This article was first published on February 24, 2021, and is part of Oliver Wyman's "Future of Finance series," a collection of content to help CFOs and Finance areas position themselves as better business partners. Please check out our latest insight on Finance Workforce Transformation.

As Finance becomes a stronger advisor to the business, companies are reimagining traditional approaches to financial planning and analysis (FP&A). Today, it’s becoming more common for FP&A and Strategy to have a greater common ground, tying the strategic plan to a forward-looking budget and planning process.

Greater efficiency is needed so that Finance teams can focus on challenging forecasts and ultimately developing better plans. Most firms today have a single, static plan/forecast, and limited forecasting agility; however, in this uncertain, changing market, these capabilities lack a clear view into the current drivers of revenue and expenses. During our discussions with Chief Financial Officers, we have found that only 25 percent feel that their financial planning and analysis (FP&A) function is driving effective business decisions, and only 19 percent feel that it is efficient. There is a significant need for FP&A performance improvement by using better, seamless technology, well-positioned talent, and strategies driven by dynamic, real-time data.

At Oliver Wyman, we have been helping clients re-examine their end-to-end financial planning and analysis efforts — spanning people, processes, capabilities, infrastructure and through developing “next generation” FP&A. What follows is the latest insight in our Future of Finance series. Here, we offer three foundational wins for how companies can improve both the effectiveness and efficiency of their financial planning and analysis efforts — and seize emerging opportunities today and in the post-COVID world. Although this paper focuses on financial institutions, the insights we share can be leveraged by non-financial companies.

Modernize your financial planning strategy

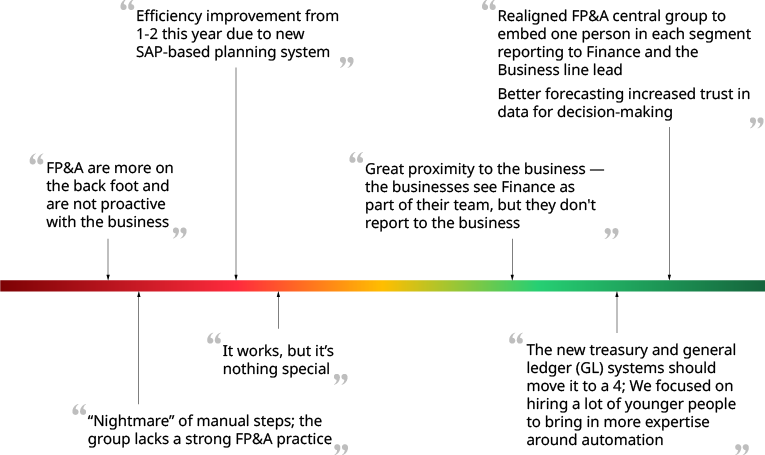

In our discussions with financial institutions, we found that the effectiveness and efficiency of the FP&A process were challenging for many. 75 percent of CFOs felt they needed a more effective FP&A function; and 81 percent of CFOs reported that the FP&A operation, itself, was rife with arduous tasks and required more days than it should to turn around forecasts and analyses of business performance.

Win #1: Save time and money with driver-based planning

Management teams are at the risk of “flying blind” if they do not accelerate the transformation of the planning function. As senior leaders face uncertainty, they are looking for a better dashboard— including the ability to have early warning signals for decision making and the tools needed to react quickly when business conditions change.

We believe there is a better way to plan — that is more suited to today’s demands. In our paper “It’s Time To Upgrade The Way Banks Plan,” we highlighted benefits for introducing the modern forecasting practice of Continuous Integrated Planning (CIP). In such a model, the focus is on rapid identification of emerging opportunities and risks.

First, it requires a shift from a linear, static planning process to a process where forecasts are “always on” and refreshed with limited manual intervention. Second, it requires a shift from disconnected to integrated planning. Here, all forecasting models and calculations are brought online and are connected to the planning infrastructure — enabling highly automated forecasting with insight generation based on drivers of business performance, ‘what if’ analyses, and real-time transparency into enterprise profitability measures and regulatory constraints.

Beyond enabling more effective decision making, Continuous Integrated Planning (CIP) frees up time on lower value tasks such as data collection, reconciliation and manual ad hoc analysis for higher value priorities, such as forecast improvement and insight generation.

Generating insights based on business performance drivers is a core element of CIP. By setting up driver trees during planning, businesses can have more transparency into what is driving forecasts. This incorporates both financial and non-financial performance levers and does so at an appropriate, fit-for-purpose level of granularity — focusing on the most material drivers. It allows businesses to create a total revenue project and actively monitor against it.

Driver-based planning offers “ah ha moments.” For example, if a business sets up a driver-based plan, the Finance team can actively monitor against it. The forecasting and modelling calculations are linked to a much more granular level of detail (for example, interest rates, default credit card rates, or promotions) based on information that exists elsewhere in the organization. Greater granularity can be generated automatically using assumptions-based rules (for example, based on historical actuals or trends) and can be modified as and if necessary, for ‘what-if’ analyses. So, if after three months, the business is missing the projection that they’ve ultimately committed to, the FP&A team can determine why the business is not meeting that projection. In many cases, this is new for many companies due to the lack of investment dollars needed to do that level of integration, however it’s a huge benefit and value-add.

Results: Our clients who have implemented driver-based planning find that it enhances transparency and improves active monitoring and early warning. Driver-based results generate richer and more strategic planning discussions, while allowing planning teams to focus on the most material drivers of performance and monitor them on an ongoing basis.

