This is a FMI authored article.

FMI and its strategic partner Oliver Wyman recently hosted a webinar moderated by Mark Baum, FMI’s Senior Vice President & CCO, and Michael Matheis, of Oliver Wyman, examining areas of growth in the retail food sector. The focus specifically was on “Pockets of Growth Within the Store: Protein alternatives and CBD.” Joining them were panelists representing the two fields, Doug Radi (CEO of Good Karma Foods, which manufactures and markets flaxseed-based dairy alternatives) and Justin Singer (CEO of Caliper Foods, which develops products and ingredients using cannabis).

We have summarized the key insights from FMI’s Senior Merchandising Executive (SME) Forum presentation on the “Pockets of growth within the store”.

Introduction

CBD and alternative protein/dairy products are two bright spots in retail food sector, representing store categories that have been growing rapidly. But while this growth is welcome by many in the food industry, the surge in interest in the categories has led to greater scrutiny and the potential for regulatory oversight, as governments look into potential health risks and/or consumer confusion posed by CBD and protein/dairy alternatives.

Some of the issues can be attributed to growth pains: Given the relative newness of the two categories, companies need to provide greater transparency as to the exact composition of their products. They also need to take care so as not to create unrealistic or misleading customer expectations as to the efficacy and utility of products. And although innovation is welcome in the industry, some established and traditional players may view it as a threat to their products. SMEs should watch out for how regulation is shaping the industry.

Plant-based alternatives to meat and dairy products and CBD show great promise as robust categories that can fuel sales at retailers for many years to come, while promoting healthy options for consumers. That said, the two categories are not without controversy and both have some regulatory hurdles to overcome: Both alternatives and CBD markets are highly dependent on the regulatory framework, which will very likely undergo change over the coming months and years. We’ll take a look at the potential as well as the obstacles facing each category.

Protein/Dairy Alternatives

Plant-based alternatives to animal-based foods have a long history. One prime example of the phenomenon is tofu, which has served as a meat alternative for hundreds of years. But many of these alternatives were aimed at a niche consumer whose palette tended toward the austere. The main purpose of those earlier plant-based alternatives was not necessarily geared toward recreating the animal-based foods they were mimicking.

However, that is changing dramatically. Driving the trend has been a new kind of consumer, one who is concerned with a broad range of issues – from the question of the environmental sustainability of an animal-based diet to concern over the industrialization of agriculture, from the ethics surrounding eating meat and other animal-based foods to the belief that eating plant-based foods is healthier.

At the same time, that same consumer is also seeking plant-based alternatives that offer the same, if not better, flavor and texture than their animal-based counterparts. And a new generation of plant-based meat and dairy alternatives food companies are striving to achieve just this, which is having an impact on consumer acceptance and is reaching the mainstream.

Hitting the food trifecta

Plant-based foods are hitting on the food “must-win” trifecta: taste, value, and nutrition/ quality. A growing number of consumers are trying out plant-based products, drawn to the category by a holistic approach to meeting their needs and convictions:

- Improving human health: Lowering the risk of cancer and heart disease

- Helping climate change: Reducing greenhouse gas emissions (raising livestock for slaughter is the largest source of greenhouse gas emissions)

- Addressing scarcity of global resources: Cutting back on meat consumption has a positive impact on already-strained natural resources, particularly water; plus, meat production is a source of deforestation, land degradation, and water contamination

- Improving animal welfare, with a reduction in animals slaughtered for meat

This broadbased approach is seen in the data. Consumers, increasingly, are seeking out healthy alternatives to meat and dairy, with 39 percent choosing health as the main reason for changing to a plant-based diet. This broadbased trend has food companies working to capitalize on the movement:

- 60 percent of millennials report they are cutting back on meat-based products, relying more and more on plant-based products

- 26 percent of consumers say they have eaten less animal meat over the past 12 months

- One out of three consumers prefer plant-based milk options, with milk alternatives and ice cream, novelty and frozen desserts seeing higher penetration

- Almond milk sales have grown more than 250 percent over the past five years

- Global sales of plant-based dairy alternatives are expected to reach $19.5 billion in 2020

