Is Walgreens’ move a bellwether for a new healthcare benefits paradigm? Oliver Wyman’s private exchange experts say yes, and have identified five key facts that matter for insurers and other industry players.

PRECEDENTS FOR GROWTH

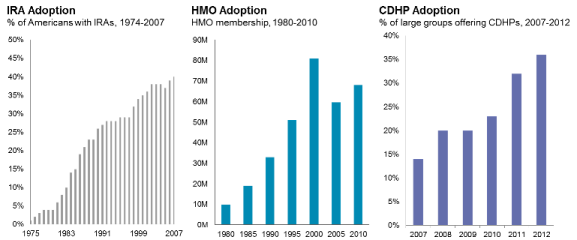

How fast will private exchanges grow? We believe there are some strong precedents in the growth of independent retirement accounts (IRAs), health maintenance organizations (HMOs), and consumer-directed health plans (CDHPs), all of which grew more quickly than many in their respective industries predicted. Based on this and other factors, we predict that 40 million Americans will receive health insurance through private exchanges by 2018, an increase of more than 10-fold over today, and more than will be on the public exchanges. More than 30 companies have already developed private exchange offerings that will be in-market for 2014.

Source: Oliver Wyman analysis