Back in 2020, the COVID-19 pandemic, and the subsequent shutdowns, created a stress test for the financial health of millions of Americans. Less than a month into the economic crisis, 43% of people surveyed by the Pew Research Center reported that they or someone in their household had already experienced a loss of income or employment.

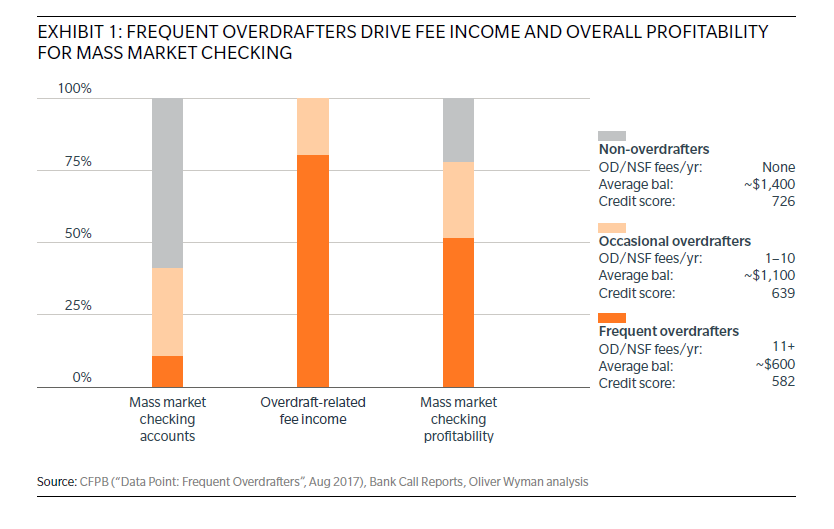

Overdraft and NSF fees drew attention in the aftermath of the first wave of job losses as such fees would fall disproportionately on those most impacted by the crisis, exacerbating already difficult circumstances. To help customers, several banks announced fee waivers as part of hardship assistance. One leading challenger bank went further and used its “fee-free” overdraft line to advance federal stimulus check payments to selected customers, many of whom needed immediate access to such funds to replace lost income.

Expanded unemployment benefits and stimulus checks have created a temporary cushion to household balance sheets that has helped draw attention away from overdraft. But as the crisis unfolds, overdraft will likely garner attention and scrutiny again, both as household checking account balances shrink and as banks feel pressure to replace lost revenue.

What should banks do about overdraft? We believe the crisis is accelerating the need to replace an antiquated product and an unsustainable value exchange. Our paper explains why and articulates a path forward.

Report Insight