In Cryptocurrency Unmasked, Part 1: Are Cryptocurrencies Secure?, we examined the long-term security of Bitcoin. The main issue of concern was the increasing consolidation of miners, which could lead to a small group controlling the system. In Part 2, here, we examine the long-term sustainability of Bitcoin; and in an upcoming Part 3, we examine the long-term scalability of Bitcoin.

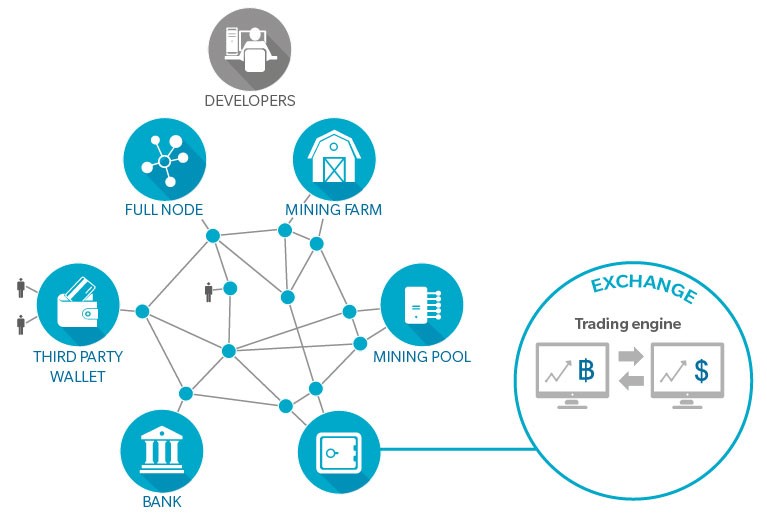

From an industrial standpoint, the supply side of the Bitcoin network is composed of nodes and miners (see Figure 1, “A Primer on High-Level Cryptocurrency Network Architecture”). Nodes are key to the privacy, anonymity, and general blockchain-accounting of the Bitcoin network, and key to facilitating transactions between parties.

Figure 1: A Primer on High-Level Cryptocurrency Network Architecture

Online interactions among four categories of actors constitute what is called the Bitcoin network: Developers, Nodes, Miners, and Third-Party Service Providers.

1. Developers maintain the Bitcoin protocol and open-source software. Few people have release rights for the “Bitcoin Core”.

2. Nodes act as accountants. They store a copy of the ledger of all confirmed transactions; receive, validate, and broadcast transactions yet to be confirmed; and receive, verify, and broadcast blocks of confirmed transactions. Nodes add verified blocks to their own copy of the ledger to create a chain of blocks (hence the term “blockchain”). Anyone with a reasonably powerful computer can set up a full node.

3. Miners expend computational power to generate blocks of verified transactions and collect a reward for solving cryptographic riddles. The first miner to solve the cryptographic riddle associated with the next block is the only one to be rewarded. As the riddles are progressively more difficult to solve, more computational power is required, putting miners in a competition for resources.

Miners have settled on two main operational models: Farms, which are large datacenters usually filled with dedicated hardware; and Pools, which join together thousands of single users to share computational power (with a fee to the Pool manager), increasing the probability of mining success.

4. Third-party Service Providers run businesses on the Bitcoin network for Bitcoin users. The largest such actors are Exchanges, which hold both cryptocurrency and traditional currency (fiat), and allow users to trade on their systems. Exchanges implement Know Your Customer (KYC) procedures and have bank accounts to store fiat, keeping track of users’ transactions on their databases.

Miners work to solve cryptographic riddles and add new blocks to the blockchain. Each block contains new coins, plus a number of unconfirmed transactions. Miners’ revenues come from these two sources: (1) the transaction fees paid by users, which resulted in January 2018 in ~ $7 million of revenue per day; and (2) the reward granted by the system in the form of newly minted Bitcoins, whose value is a function of the market. In January, miners earned rewards of ~$32 million per day from new coins (see Figure 2. “Average daily bitcoin rewards for miners”).

ECONOMICS OF SOLVING A BLOCK

In January, the average revenue per transaction was ~$112—~$89 for the coin reward, and ~$23 in fees. Given an average of 1,750 transactions per block, the total reward for solving a block was ~$196,000.

By design, when the Bitcoin system was set up in 2009, the last Bitcoin was projected to be mined in 2140. Well before that, however, in 2029, the number of coins will be eight times less than it is now, and will be increasingly marginal over the longer term. Today, 12.5 Bitcoins are granted to a miner who solves a block; in 2021, the number will be 6.25; in 2025, the number will be 3.125; and, in 2029, just 1.5625. Clearly, revenues from the reward of mining new coins will tend to zero, as the number of remaining coins available in the system declines.