For example, in one project, we removed manual intervention and built a new planning and forecasting system that integrated with more than 1,000 different data sources, so that all the inputs were automatically fed. Prior, it took 45 calendar days to get manual input and perform interim steps. After the automation, the client had a faster and more nimble planning cycle — the activity took three calendar days and provided a superior platform for inquiry and analysis.

Ultimately, in a shorter amount of time you get a better result. The information-gathering process is more efficient as the data is automatically pulled in; and the planning becomes more effective with the availability of comprehensive data — allowing FP&A teams to spend their time on analysis (reviewing and challenging the output) from the automated forecast.

Win #2: Invest in the talent of your finance team

Forecasting and planning efficiency gains, while sizeable, are only a small part of the equation. With a greater focus on insight generation, businesses need to invest in FP&A talent that has a combination of intellectual curiosity, strong communication skills and technical savvy. For example, recruiting talent with excellent interpersonal skills is a ‘must have’ as FP&A takes on a more strategic advisory role to the CFO and builds trust-based relationships with business leaders. Talent also needs to be well-versed in advanced analytics and technologies so they can analyze complex data, identify trends and consider business implications over multiple dimensions and timeframes — all while effectively running the financial planning and analysis process.

CFOs have been addressing these talent initiatives, however, there have been challenges with attracting the necessary skill competencies or training more tenured employees. These challenges cannot be left for human resources teams to solve alone. We have found that involving the CFO, senior management and business line leaders in the hiring process can be greatly beneficial in fostering engagement and building collaborative relationships within the business. Another key to improving junior or mid-level talent retention is to offer rotational management training programs and advanced professional development opportunities. We have found that this helps to keep young talent engaged (especially within a competitive environment) and allows them to understand the goals and needs of the business better.

Results: We have helped our Finance clients to determine the right mix of talent for their team and expand the role of FP&A from number crunching to strategic advisor. For example, we recently helped a European multi-national firm redesign their FP&A function, with a large focus on the organizational component. A key component of this included defining the skills sets needed for each of the roles within the function, and determining training curriculum and other development experiences to realize these skills. This included a rotation for key roles throughout the business to build the broader business acumen and enable a successful FP&A function for this CFO in the longer term.

Win #3: Establish proximity to the overall business

Although FP&A functions can be structured differently, it’s important for Finance teams to operate as a true advisor to the business. Strategic planning and forecasting require agile working styles across teams.

First, Finance needs to establish a greater partnership and receptive buy-in from senior management, and then develop an organizational structure where business CFOs and forecast analysts have enough proximity to the business. Building this acceptance and strong linkage can be beneficial for organizations, helping them to enhance communication and decision making and further drive profitability.

Second, organizations can create rotational programs and offer interim projects outside of Finance. This allows FP&A teams to develop new skills and generate experience within the business. With stronger connections and relationships, FP&A analysts and managers will become more comfortable speaking the language of other teams (for example, Sales, IT, Supply Chain, Operations and Marketing). This can also foster trust and improve communication between departments. Establishing business proximity can help a company leverage cost efficiencies, develop new customer segments, sell more services and products, and determine better pricing.

Third, organizations need to structure FP&A for sustainability — that is efficient to operate, attracts talent across a variety of roles, and is able to provide upward career mobility for talented employees. This can be a challenge for a CFO when the many components required to support FP&A are operating in silos or “shadow functions” across the organization. Instead, an ideal model embraces an enterprise-wide model which may incorporate employees in different parts of the business but operate with common roles and responsibilities, tools and processes. This should also offer career mobility to allow talent to evolve across function.

In working with a recent client, we identified each Business Unit (BU) had their own FP&A group of three to five employees and the Corporate Center had a separate function of 10 employees. Whereas they had a similar objective, the tools, processes and reporting were different and there was limited sharing of insights, talent or capacity across these groups. By unifying the groups but still allowing each BU to retain dedicated teams, the client was able to adopt common processes and optimize the placement of talent; this resulted in an increased throughput and a broadening career model for FP&A across the enterprise.

Results: To help our Finance clients improve organizational infrastructure and Finance’s proximity to the business, it is important to develop a common view of how the FP&A function should operate and support the business. We have worked with numerous organizations on the operating model aspects of FP&A, either alongside a broader Finance transformation or independently as an operating model/organizational design project. In either situation, the result is establishing a model that has Finance positioned to better support the business in the decision making they need, while internally structuring operations to be more efficient.

Get started.

Achieving more dynamic insight through financial planning and analysis allows Finance to have a greater impact and improve business results.

FP&A teams can focus on challenging the forecasts and ultimately developing better plans with richer ‘what if’ capabilities and a clearer view into the drivers of revenue and expenses.

Improvements in FP&A should focus on developing processes, infrastructure, systems and teams that are: (1) Technically seamless to meet rapidly changing market demands; (2) Agile and drive better decision making when underlying conditions change; (3) Strategic with improved driver- based monitoring and business proximity; and (4) Well-integrated within the business so that insights are delivered in a timely manner and well-structured for the business to utilize them.

At Oliver Wyman, we can help your business to assess current planning capabilities, modernize processes, and upgrade infrastructure and talent. Whether the organization wants to reimagine the planning process or access a new system, we have the capabilities to support your efforts and ultimately seize emerging opportunities today and in the post-COVID world. The time to start is now.