Through this tumultuous period we can already glimpse some lasting changes. These include the acceleration of e-commerce, greater consumer demand for mobile and contactless payments, the need for effective and inclusive digital servicing, more flexible business-to-business and government-to-consumer payment options, and a replacement for static fraud models. We already knew these shifts would happen, but the pandemic has accelerated the call to action

In this edition of Payments Plus, we share findings from our proprietary Shopping Outlook Survey that tracks evolving consumer sentiment during the pandemic. We also discuss the continued rise of point-of-sale financing, the opportunities presented by leveraging payments data, and the appearance of new fraud threat vectors. These topics will become even more important for our industry as we emerge from the pandemic and look forward to brighter days.

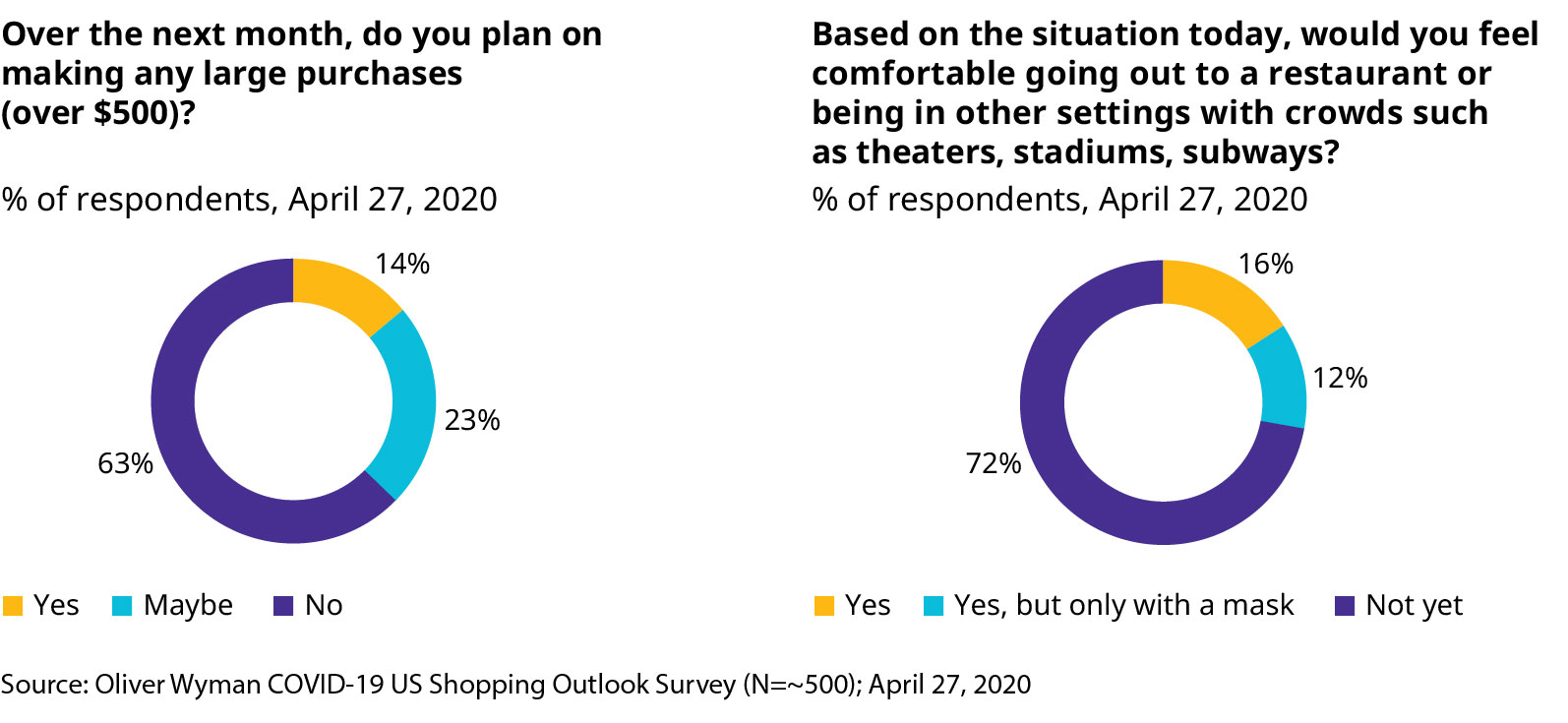

Exhibit: Consumer Sentiment During the Pandemic

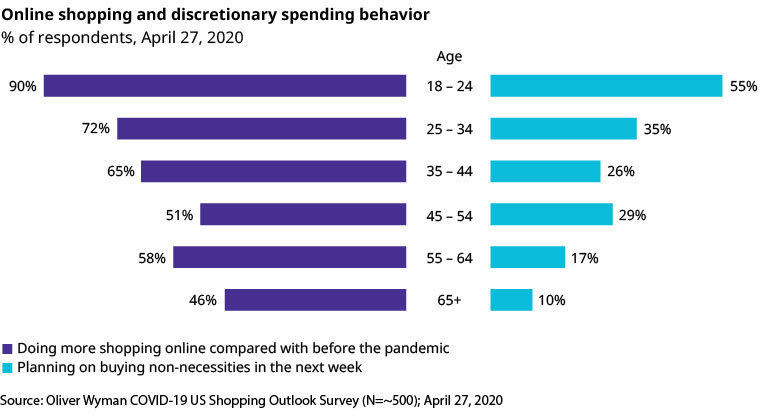

Exhibit: Younger individuals, especially those between 18 and 24, are shifting their spending online and have a greater propensity for discretionary spending.

Payments Plus is a regular update from Oliver Wyman where we share a sample of perspectives drawn from client work across the Payments Industry.

Contact us at payments@oliverwyman.com.