According to Oliver Wyman’s analysis, the small-utility opportunity across the United States includes over 150 electric and gas utilities with combined net PPE of more than $30 billion and annual after-tax earnings potential exceeding $1.3 billion. Such small-acquisition growth strategy could be of value for private equity and infrastructure funds as well as for publicly traded utilities.

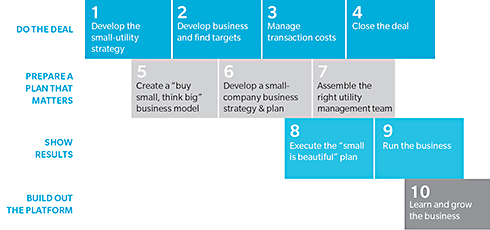

For private equity and other investor groups (e.g., pension funds, endowments), capitalizing on a growth strategy involves ten critical steps:

This Oliver Wyman article was written in part for private equity and other investor groups that may be interested in infrastructure plays as well as for larger investor-owned or private utilities which are considering growth through smaller targeted acquisitions. It discusses the benefits of the small-utility acquisition strategy and outlines the process for building the attractive deal stream.