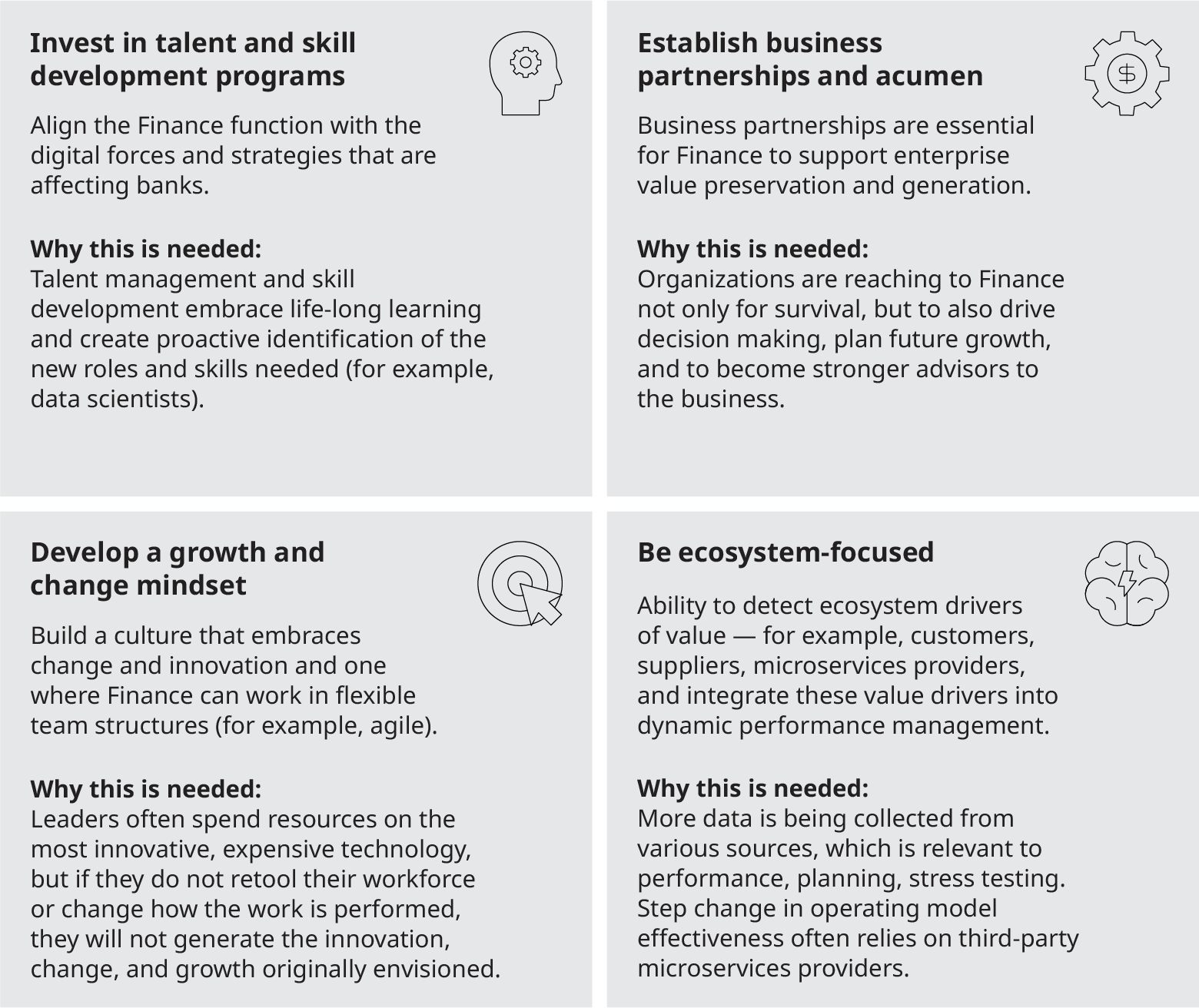

The Finance skill set of the future requires a greater prevalence of agility and strategic thinking. As Finance becomes stronger advisors to the business, a growth mindset is essential along with the ability to work on projects that evaluate a broader set of risks and scenarios for the enterprise. Stronger capabilities are needed that use real-time data and analytical tools for decision making. Hiring data scientists is now more common, and talent needs to both understand key performance indicators (KPIs) and be able to advise the business on using KPIs effectively (which may include advice on how KPI affect human behaviors and decisions).