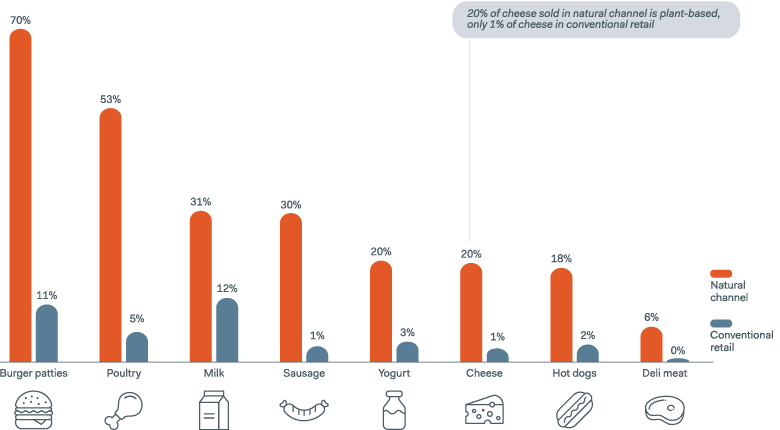

Dairy/protein alternatives in this context refer to nut milk, soy milk, plant-based protein (such as burgers from pea protein like Beyond Meat) and meat grown in a laboratory. While sales are minuscule alongside total conventional retail food sales, they nonetheless account for a big majority of sales in natural/organic retail channels, which hold great potential for growth (total value of conventional retail channels is $12.4 billion annually). (See Exhibit 1.) Billions of retail dollars will convert to plant-based sales in the coming years.

Currently, sales of plant-based protein alternatives make up a relatively small portion of the food market. But customers continue searching for healthier and cleaner protein sources, suggesting a bright future for alternatives. The numbers paint a similar story: Sales of plant-based foods rose 31 percent over a two-year span, jumping from $3.4 billion in April 2017 to $4.5 billion in 2019.

Exhibit 1: Plant-based share of food categories

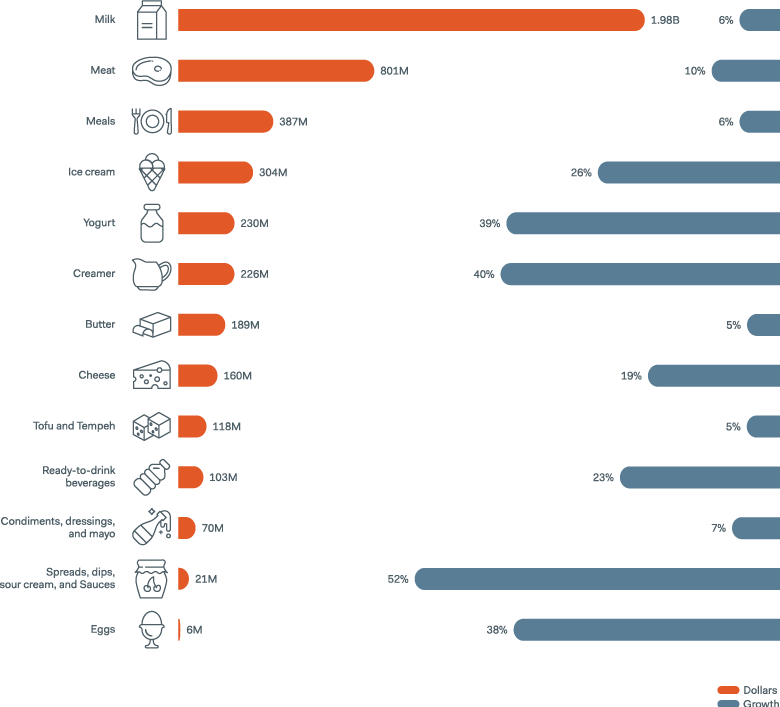

In the year ending April 21, 2019, plant-based foods sales grew by 11 percent, as compared to just 2 percent growth in conventional food sales. (See Exhibit 2.) Milk ($1.9 billion) and meat ($800 million) account for 60 percent of total plant-based foods sales, while the fastest-growing segments are yogurt (with jumping 39 percent, to $230 million), creamer (up 40 percent, to $230 million), and sauces (rising 52 percent, to $20 million). And growth is projected to continue, with sales expected to reach $5.2 billion by 2020.

