The Wealth industry is on the cusp of the next evolution towards “Wealth Management 3.0," offering attractive growth opportunities and the ability to make financial advice and investments more accessible to a broader demographic and range of clients

The Wealth industry is on the cusp of the next evolution towards “Wealth Management 3.0," offering attractive growth opportunities and the ability to make financial advice and investments more accessible to a broader demographic and range of clients

What follows is our latest Morgan Stanley and Oliver Wyman Global Wealth & Asset Management report, Time to Evolve. We explore the opportunities and priorities for wealth and asset managers as the industry is on the cusp of the next evolution towards Wealth Management 3.0.

In our 2022 edition, Time to Evolve, with Morgan Stanley, we discuss three pressing strategic and investment priorities for wealth and asset Managers to successfully evolve to Wealth Management 3.0. We share our global industry analysis, trends, and insights for leaders to rethink operating and distribution models, reach wider client segments, and capture transformative and profitable growth opportunities. Below is an excerpt of our report, for the full version, please click the PDF below.

Time to Evolve

For over a decade many wealth managers have put their growth focus on the ultra-high-net-worth (UHNW) and higher-net-worth (HNW) segments, thus not prioritizing less wealthy clients. Only players with a premium brand or strong investment banking capabilities have been able to profitably grow in the highest wealth band segments, as the UHNW market is both hard to scale and highly competitive.

We see a revenue pool of ~$230BN in the lower high-net-worth (HNW) and affluent segments, which wealth managers can now tap in a profitable way

We see a revenue pool of ~$230BN in the lower high-net-worth (HNW) and affluent segments, which wealth managers can now tap in a profitable way