Finance needs to develop talent with a higher-level of non-traditional technical skills, and have teams that that can manage the proliferation of automation, AI and robotics. Finance also needs to rethink outsourcing strategies. Previous transformation efforts have often focused on automation and the offshoring of service centers to cheaper locations— with “standard” Finance skill profiles, which in many cases has resulted in fewer career development opportunities for employees of the retained core Finance function. As third- party digitalization and microservices continue to emerge, these outsourcing strategies will need to be reassessed.

Significant culture and support gaps

Our recent client work demonstrated that Finance employees are experiencing significant gaps in culture and the support mechanisms for successful workforce transformation. For example, current career path options are often limited and require greater business and skills exposure. And we have found that previous leadership styles often do not empower employees, with leaders not always being accessible or focused on coaching. Directors and managers we have spoken to received limited coaching on how to further develop teams with broader skill sets.

Today, maintaining employees’ well being and flexible working options is paramount for organizations to be talent competitive and achieve sustainable performance.

Today, maintaining employees’ well being and flexible working options is paramount for organizations to be talent competitive and achieve sustainable performance.

Many organizations have started to expand or develop capabilities but need more investment, resources and planning in these areas. At Oliver Wyman we work closely with clients to re-examine their Finance infrastructures, operations, processes and talent needs. Below we share four areas of development and actions that are needed to stay ahead of demands stemming from the digital transformation in the banking industry.

