In June 2021, Oliver Wyman conducted the third and last in a series of global surveys to understand how perceptions of travel have evolved over the course of the COVID-19 pandemic. Our third survey involved nearly 5,300 people across nine countries (Australia, Canada, China, France, Germany, Italy, Spain, United Kingdom, United States), all of whom had flown at least once in 2019; nearly 90 percent had been vaccinated against COVID-19 or are planning to be vaccinated. Our prior surveys were conducted in May 2020 and October 2020.

With vaccination campaigns now underway worldwide, a third of respondents to our latest survey are willing to travel now, up from 18 percent in the previous survey in October 2020 (prior to the development of vaccines). Two-thirds of the travelers we surveyed, however, are still waiting for restrictions to be lifted, a decline in active infections, or vaccination – a situation that is being impacted by the Delta variant and a subsequent spike in infections in many regions (Exhibit 1).

Leisure travel

Appetite for travel has steadily increased over the past year, and three-quarters of travelers we surveyed now expect to travel the same or more in the future – once restrictions lift – compared to before the pandemic. Travel providers could see somewhat stronger domestic travel demand through the year-end holidays, particularly where vaccine mandates are in place, but international travel will continue to be impacted by unpredictable and at times inconsistent government policies (such as the US being open to Mexico but closed to Europe, as of this writing). Most of those planning to travel are waiting to book trips until close to their travel dates, to ensure they have the latest information on travel policies and spikes in infection rates at their destinations.

We expect leisure travel demand will grow with the uptake of vaccinations and loosening of pandemic restrictions, as readiness to travel correlates somewhat with immunity levels and the stringency of lockdown policies in each country (Exhibit 2). But nearly a third of leisure travelers expect their personal travel budgets to be tighter, and they plan to spend less on flights and travel amenities. About 15 percent of travelers expect to have increased travel budgets and are planning to spend more on longer trips, dining, and destination experiences.

Respondents in the US, China, and Australia favor leisure trips to cities in their home countries, which could help boost urban areas’ economies. Europeans are somewhat torn between staying local and traveling internationally – mainly for short-haul trips within Europe. For those in other regions who want to travel internationally – when it becomes possible again – Europe is the top destination choice for travelers in North America and China, while Australians favor travel to Asia.