Wealth Management 3.0

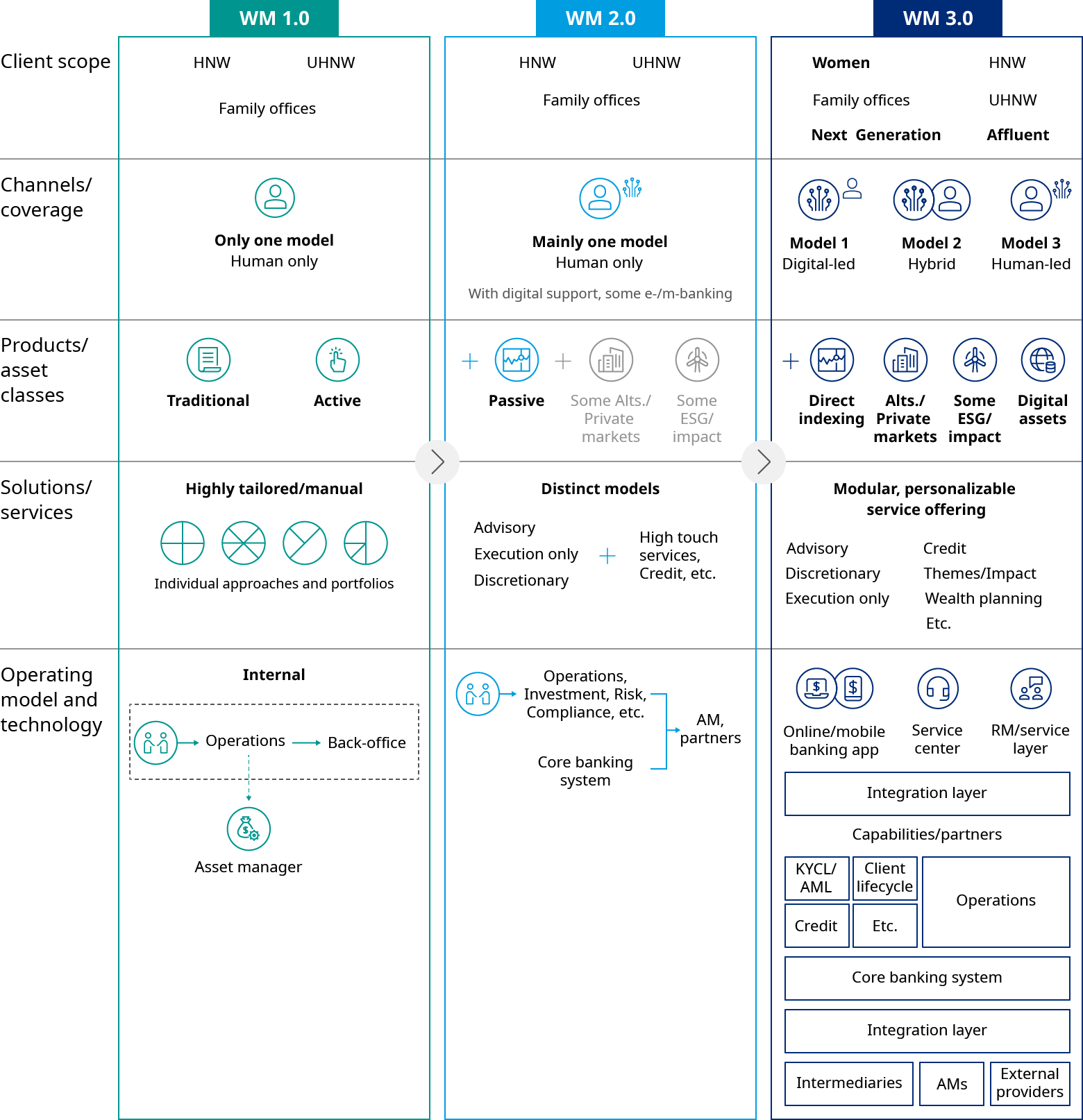

We believe the next decade will be about wealth management 3.0 — the transformation to a scalable and modular wealth management proposition, enabled by digital transformation.

Facilitated by technology, wealth managers can make superior financial advice and investments accessible to a more diverse client base at lower, differentiated costs to serve. Clients can pick and choose different modules of advice, products and services to create their own, personalized solution. Wealth managers will support their clients along the journey through different channels, from human- to digital-led. Digital solutions will also form the base layer to cater to more traditional, higher wealth bracket clients, who increasingly expect enhanced digital experiences along with traditional human-led bespoke service offerings.

Accelerating to Wealth Management 3.0

For many wealth managers, this will require significant change and investment in their coverage and service models as well as operating models and technology in order to win market share profitably in the future. Leading firms which are accelerating the transition to Wealth Management 3.0 have been investing a high single-digit percentage of their revenues in this transformation effort and are planning to continue to do so for the next 3 to 5 years.

Stronger technical integration with Asset Managers

For asset managers, the wealth management channel becomes ever more important. We expect the share of the wealth and retail client segment of total assets under management (AUM) to grow from 58% to 64% in the next 5 years.

As wealth managers transform their service and delivery models, asset managers will need to evolve their distribution approaches. Asset managers face fundamental choices: partner and distribute through wealth managers, build captive digital-led wealth management distribution solutions, or establish open platforms geared towards this segment. A combination thereof may also work for some. Each model comes with benefits and drawbacks, but they all require re-architecting the wealth channel and associated operating model.

The interaction and distribution models between wealth and asset managers will require deeper technical integration and more personalized end-client experiences. Success will increasingly become a function of how effectively asset managers can forge partnerships with wealth managers through building integrated operating models and better end-investor experiences. Tailored market insights, data & analytics, and better access to investments through digital-and human-led channels and portals will enable advisors to deliver value to their clients across the full lifecycle.

Economics, opportunities and challenges

Advancements in technology, and the macroeconomic and geopolitical regime shift will accelerate a transformation in the Wealth & Asset Management industry — to Wealth Management 3.0.

- Uncertain market outlook – 2022 is off to a more challenging start than 2021: After a decade-long bull market across asset classes, the market outlook is much more uncertain and muted (~4-5% CAGR over the next 5 years).

- There is a considerable risk of sustained inflation and much tighter liquidity disrupting economic growth. Moreover, the war in Ukraine raises the prospect of a new era of geopolitical escalation and deglobalization, not only in terms of supply chains but also asset allocation.

This regime shift will accelerate the transformation of service and operating models, as complexity, margin and cost pressures intensify. At the same time, client demand continues to evolve rapidly towards new products and features such as ESG, private markets and digital assets, more personalization, and seamless digital and hybrid experiences. As a result, technology will play an ever more critical role in this transformation.

Substantial opportunities and challenges for both wealth and asset managers

We see “Wealth Management 3.0” as this next stage of evolution triggered by the paradigm and regime shifts outlined within the report. Over the last couple of decades, wealth managers have successfully moved to more digitalized, data- and IT-driven models (“Wealth Management 2.0”) from their brick & mortar, paper-based, white-glove only origins (“Wealth Management 1.0”). The next stage will be defined by substantial modularization and diversification of offerings, service models and operating models, allowing lower, more differentiated costs to serve — all facilitated by technology.

Wealth managers’ growth and profit opportunities are under pressure

Wealth managers have been facing revenue margin pressure in recent years driven by a mix of deposit margin contraction (although some institutions have launched countermeasures such as negative interest rates), pressure on mandate margins and a change in client mix towards UHNW as well as continued change in product mix towards cheaper passive products.