Force 2: The Pandemic profoundly impacted employee experience

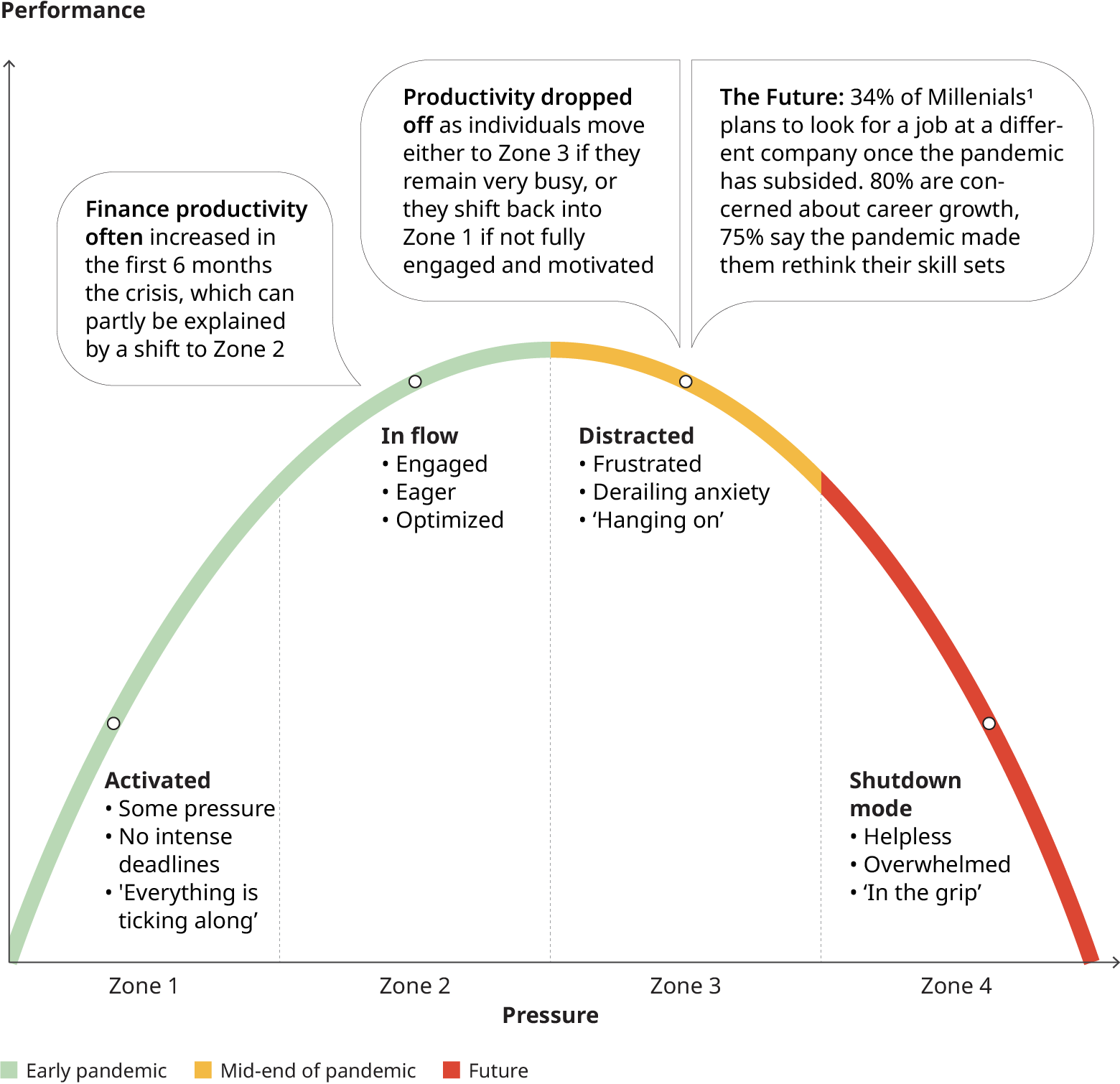

The pandemic profoundly impacted employee experience and changed employee work-life visions. Today, maintaining employees’ wellbeing and flexible working options is paramount for organizations to be talent competitive and achieve sustainable performance.

While many banks experienced a welcomed increase in productivity and employee engagement at the beginning of work-from-home arrangements, that productivity has now dropped off as individuals are either frustrated with their situations or are no longer working in crisis mode.

As we continue moving towards the new normal, Finance functions need to react urgently to this dramatic shift in employee sentiment. Employees expect flexible working (a hybrid-model that combines both office and work from home arrangements) to become the norm (as opposed to solely working remotely). The market outlook for Finance talent remains competitive, fueling the need to develop more flexible working options and career trajectory paths to attract top talent. Next, we will discuss how we can use the pandemic‘s learnings to design the Finance organization of the future.

Force 3: Re-envision the future of work

Sustainable, flexible working arrangements provide high employee job satisfaction, while also increasing talent attraction and retention. CFOs and Finance organizations need to re-examine and consider the various roles within their Finance function, and determine how these roles were exemplified during COVID-19. How can the elements of roles be adjusted — to keep high employee satisfaction and also meet the needs of the business? Below, based on our recent work, we present different aspects illustrated through "personas." We provide examples of the needs or choices to consider when designing a new Finance operating model that embraces flexible working.

Achieving sustainable workforce transformation

Finance teams should use a segmented approach to implement workforce changes, as the needs and the focus areas within the function differ greatly. Additionally, the approach can focus on cost neutral strategies with the (partial) reinvestment of savings from automation and broader “nearshoring,” into enhanced value-added Finance capabilities and skills.

