Joining them were panelists representing highly innovative solutions that are shaping the future shopping experience: Curt Avallone (Chief Business Officer of Takeoff Technologies), Julia Wenner (Global Trade Marketing Director of HL Display), and Galen Karlan-Mason (CEO and Founder of GreenChoice). This article represents a distillation of the webinar.

In 2030, how will consumers shop? Consumers are demanding greater transparency and personalization from their grocers so they can make informed choices that support their dietary needs, health goals, and values. These rapidly shifting consumer demands, paired with emerging technologies, will lead to a “smart” supermarket with a massively improved omni-channel experience and more efficient operating model. Smart merchandising solutions will make the shelf more attractive for customers while reducing labor hours and waste.

Automation is a crucial element of the smart supermarket of the future, reducing costs and freeing up staff to focus on work that enhances the shopping experience. But at the heart of the brick-and-mortar business is an enhanced shopping experience focused on high-quality fresh produce, delicious food in an attractive gastro environment, and fulfilling social interaction.

Consumer Shopping Habits Are Shifting

Shifting consumer preferences, macro trends, and emerging innovations are reshaping the retail sector. The future supermarket needs to respond to these trends if it is to attract the consumer of tomorrow:

- Smaller households. There was a 34 percent increase in single-person households in the US from 2000 to 2018. Because cooking for one can be challenging, those in single-person households are less inclined to stock up and cook meals from scratch.

- Aging population. By 2030, 25 percent of the US population will be 65 years or older. This aging population will be marked by specific shopping habits and dietary needs, along with a reduced capability to drive to stores.

- Digital revolution. Double the number of US shoppers use online-only retailers to shop for groceries today as did in 2015. Online is becoming a powerful grocery channel that can also be leveraged as an avenue for marketing and sales.

- Speed/convenience. Americans spend an average of 37 minutes a day on food preparation, serving, and cleanup: indicative of how little time Americans allocate in preparing meals.

- Omnichannel mindset. US grocery shoppers use an average of 3.1 channels frequently. Americans are willing to use all channels available to get the best quality, price, and convenience.

- Freedom to customize. Shoppers are willing to share their data to enable personalization of their products and services: Some 46 percent of US shoppers would provide their store with personal information for a better shopping experience.

- Hassle free. US shoppers are looking for solutions that maximize convenience: 56 percent say that a long wait time at checkout is unacceptable.

- Sustainable, naturally functional. Food inherently resembles medicine, with consumers seeking out pure, organic, and healthy foods. It is estimated that revenue generated by the functional food market worldwide will grow at a compounded annual rate of 8 percent from 2017 to 2022.

- Food consciousness. Seventy percent of US shoppers say that product information displayed at the shelf or with the product is very important. They want to know more about their product beyond what’s on the label, seeking transparency on ingredients and ingredients’ origins, additives, and production chains.

- Global discovery. Some 77 percent of millennials have a high interest in experimenting with new foods, indicative of a growing appetite for perceived to be new, innovative, and exotic.

In Response To Consumer Trends, The Retail Landscape Is Shifting

Consequently, the retail industry must react to the way customers shop, and we are already seeing significant changes. We see the following five primary dimensions of retail transformation:

- Channel change from offline to online and omnichannel

- Direct-to-consumer channel and the rise of micro brands

- New convenience and urban formats

- Upgraded offers from (hard) discounters

- Partnerships and acquisitions

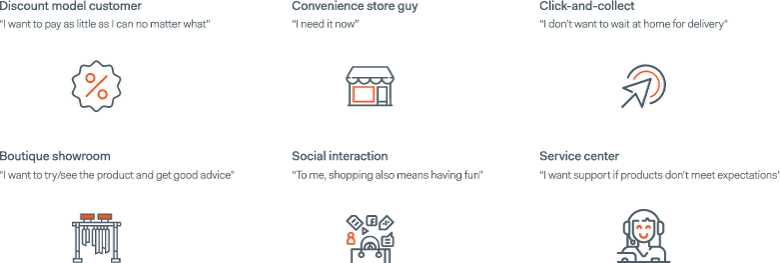

As the shopping experience grows increasingly omnichannel, physical outlets will continue to play an important but different function. (See Exhibit 1.) Successful stores will need to play more specialized roles than they do today and will need to give customers a reason to visit (versus shopping purely online).

Exhibit 1: Services customers will be asking for from brick-and-mortar stores

New Technologies Will Reinvent The Shopping Experience And Store Operating Model

In addition to shifting demand, disruptive technologies and innovations will reinvent the shopping experience and the operating model. Robotics, Internet of Things (IoT), artificial intelligence (AI), virtual reality, blockchain technology, drones, and 3D printing are just a few examples of disruptive technologies that are changing the way we shop and how supermarkets will operate in years to come.

- Robotics are used in supermarkets already to serve meals, assist customers, or scan aisles for misplaced products and out-of- stock items.

- Machine learning and AI have proven themselves capable of supporting demand forecasting and are being used increasingly for recommending products and customizing pricing and promotional decisions.

- Drones and 3D printing are more distant solutions, but we have already seen tests around 3D printing in the nonfood area, drones used for deliveries, or drones used for out-of-stock scanning.

- We think these technologies represent a huge opportunity but may also require a significant investment and only make sense if they really improve operations and/or have an impact on the customer experience.

How Will This Come Together In Tomorrow's Smart Supermarket?

HOW WILL THIS COME TOGETHER IN TOMORROW’S SMART SUPERMARKET?