Business travel

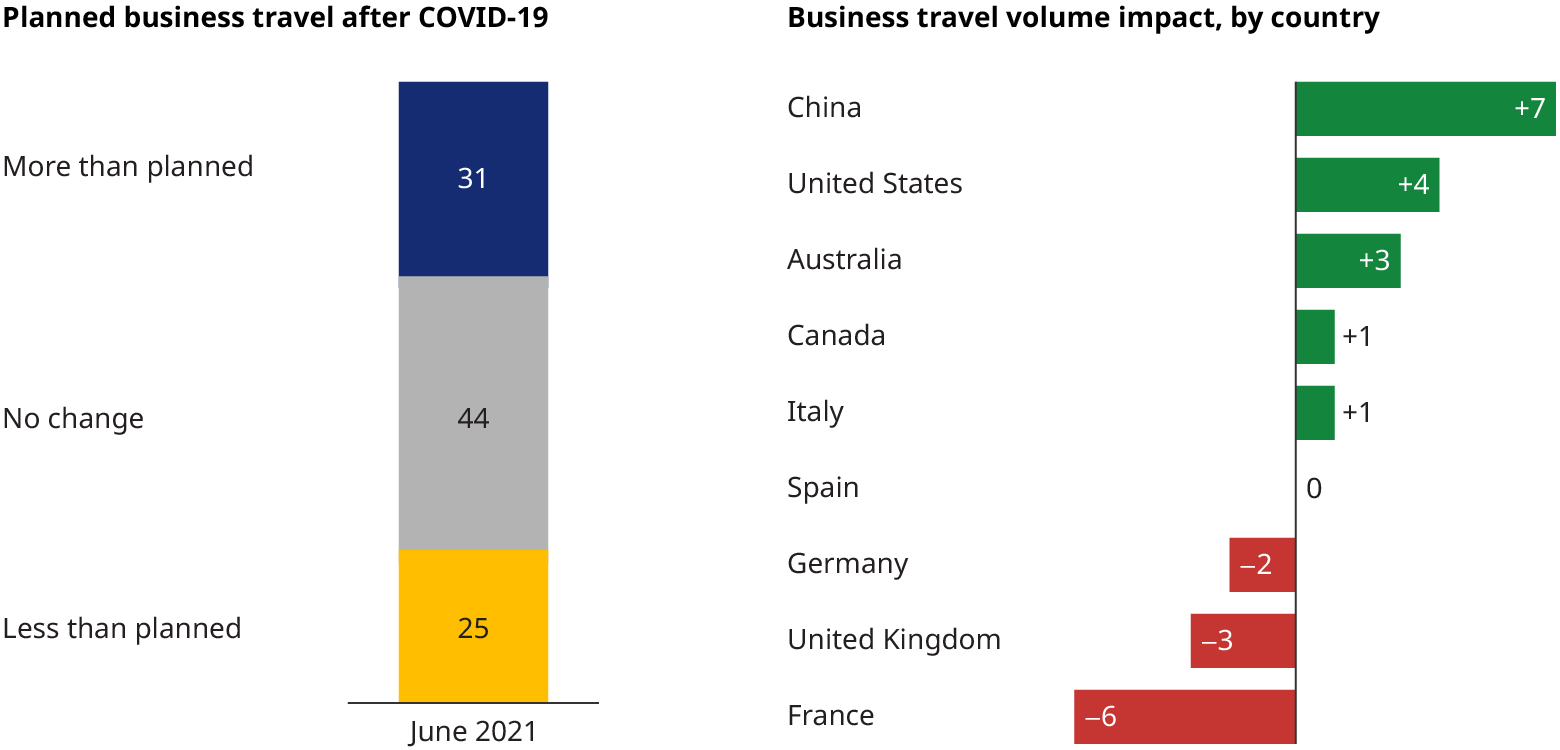

The pace at which business travel resumes is being affected by travel restrictions in international markets and domestically by delays in companies’ planned return to the office. Compared to our prior survey in October 2020, however, survey respondents who travel for business show a significant shift toward expecting to travel more than planned (Exhibit 3). A large driver of this in the near term we believe is “fear of missing out” in response to rising economic activity.

By country, respondents in the UK, France, and Germany expect to travel less for business overall compared to pre-COVID levels, once travel restrictions are fully lifted, while the US, China, and Australia expect to see an uptick. As result, we expect near to mid-term business travel volume overall to increase slightly versus the pre-COVID-19 baseline.

Longer-term, we believe business travel overall will stabilize at a somewhat lower level compared to pre-pandemic, as companies revise remote work and corporate travel policies, and look to reduce travel budgets and carbon emissions.

Two-thirds of survey respondents have found teleconferencing to be effective and an equal number can work from home at least part of the time. Increasing delays in returning to the office due to the Delta variant continue to cement these new working habits.

Travel choices and experiences

The majority of travelers – and particularly frequent flyers – now appear to be comfortable with most transportation options and travel activities. A quarter to a third are still uncomfortable where extensive interaction with people might be involved, but this is nearly a 20-percentage point improvement from October 2020, when close to half of respondents were uncomfortable engaging in these activities.

Only about a third of recent travelers report that their travel experience was negatively impacted by the pandemic. As in our previous survey, food and beverage, both at airports/train stations and onboard, continues to be a major reason for dissatisfaction. COVID-19 testing is also a common pain point for air travelers.

Cleaning policies and communications around COVID-19 are still desired by travelers, but they are less willing to pay for them. As flight purchasing criteria, price reigns supreme, but promotions and flight schedules are gaining in importance once more. On the lodging side, travelers continue to prefer large, branded hotels and staying with friends/family.

Travelers view surface cleaning and air filtration as the most important traveler health and safety measures, but around a third would like to see an empty seat next to them on planes and trains and want masks to be mandatory onboard – which may be influenced by continuing infection spikes. Proof of a COVID-19 test or vaccination is now seen as important by about a quarter of travelers.