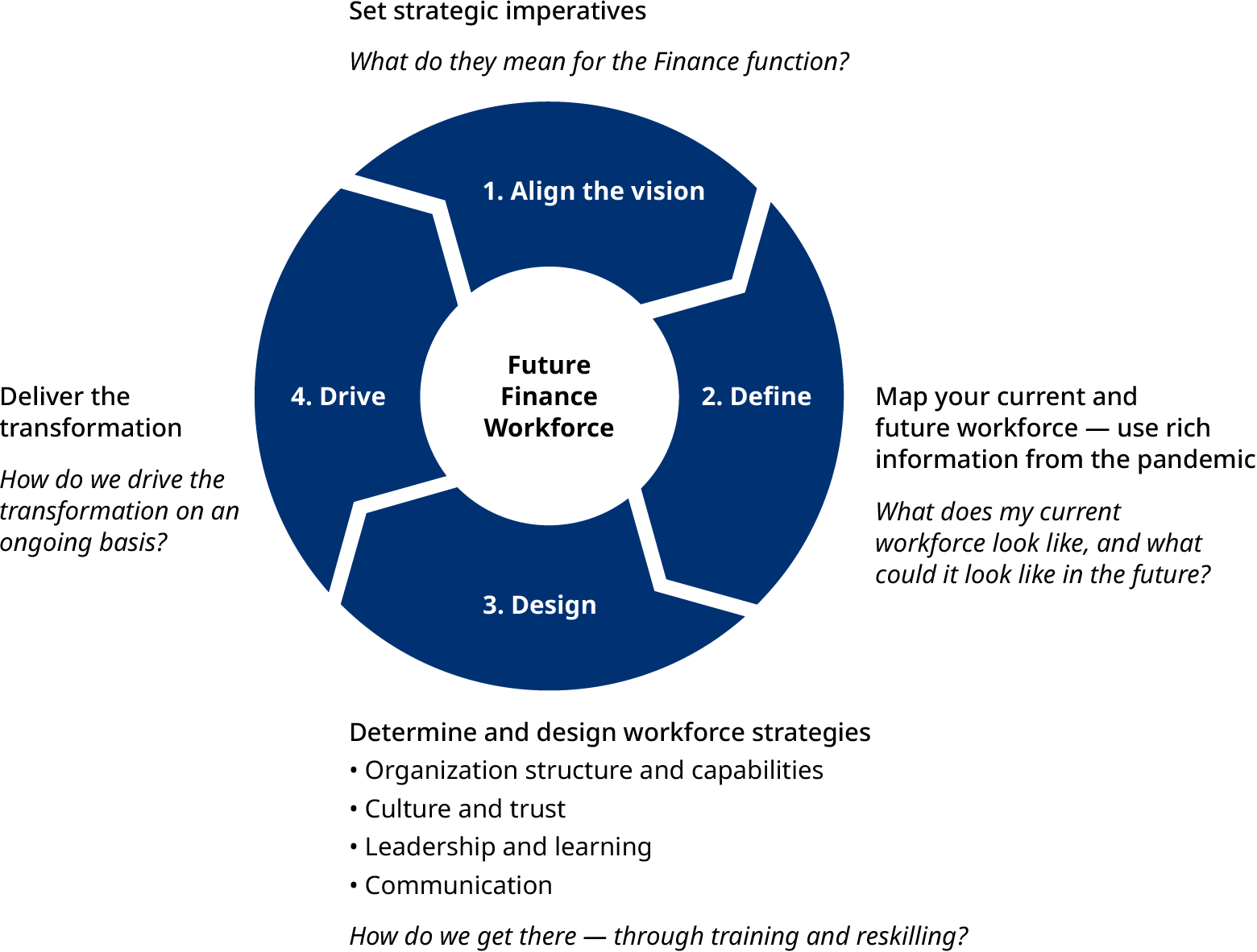

At Oliver Wyman, we have a well-established four-step approach for achieving a sustainable, flexible workforce transformation. Our full report (page 13) shares a summary of our approach and below we preview the four steps.

Five key success factors for Finance workforce transformation

We believe Finance needs to establish a shared vision and receptive buy-in from senior management, business-line leaders and human resources. Building this acceptance and strong linkage can be beneficial for organizations, helping them to foster engagement, build collaborative relationships, and enhance communication and decision making. As Finance workforce transformation programs are delivered over a longer-term horizon, we found that it is fundamental to establish and communicate a vision. This vision should consider the medium to long-term effects of strategic and disruptive forces on enterprise-value drivers as well as the resulting factors that impact the workforce. Establishing frequent pulse checks of reality against transformation targets are key for enabling smaller adjustments throughout the implementation, while introducing a simple implementation-focused roadmap can ensure the much-needed transparency for Finance teams when they “embark” with their leaders on this daunting journey.

Get started

Oliver Wyman's Finance workforce strategy and toolkit

The road ahead is uncertain. With many competitive forces and challenges in the marketplace, having a Finance team that is positioned to strategically support the business can be instrumental in making the right types of decisions required to thrive in this environment.

How can your Finance organization best position its workforce for future success? At Oliver Wyman, we have built a well-established strategy and toolkit to support CFOs with managing these accelerated digitization pressures — and drive sustainable action.

As part of our offering, we: (1) Provide Finance leaders with the foundational building blocks for leadership, culture, communication, policy and governance; (2) Develop people programs and new ways of working (through collaboration with our Human Resources consulting colleagues at Mercer); and (3) Support organizations with establishing the infrastructure and resources to drive successful transformation execution.

Our team can help your business re-examine and strategically position Finance operations and workforce talent. Successful implementation has resulted in clients’ achieving stronger Finance function performance and enterprise value-generation capabilities as well as fostering higher Finance employee engagement.

The time to start is now.