Roughly half the use of 3D printing is now for prototyping, but experts think that, by 2020, 80 percent of the global production capacity of 3D printers will be dedicated to the manufacture of finished products. GE, for example, expects to make 40,000 jet-fuel nozzles by 2020.

3D printing of finished products is likely to totally transform the value chain, especially for small series production of complex parts. Spare parts—for planes, trains, elevators, cars—is a big and lucrative business, both for manufacturers and logistics companies that move the right part to the right place at the right time. But, as 3D printing is getting faster and cheaper, both the manufacturing and logistics sides of the market are beginning to go digital.

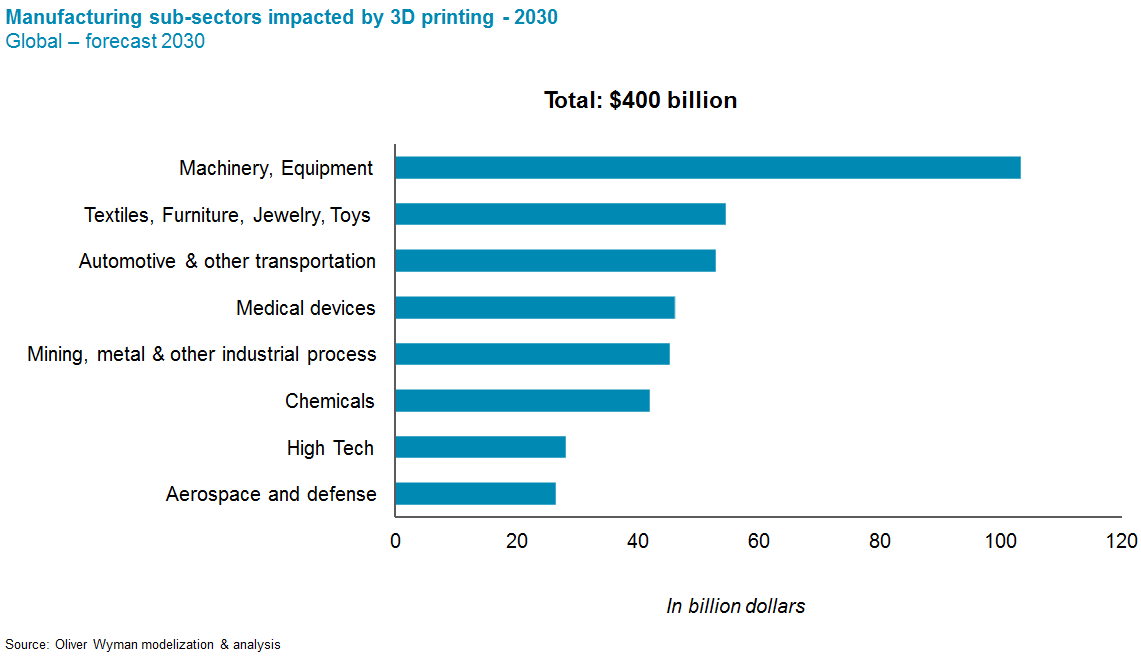

3D Printing Forecast: In 2030, 3D Printing could represent a $400 billion market

3D Printing—or "Additive Manufacturing"—is a disruptive process of making a three-dimensional solid object. From a computer-aided design (CAD) model, it is possible to produce any kind of item, especially those with complex architectures. CAD files control the printers and produce parts by deposition, polymerization or melt layers of organic raw material, mineral or metal. It is thus possible to produce parts in plastic, ceramic and metal.

Additive manufacturing allows fast on-demand prototyping without expensive tools and molds, and reduces waste—saving manufacturers time and money. But the real disruption is likely to come in the manufacturing and shipping of parts. 3D printing excels at small-series manufacturing (less than 200 units per month) and mass customization. On the logistics side, 3D printing can be done anywhere there is a printer, thus cutting out shipments. UPS, for example, is outfitting outlets with 3D printers, anticipating the day when it will receive CAD files, print parts, and deliver locally.

The implication is that parts manufacturers could disappear, especially in the aviation industry, which is the most advanced B2B adopter of 3D printing. GE, as noted earlier, has invested heavily in 3D printing, as have Airbus and Boeing. Auto manufacturers have long used 3D printing for prototyping, but resisted it as too slow and expensive for engine and dashboard parts (although Ford has been experimenting with nonconventional 3D printing methods like continuous liquid interface production which claims 25-100x faster print speeds, and BMW iVentures recently invested in Desktop Metal, a startup focused on metal 3D printing), but as 3D printers increase speed at a lower cost and offer a wider range of materials than a few years ago, that potentially changes the breakeven calculus.

Most manufacturing and logistics organizations are taking a relaxed approach to 3D printing, thinking they will have time to adapt. That is less and less true every year. Our recent analysis suggests 3D printing could represent a $400 billion manufacturing market by 2030. Organizations that are piloting and building a foundation for 3D printing now will be best positioned to capture future value.