Biometrics and digital identity

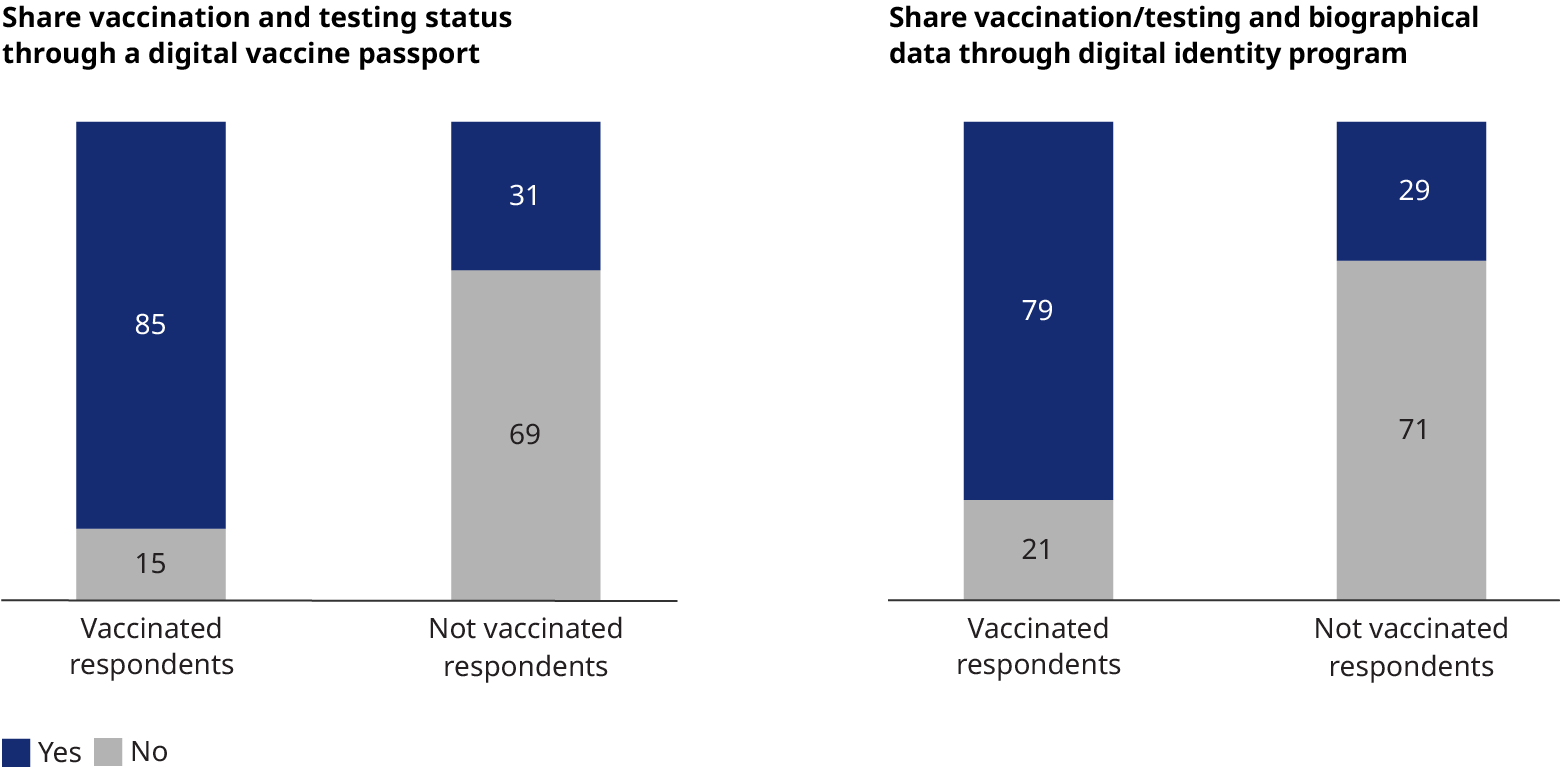

This edition of the survey included our first look at whether travelers are willing to participate in programs that provide identity and health details digitally to travel providers and screening authorities. We found that willingness to participate correlates strongly with vaccination status. In the US, those under age 45 and frequent travelers are most willing to enroll in biometric or digital identity programs.

Outlook for travel

At present, travel is still being buffeted by the slow pace of vaccinations, infection surges due to new COVID-19 variants, and uneven government policies regarding travel restrictions. While this situation continues, we expect leisure travel to be dominated by shorter trips, closer to home, with more bookings made close to travel dates. Although business travel bookings also appear to be improving near-term, changing company policies and the effectiveness of teleconferencing will contribute to longer-term moderation in demand.

The strenuous efforts on the part of the travel industry to focus on customer health and safety appear to be paying off, but international travel will only see gains when burdens from government restrictions and testing requirements lessen. Travel providers will need to continue to stress communication with their customers – and will need to be ready to respond to rapid changes in demand. Offering customers easier and short-notice cancellation, rebooking, and change of destination options could be of benefit to travelers and help cement customer loyalty – particularly as core travel demographics change.

Oliver Wyman’s three surveys and more than a year of charting traveler sentiments during the pandemic has revealed shifts in travel that will be both fleeting and enduring. On the one hand, the waiting world is looking forward to resuming much of its former travel, once it is safe to do so. On the other, not all facets of the travel market will recover equally well, and travel habits may never be quite the same.