Currently, the global meat and dairy sector is going through an unprecedented competition and disruption, driven by the growth of viable plant-based alternatives across multiple categories. As a result, this has led to an explosion of brands and investment, with more than $1.1 billion invested in plant-based milk alone since 2015. This statistic indicates the magnitude of change: In 2007, there were just three types of plant-based milk and only five brands; today, there are more than 25 types of plant-based milks and more than 50 brands.

Exhibit 2: Plant-based category growth

Protein/Dairy Alternatives: Regulatory Outlook

The greatest concern in terms of regulatory status quo surrounds the issue of marketing and labeling protein alternatives (including meat and dairy). Mislabeling may mislead customers into believing the new products are equivalent nutritionally to what they have been accustomed to eating. Consumers need to be informed, in a simple and direct manner, what they’re purchasing and consuming.

The issue as to what can (or cannot) be called dairy has been a question for a long time, but it has taken on greater urgency, given the decline in traditional dairy sales and the steady growth in plant-based dairy products. Many dairy products, including cheese, yogurt, and milk, have standards of identity (SOI) established by regulation, setting out requirements that must be met to be considered and labeled as such.

Milk is a prime example. For the past several years, we have seen plant-based products adopting the words “milk”, “yogurt”, or “cheddar cheese” into their brand names and labeling. Some contend that regulators should enforce the current rules, which state that plant-based alternatives should not be marketed and labeled as milk, while others argue that no one is being misled: “almond milk,” they maintain, is clearly not claiming to be animal milk.

Currently, dairy products are defined as being derived from dairy animals. Labeling regulations, though, are not being enforced. Moreover, the Food and Drug Administration is in the process of updating the definitions of various food types. The FDA is seeking more information about the properties of plant-based alternatives, so that they can maintain dairy product standards (while allowing flexibility for innovation). And while there is no timeline on future guidance, it will eventually happen.

A similar controversy is taking place with laboratory-grown meat. In March, the US Department of Agriculture and the FDA announced they had established a framework for regulating cell-based meat and poultry. However, the framework is still in the preliminary stage. Moreover, some states have passed legislation prohibiting the labeling of lab-grown “meat” as meat. This situation could lead to a problematic patchwork of local laws, something that is of great concern to advocates of cell-based meat.

CBD (CANNABIDIOL)

Cannabidiol – better known by its three-letter acronym CBD – has been widely reported on in the media of late. In fact, CBD seems to be popping up everywhere, from booths at farmers’ markets to an add-in for smoothies. Nonetheless, there remains a great deal of confusion surrounding CBD and its uses and effectiveness. To fully understand what CBD is, it’s useful to lay some groundwork.

CBD is a key active ingredient of cannabis, or marijuana. It is derived from the hemp plant, which is related to the marijuana plant. Although both plants are cannabis sativa cultivars, hemp has THC (the main psychoactive property in marijuana) of less than 0.3 percent by weight. So while CBD is a component of marijuana, CBD by itself does not cause a “high.” It can be extracted from cannabis but is not psychoactive and is legal in the US.

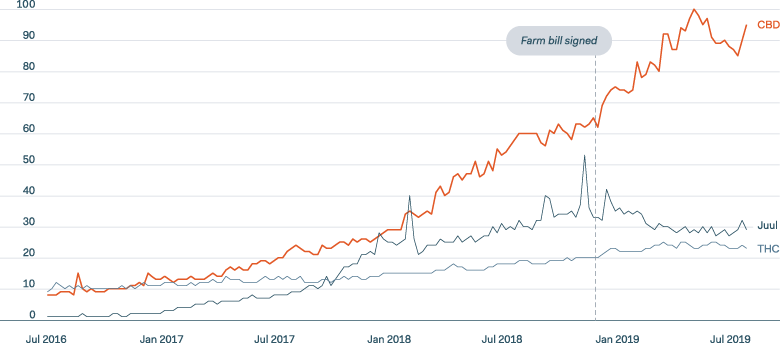

CBD is growing in popularity: 26 percent of US adults have tried CBD at least once in the past two years and 14 percent of the adult population in the US uses it regularly. (See Exhibit 3.)

They are drawn to the ingredient’s properties:

- 63 percent find CBD “extremely” or “very” effective in reducing stress or anxiety (this behavior has been primarily seen in Millennials)

- 38 percent find CBD “extremely” or “very” effective in alleviating joint pain (this behavior has been primarily seen in Baby Boomers)

Experts have expressed high hopes for CBD in the near future, as it shows great medicinal potential, and it is considered to be the most promising additives in foods since the advent of caffeine.

