Australian general insurance companies have enjoyed attractive growth and profitability over a long period. This growth has been sustained by underlying macro-economic tailwinds and a growing awareness of risk among Australian consumers and businesses. The Australian general insurance industry has been one of the most profitable in world for nearly 20 years: The UK and North American markets are materially less profitable.

However, the Australian industry has faced increasing headwinds over the last five years:

Annual market volume growth has been flat at 1.6 percent, with 75% of premium growth driven by price increases

Competition has intensified with large incumbents losing 6% market share and experiencing more than a 50% decline in profitability

Cost growth at 6% and claims inflation at 5% have both outpaced premium growth of 4%

Despite consistent and significant premium increases, industry profitability is just over a third of the level in the early 2000s. This trajectory is unsustainable. In addition, two major structural shifts are having an impact on the growth and profitability of the general insurance sector globally:

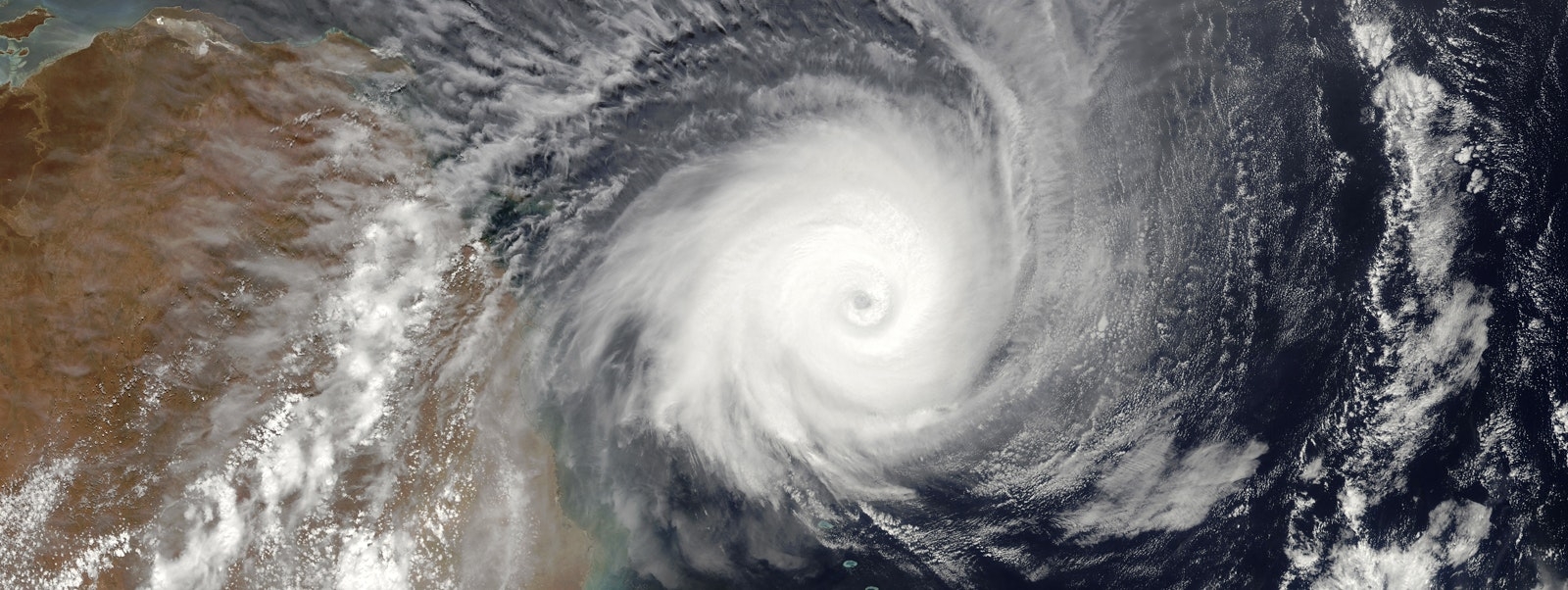

The changing nature of risk: The risk landscape has shifted dramatically with common risks becoming more frequent and intense, while new risks are continually emerging

Value shift towards distribution: the shift of value towards distribution partners is accelerating owing to capital efficiency, resilient revenue models and captive customer bases.

Winners will need to make bold strategic choices on their sources of competitive advantage and their participation in and ownership of different sections of the value chain. In addition, we identify the capabilities that insurers should aim to excel in to build a more sustainable and resilient sector.