While the pandemic brought a sharp and painful recession, swift actions from central banks buoyed financial markets and implicitly shielded asset management revenue pools. In this report, we look at what the pandemic means for structural trends and the outlook for revenue pools. We also discuss implications for asset managers navigating the bounce-back from the crisis.

Impact on industry revenue pools and structural trends

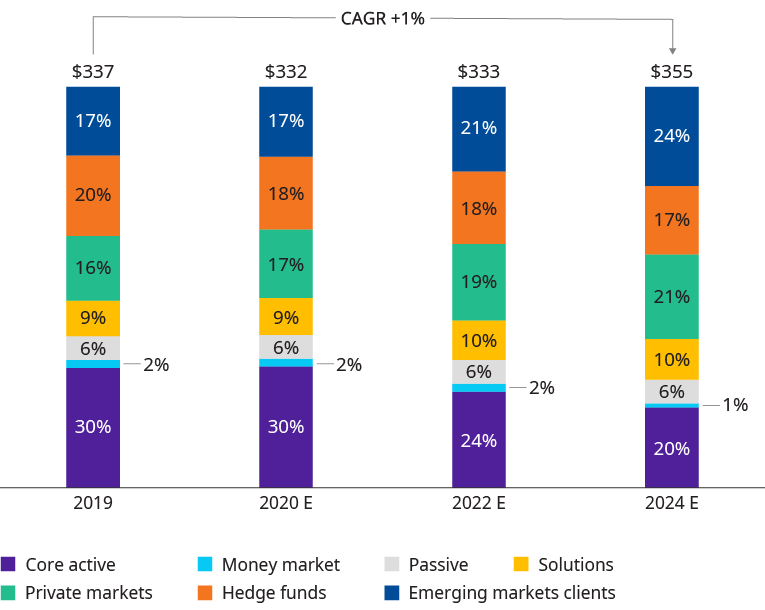

Early macroeconomic indicators point to a V-shaped recovery and this, combined with recent flow dynamics from April and May, lead us to believe that asset management industry revenue pools will be relatively sheltered from the steep declines many feared in March. Key structural trends, including downward fee pressures and an aging population negatively affecting inflows, will remain intact; indeed, we expect them to be accelerated by the pandemic. We assume inflows will be muted up to 2024, with a base case forecast of 2.0-2.5 percent (versus historical inflows of three to four percent). Yet, this will be counterbalanced by more active churn, particularly within the core active segment. On net, our expectations are still more muted compared to last year, but we see an overall positive trajectory for revenue pools through 2024, expecting around one percent growth per annum, through the forecast horizon.

Private Markets AuM include dry powder

Source: Oliver Wyman analysis

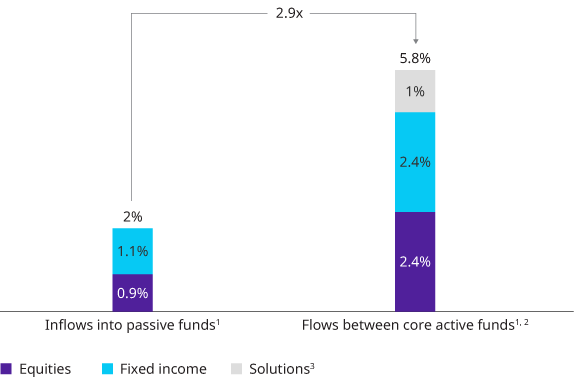

Our structural view on core active management remains unchanged – passive incursion, acceleration of competitive pressures, as well as fee compression will drive material fee pool declines. Leading up to the crisis, we were observing an acceleration of churn, with flows from active-to-active 2.9 times the level of inflows into passive. The major difference that we expect through the recovery is that the intensity of the shift to passive will be moderate for those that can demonstrate relative out-performance. In fact, we are already seeing early indicators of core active flows improving since March, along with better active equity performance overall, yet these flows are skewed to players with material outperformance.

1. Excludes other asset classes

2. Relative flows between funds of the same asset class based on the evolutions of fund AUMs controlling for market effects

3. Proxied using “mixed assets” in Broadridge

Source: Oliver Wyman analysis, Broadridge

Achieving growth through the bounce back

We anticipate that the key growth zones relevant before the pandemic - emerging markets clients, private markets, and solutions — will remain intact. We expect the revenue pools related to these three zones to grow at an average of seven percent per annum through 2024 ( versus contracting approximately four percent per annum for the rest of the industry).

Of these, private markets are most likely to benefit from a v-shaped recovery as headwinds ease for the segment. A persistently low interest rate environment globally, and subdued outlook for returns from traditional asset classes, should feed ongoing client demand (as investors trade liquidity for returns).

Finally, ESG has started to serve as a real enabler for growth as adoption accelerates given strong investor engagement combined with better performance through the crisis. In particular, early movers across segments stand to benefit and capture flows in the near term. However, as ESG investing matures, we expect it to become a capability widely adopted across strategies and segments rather than a long-term incremental fee pool driver for the industry.

Asset Managers building back better

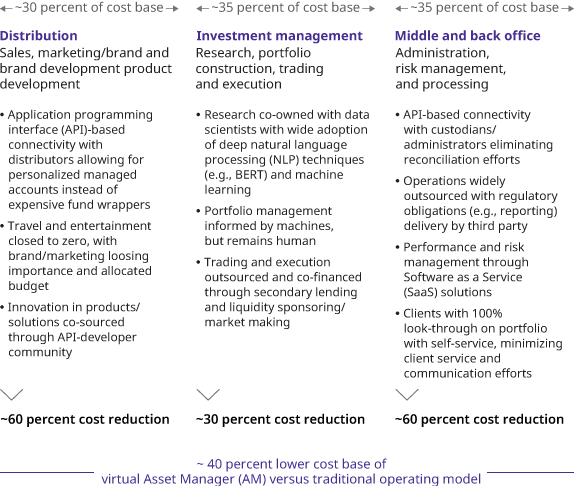

We estimate that structurally embedding efficiency gains revealed by the crisis could deliver 10-15 percent cost savings. Taken to the logical extreme, we see the possibility of a fully “virtual” manager, who we believe could operate at a 40 percent lower cost base versus traditional managers. While such an extreme transformation would introduce a number of operational and strategic risks, we suggest firms reorient their perspectives and look at the fully “virtual” manager as the “zero base” upon which to build back better.

Technology will play a pivotal role in enabling operating model changes, not just a transition to flexible and remote working. One area we would highlight where we see asset managers at least five years behind banks is in the adoption of API (Application Programming Interface). We think this is a key path to enable closer connectivity to distributors as well as an opportunity to streamline data infrastructure and reduce operational costs.

Source: Oliver Wyman analysis

.jpg.imgix.threeColumnTile.jpg)