Exhibit 3: Surge in interest in CBD

The spectrum problem

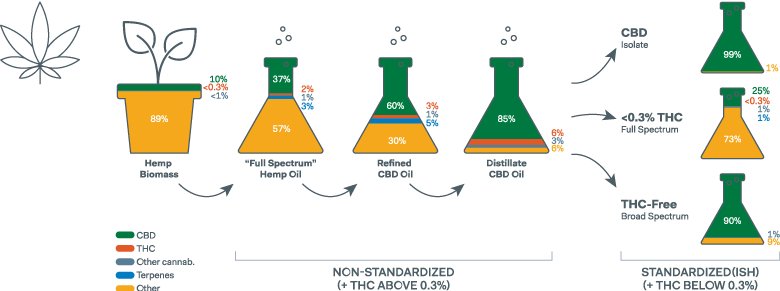

The potential benefits of CBD are generating great expectations, offering an expanded range of options to customers. That said, there is a great deal of confusion and debate in the marketplace over the efficacy of products featuring the three different “flavors” of CBD: full spectrum CBD, broad spectrum CBD and CBD isolate. Here are the differences between the categories:

- Full Spectrum CBD: Full spectrum CBD means that the product contains all the cannabinoids that are found in the cannabis plant in nature, rather than just CBD (Cannabidiol)

- Broad Spectrum: Broad spectrum of CBD is CBD that has been extracted from the cannabis plant with all of the other compounds from the plant except for THC. That means it contains terpenes, essential oils, and other cannabinoids from the plant. This should not result in psychoactive effects, but there is still more research to be done.

- CBD Isolate: The chemically isolated form of cannabidiol. Proponents tout CBD Isolate as the purest form of cannabis.

According to the FDA, product labels should not be open to misinterpretation, so that consumers trust that the label = same product. Spectrum marketing can be misleading to both industry and consumers, given that there are clear differences in the composition of each of the products obtained from hemp. (See Exhibit 4.)

Sales of CBD-related products in the US are projected to hit more than $20 billion in 2024, increasing from $11 billion in 2018, and the expectation is that CBD products will be sold in general retail markets, rather than in licensed dispensaries.

CBD: Regulatory Status Quo And Outlook

The number of CBD-based products on the market has proliferated since hemp and hemp-derivatives were legalized in December 2018. Companies have made unsubstantiated health claims about their CBD products, stating they can prevent, treat or cure different diseases.

The FDA has taken a hardline on these claims. Although the agency recognizes the huge public interest in these products, it is placing CBD products under heavy scrutiny, while continuing to do research into their effects and safety. The process is likely to take years, as there are many questions that remain to be tackled.

The FDA insists companies be completely open and transparent about the composition of their products, including accurate and truthful information regarding:

- Complete list of ingredients

- Labeled percentage of CBD dosage

- Full transparency on the sourcing of CBD

- The FDA will test different CBD products to ensure quality and efficacy

Exhibit 4: Range of CBD’s composition can lead to confusion

Conclusion

Plant-based alternatives to meat and dairy products and CBD show great promise as robust categories that can fuel sales at retailers for many years to come, while promoting healthy options for consumers. Despite the public interest and the support from members of Congress, experts estimate the regulatory process could take years to resolve.

So, what does this mean for SMEs and merchants in general, what should they do, not do, and look out for? Here are some of the things SMEs can do and need to be on the watch for:

- Be the standards’ bearer: As an industry, it is critical to push for the highest set of standards in plant-based alternatives and CBD products

- Know your customer: An interesting strategy would be to target customers providing specific health benefits for a given product, understanding specific needs of each customers cohort. By tracking users’ behaviors over time, it would be possible to target them more effectively (e.g. athletes may need more salt, while people with heart issues need less – a plant-based burger, which is high in salt, would be highly beneficial for the former but not recommended for the latter).

- Educate the consumer: Given that we are in the early stages of this trend toward plant-based alternatives and CBD, customers do not know yet what their preferences are and need to learn what they want. Some might say they don’t want to consume processed products or meat from a lab, choosing natural foods, while others would rather to avoid animal consumption.

- Take a phased approach

- Use vendors who don’t overpromise: This is important to ensure consumer expectations and product properties are consistently met

- Sell only clearly labeled products