Rapid AUM growth coupled with tactical efforts to realize productivity increases allowed large wealth managers to succeed in maintaining cost-income levels. Pressure on smaller firms and booking centers has grown significantly, leading to increased consolidation and footprint rationalization, particularly in Europe where the lack of a real banking union still hinders a fully integrated operating and funding model across markets. Considering the cyclical headwinds and structural changes outlined above, we foresee that profit pools of wealth managers are under threat unless there is a fundamental transformation of service and operating models.

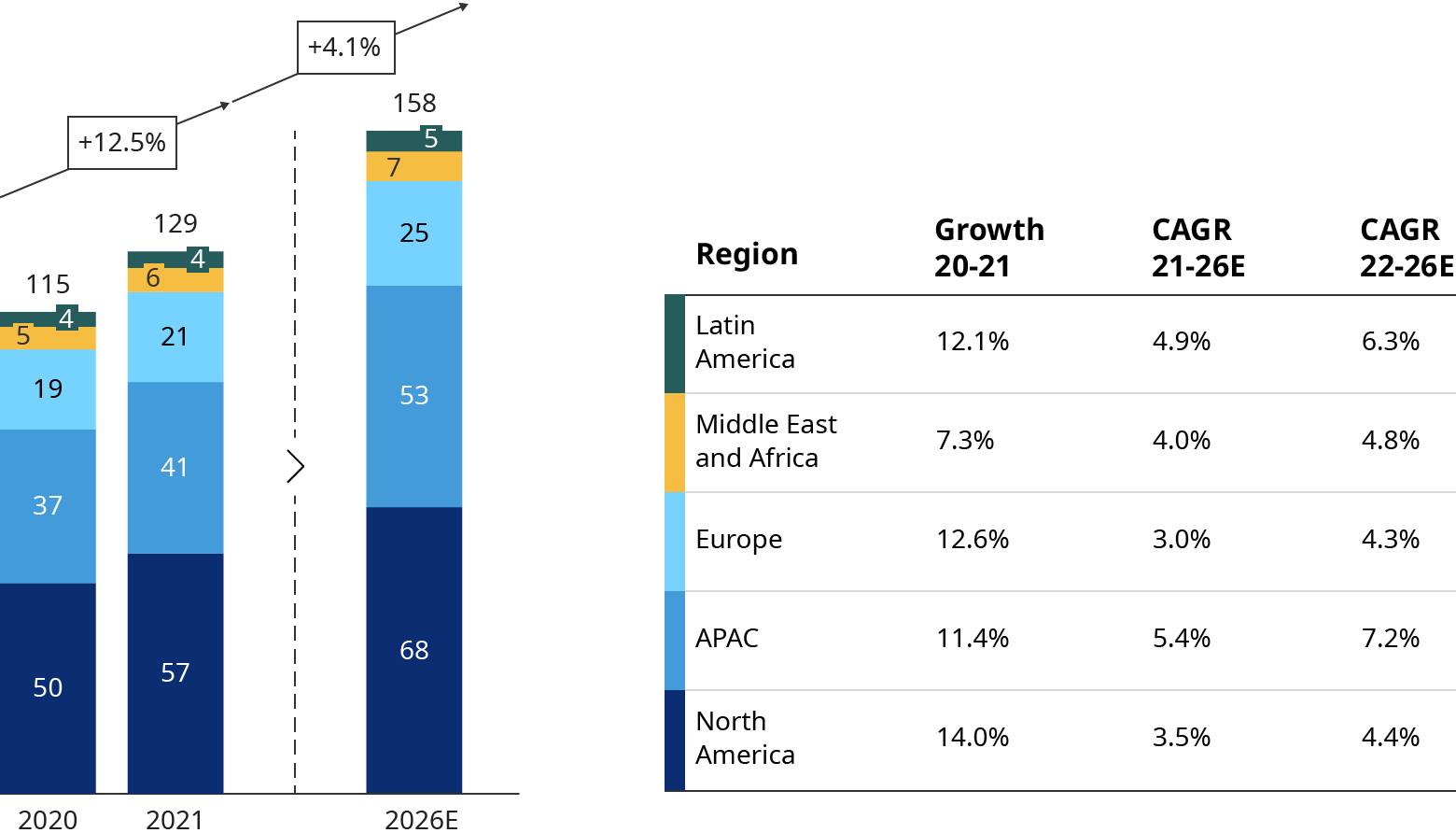

Lower growth and changing regional growth differentials

Heightened geopolitical tensions, inflation, and uncertainty regarding economic growth will negatively affect global AUM growth in 2022, where we expect a slight decrease in personal financial wealth for the first time in over a decade.

