This article first appeared in Forbes on July 30, 2021.

Despite some tightening of corporate travel budgets and widespread consensus about the effectiveness of teleconferencing and working remotely, business travelers in the United States may be ready to break out their rolling suitcases again.

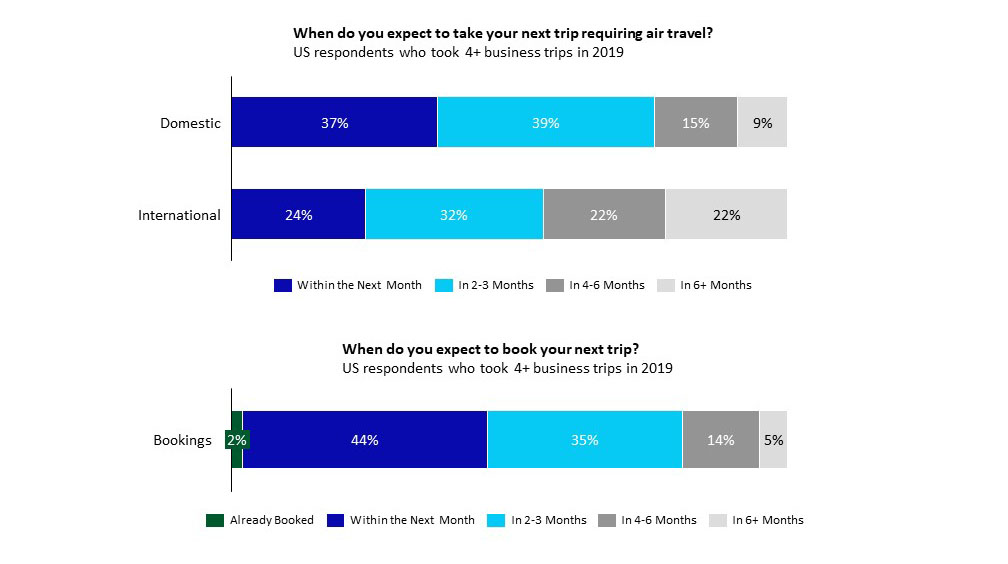

In a survey of more than 900 Americans completed the week of June 28, three-quarters of the respondents who took four or more work-related trips in 2019 said they plan to take their next domestic flight within three months. Almost nine out of 10 said they expect to take at least as many business trips over the next year as they had in the year before the COVID-19 pandemic was declared.

It’s positive news for the travel industry, which has worried that a significant portion of business travel might not return after COVID-19 subsides. That fear has been based on the success many companies have had allowing employees to work remotely and use teleconferencing to do business.

But the US economy is recovering at a faster than expected pace, thanks to vaccination rates and an unprecedented level of fiscal stimulus, which is encouraging frequent business travelers to consider hitting the road again. The reasons? Teleconferencing has limitations. Many respondents cited the need to meet in-person to rekindle relationships with customers, suppliers, and business partners. Another frequent reason cited for the need to travel for business was a job change. Even those who only travel infrequently for work indicated they plan to fly as much or more over the next year.

The global outlook

In the larger global survey of almost 5,300 in nine countries, there was also a dramatic shift toward an anticipation of traveling as much or more for business versus answers given to Oliver Wyman’s October survey. Where in October only 11% of respondents said they would travel more for business over the next year, 31% told the June survey they planned to travel more for business in the next 12 months. In June, 25% said they expected to travel less versus 43% answering less in October. The countries most eager to travel for business once COVID-19 travel restrictions are lifted were China, the US, and Australia.

About 32% globally said it was safe to travel in the June survey versus only 18% in October. More than half of Americans thought it was okay in the recent survey compared with 25% in October. The countries scoring the lowest on the question of whether it was alright to travel now were China (14%), the United Kingdom (17%), and Canada (16%). Of course, the increase in COVID cases from the Delta variant may cause some backsliding on rising confidence levels.

But there were some countries in Europe where survey results indicate business travel might decline over the short term at least. The biggest hesitancy to resume traveling for business was voiced by the French and British. Whether one-day trips or those of longer than a week, more respondents in both France and the UK said they were likely to take fewer trips than more. In the case of the UK, it was a double-digit difference between those who would take fewer rather than more trips.

Potential boom coming

Meanwhile, people keep going on vacation or visiting friends and family. Of the Americans questioned, 54% said they planned to take their next domestic flight in the next three months, and more than three-quarters would book a trip before the end of the year.

Based on Oliver Wyman modeling of federal air travel data and current travel trends, we predict that traffic out of US airports will match and may even exceed the rate of pre-pandemic travel sometime in early 2022. That would be ahead of earlier projections of a mid-2022 recovery, made before the vaccine push and the subsequent boom in leisure travel. Based on stated travel plans in the survey, we anticipate travel to pick up significantly around the Thanksgiving and Christmas holiday travel days.

But it’s unclear the extent to which the jump in the number of COVID cases and hospitalizations will cause travelers to pull back. Indicative perhaps of a growing uncertainty with the spike in cases, only 9% of US respondents have already booked their upcoming leisure trips. The percentage of those who have booked is similar for the broader global survey. Even fewer (2%) among US business travelers have booked their next flight. Late bookings make it harder for airlines and other travel companies to plan capacity, especially given problems finding enough personnel.

Dan Darcy, Laetitia Plisson, and Rory Heilakka, Oliver Wyman principals, conducted analysis of data upon which the article is based.