In response to shifting consumer preferences and technical innovations, the future supermarket will present a more efficient operating model and new shopping experiences.

We do not claim to know exactly what the future store will look like, but we do believe that we have a good idea about certain emerging components of the future store from extensive global research. (See Exhibit 2.) This perspective is based on dozens of interviews, work with retailers around the world, and in-depth research on emerging technologies and consumer macro trends.

The customer of the future visits the grocery store to benefit from services, test products, and receive product recommendations.

At the heart of the business is an enhanced shopping experience focused on hight-quality fresh produce, delicious food, and social interaction.

1. Customers can call up product information and browse customer reviews from their mobile devices.

2. Nonperishables are mainly stored in backroom and ordered by customers through online services (delivery or pickup).

3. Automated picking technologies and consolidated food-storage centers will enable highly efficient eGrocery.

4. Service counters and food courts will offer expert advice, a place to socialize, with barista-served coffee and tastings of meals for home delivery or pickup.

5. Machine learning algorithms will reduce forecasting errors, making stock management much easier.

6. Electronic shelf labels will enable automatic price updates, creating efficiencies – especially for discounted products; personalized prices on a smartphone may even replace unified shelf prices.

7. Smart merchandising solutions will make the shelf more attractive for customers, reducing labor hours and waste.

8. Shoppers can try out products—such as makeup— virtually.

9. Associates need to establish direct customer relationships and develop new skills and product expertise.

10. Smarter tools and automation will massively reduce back-office work.

11. Checkout will be customer-led and supported by tech. Scan-and-go solutions offer a new channel for personalized promotions and customer interaction.

What Does This Mean For Merchandising?

Innovations in the future supermarket come with new opportunities for merchandising and impact on the 4Ps (price, product, place, and promotion). Here are some case studies of companies that are bringing solutions of the future into stores today.

Case Study 1

Takeoff Technologies provides an end-to-end eGrocery solution, using hyper-local automation to lower the cost-to-serve in online fulfillment. Its in-store micro-fulfillment centers are designed to create a profitable eGrocery solution. With consumers demanding an omnichannel grocery offering and the volume becoming too significant to “hide the losses” of inefficiently servicing eGrocery, a transition from a defensive posture on eGrocery toward a profitable solution is essential.

Micro-fulfillment centers offer a solution for the two primary eGrocery cost challenges: picking time and last-mile delivery. Traditionally, picking for an eGrocery delivery takes about 60 minutes, an effort that makes eGrocery an unprofitable burden for many grocers. Takeoff Technologies’ micro-fulfillment centers cut picking time down to about six minutes. Takeoff Technologies’ micro-fulfillment centers can be installed in the existing backroom of supermarkets, providing a hyper-local option that significantly reduces the cost of last-mile delivery.

Case Study 2

HL Display is a shopper-experience company with expertise in improving the shopping event while increasing cost efficiency and maintaining environmental sustainability. It specializes in merchandising solutions designed to support efficient store operations and improve the customer’s shopping experience. Those solutions include:

- Shelf automation frees up employees to focus on creating a better shopping experience by engaging with shoppers (such as promoting fruits and vegetables, operating in-store delis, preparing fresh foods, and offering in-store services)

- Packaging-free merchandising is a key trend across Europe, driven by desire to reduce packaging waste. Several trials are going on currently. These merchandising solutions enable differentiation, reduced waste, and higher margins.

- “Sustainable choice” in-store solutions are currently being rolled out and developed by HL Display. These merchandising solutions are made of recycled or renewable resources (such as sugar cane and other bioplastics). HL expects one-third of its assortment to have a sustainable choice option by the end of the year.

CASE STUDY 3

GreenChoice is a data-driven tech startup offering a “digital food assistant” to consumers and plug-ins to retailers that provide shoppers with personalized dietary guidance supporting their health needs, goals, and values.

The startup solution is empowering consumers with customized dietary guidance by responding to the following trends:

- Personalization. Consumers crave personalization to meet their wants and diet goals and are willing to share personal information to get there.

- Transparency. Impending regulations are likely to ban certain additives and require greater transparency into others. Consumers are wising up to harmful additives/ingredients, and it’s best to start addressing these demands to get ahead of the curve.

- Sustainability. The UN Intergovernmental Panel on Climate Change (IPCC) has stated that the world has just over a decade to get climate change under control before it leads to a crisis. Whether or not businesses believe this claim, the point is that young people do, and businesses must address their concerns.

- Building trust. Consumers are demanding greater transparency from their grocers so that they can make informed choices that support their personal dietary needs, health goals, and values.

How Can You Leverage Innovations For Your Business?

Rapidly shifting consumer demands, in tandem with emerging technologies, are leading to the advent of the “smart” supermarket. But there are many opportunities that need to be considered as supermarkets develop their omnichannel offering. Here are some key questions a retailer needs to ask – and answer – to know where it stands in the journey to tomorrow’s revolutionary digitalized supermarket:

- Innovations and technology: Have you identified the use cases for technology-enabled improvements to enhance efficiency and customer experience?

- Business case: Do you have transparency on the necessary investment and expected return on investment for innovations?

- Workforce of the future: How will your workforce shift in the supermarket of the future and how can you prepare?

- Pilots and tests: Are you already testing and piloting new technologies in-store or across your network?

- Omnichannel: Have you thought through what an omnichannel offering should look like for your business?

- Merchandising: Have you adapted merchandising processes to leverage store innovations?