We expect growth to be around 4% p.a. over the next five years through 2026, materially slower than the 8% seen in the last five years (2016-2021). While APAC and North America look set to drive roughly 80% of worldwide new wealth creation until 2026, the growth differential between regions is narrowing.

Broadening access to wealth management

Over the past decade, the primary focus of internationally oriented wealth managers was on higher wealth band clients as they drove the majority of AUM growth and given their oftentimes institutional needs, provided the opportunity for larger bank-owned wealth managers to foster cross-divisional revenue opportunities with their corporate and investment banks. Many wealth managers struggled to profitably serve lower wealth band clients given uniformly high costs to serve, and consequently they managed cost-income ratios by offboarding and restricting the access of these clients.

We expect UHNW investors with more than $50MM in wealth to continue to drive wealth creation and to account for more than 40% of total wealth growth by 2026. However, this segment accounts for less than 15% of the overall potential wealth management revenue pool and for less than 20% of its growth.

Broader banking revenues linked to the UHNW segments, such as from investment banking, will likely also come under more pressure due to deleveraging, slowed deal activity and potential reduction in banks’ risk appetite. This growth will also come with higher uncertainty and risks compared to the last decade, where for example European collateral could finance a transaction in the US for a Chinese client. Nevertheless, UHNW will remain a core segment for global wealth managers.

Wealth managers: three priorities in Wealth Management 3.0

The largest revenue growth opportunity will be in the affluent and low high-net-worth (HNW) client segments with more than $300K and less than $5MM in wealth. This segment looks set to create ~$45BN of new revenues and account for about 60% of the total wealth management revenue pool by 2026. Currently, we see a revenue pool of ~$230BN in this segment, of which only 15-20% is penetrated by wealth managers.

The largest revenue growth opportunity will be in the affluent and low high-net-worth (HNW) client segments with more than $300K and less than $5MM in wealth. This segment looks set to create ~$45BN of new revenues and account for about 60% of the total wealth management revenue pool by 2026. Currently, we see a revenue pool of ~$230BN in this segment, of which only 15-20% is penetrated by wealth managers.

We see three priority investment areas for wealth managers to accelerate their transition:

- Coverage and service model: Introduce full omnichannel capabilities, complementing human-led with distinct hybrid and digital-led interaction models.

- Delivery model: Make delivery more flexible, differentiate and lower costs to serve clients through operating model and tech transformation. A wealth manager’s costs to serve an average client today in the traditional UHNW/HNW bracket is $8-20K (we expect this to remain rigid for traditional human-led premium propositions), but this can drop to $2-8K in a hybrid model and $0.5-2K in a digital-led model.

- Value management: Create transparency on client-level economics, develop a systematic approach to measure, manage and communicate value creation with the support of digital dashboards with real-time information. This will enable dynamic management of revenues, costs and profitability at the product, advisor and client level.

Asset managers: from intermediation to integration

Wealth Management 3.0 will be defined by the substantial modularization and diversification of offerings, service models, and operating models that allow for lower, more differentiated costs to serve — all facilitated by technology

Wealth Management 3.0 will be defined by the substantial modularization and diversification of offerings, service models, and operating models that allow for lower, more differentiated costs to serve — all facilitated by technology

As the wealth channel becomes more dominant and wealth managers transform their service and delivery models, asset managers need to rethink their positioning with wealth managers and ultimately the end clients. We expect a significant shift in the way they interact, from a simple intermediated distribution between an asset manager’s wholesale team and the wealth manager’s fund selection team towards a deeper technical integration. This will support delivery of more customized content, products and solutions, enabling a more personalized end-client experience at lower costs. We expect a few asset managers will create their own end-to-end wealth ecosystem with direct captive or open digital investment and wealth management platforms.

Despite the opportunity for direct distribution models, we expect intermediated channels via wealth managers to dominate. A strategic priority of asset managers will be refining the interface with wealth managers and adapting their operating models accordingly.

We see three emerging themes that asset managers need to address to succeed:

- Increased importance of integration and customized content: In selecting asset managers, wealth managers will place increased weight on the ability to build technical integrations with their own operations to streamline content delivery, facilitate development of customized products and outcome-oriented solutions.

- Technological adoption and sophistication as drivers of economics: Technological capabilities are becoming more important than pure scale as a driver of operational efficiency, allowing smaller players to compete more effectively against scale players

- Supercharging advisors and clients: As end-clients in Wealth Management 3.0 need more (digital) guidance on a broad suite of products and a higher quality digital customer experience, asset managers must develop the (digital) content capabilities that truly elevate their advisor partnership.