Miners’ costs are a combination of energy consumption and the purchase of the software/hardware equipment (and, of course, their time). Because the cryptographic riddle becomes more and more complex (Bitcoin is designed so that miners solve one block every ~10 minutes), miners need to grow their computational power at least at the same rate as the system’s increase in complexity, otherwise they will reduce the probability of solving blocks, and thus see a dip in revenues and profits. Increased computational power, however, has a cost, and it also means increased energy consumption, which definitely puts pressures on profits.

The cost/reward ratio is affected by the probability of solving a block. If the probability of solving a block is too low, the cost/reward ratio could be higher than 1 (cost exceeds rewards). The probability of solving a block is theoretically equal to the ratio between the computational power of a certain miner and the total network computational power (hash rate). Today, costs for the top miners total about 30 percent of the rewards.

If the difficulty of the cryptographic riddles increases at the same rate as it has in the past two years, and the bitcoin currency value and transaction fees remain as they are today—which won’t necessarily be true—the cost/reward ratio could be higher than 1 (cost exceeds reward) by 2025. (The reward, of course, is a function of the free market value of the coin, which has fluctuated wildly in the last year.)

ECONOMICS OF BUY-SELL TRANSACTIONS

As mining rewards diminish, revenues from transaction fees (as people buy and sell coins) will gradually replace new-coin rewards (see Figure 3 “A simple transaction case: Alice sends Bitcoin to Bob”).

Figure 3: A simple transaction case: Alice sends Bitcoin to Bob

Let’s say Alice wants to send Bitcoin(s) to Bob. In the simplest scenario, both Alice and Bob rely on service providers that store their bitcoin wallets and run a full node.

- Alice fills in a form on a web app, specifying: (1) the amount she wants to transfer; (2) Bob’s Bitcoin address; and (3) the fee she is willing to pay for the transaction. The fee can be fixed or dynamically set by the service provider to ensure that the transaction is confirmed in an acceptable timeframe.

- Alice’s wallet contains the keys (public and private) needed to sign transactions, but doesn’t contain Bitcoins. She signs the transaction with her private key, with a simple transaction message: “Alice transfers X Bitcoin(s) to Bob, Signed by Alice, Transaction fee: Y Bitcoin.” Instead of “Alice” and “Bob,” of course, the message contains anonymous addresses.

- Alice’s service-provider’s node broadcasts the transaction to all the nodes it is connected to (on average eight). By reading through all the historical transactions in their copy of the blockchain, the nodes check two things: (1) the validity of Alice’s signature; and (2) whether Alice really owns the Bitcoin needed (coins plus transaction fee). The nodes stamp the transaction as valid or invalid, and broadcast it to the nodes they are linked to.

- Miners ready to work on a new block (to later add to the chain) choose among transactions circulating the network, selecting them on the basis of validity and fee. The higher the fee, the better. Then they package these transactions in a block and start working on the associated cryptographic riddle. Because Alice chooses to pay a fee high enough to grant her access to the block, her transaction attracts a number of miners. Once one solves the block, he or she broadcasts it to the network.

- Nodes verify the validity of the block and add it to their copy of the blockchain. As soon as the network consensus accepts the new block, Bob can spend the Bitcoin that Alice sent him.

However, the current math on transaction fees alone (without coin rewards) does not look good for miners. With average transaction fees at $20, most accounting estimates miners in the U.S. face an average full cost of $30-$42 (considering industrial energy prices and equipment costs). Chinese miners are in a better position—because of lower energy prices, their full cost is roughly $26-34 per transaction—but still face unfavourable economics. In addition, these estimations may be optimistic, since they are calculated based on the difficulty of solving the cryptographic riddle, and not on the real total computational power available. In our own calculations, considering the daily energy index consumption as a proxy to estimate the computational capacity, we calculate an increase of ~30 percent of the above cost figures ($55-$85 in the U.S. and $45-$66 in China).

If miners are rational agents, they should keep mining until the sum of fees and new coins associated with a block, multiplied by the probability of success in solving the block, equals the total sustained cost (energy consumption + equipment). For the moment, it is clear that large miners are still extremely profitable, mainly because of the rewards they get from new coins, at present market value. But, as the number of coins diminishes, the transaction fees will need to increase to cover costs. That is some ways off, but definitely a major factor in long-term sustainability.

In the last four months, for example, the transaction volume has steadily decreased from the peak reached at the beginning of December 2017. If this trend continues, it will definitely pose a major threat to the long-term sustainability of Bitcoin; if Bitcoin doesn’t circulate, its value will diminish over time. On the other hand, if Bitcoin becomes a more popular/widespread means of payment, the daily transaction volume should increase—via increase of the average number of transactions per block or increase of the average transaction value. And that leads to the issue of scalability, addressed in Cryptocurrency Unmasked, Part 3.