Few expect this storm to pass quickly. This paper, a collaboration between the Association for Financial Professionals and Oliver Wyman's , offers guidance on developing a plan for managing commodity risks that draws on the best practices of companies from around the world. The paper provides an in-depth review of the role of analytics and outlines a new systematic approach to managing commodity risk, illustrated through case studies.

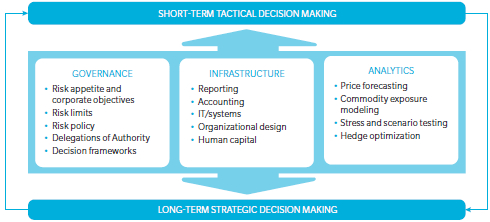

Commodity Risk Management Framework

As illustrated above, structured commodity risk management framework is built around three pillars: governance, infrastructure, and analytics. Together, these pillars support both short-term tactical decisions and long-term strategic initiatives

"Vulnerability, Not Volatility" is the second in a being developed by Oliver Wyman and the Association for Financial Professionals. The series addresses critical issues for finance professionals with the objective of stimulating discussion and feedback to Oliver Wyman and AFP through interactive roundtables, presentations at professional events, surveys, webinars, and personal interviews. The first article in this series,"The New Weakest Link in Your Supply Chain," examined how companies can protect themselves against the deteriorating financial strength of suppliers.