As we venture into 2020, evolving regulations and changing consumer behavior will impact insurers. Cybersecurity, data privacy, and customer protection continue to shape new challenges and trigger regulatory scrutiny.

As an insurance leader, you may already be considering how to address regulatory and risk management challenges—and it’s a daunting task. At Oliver Wyman, we have been working with clients to solve these issues and more effectively manage compliance risks. Our paper, Jumping Forward, delves into the challenges and impacts our clients are facing. We present the strategic changes and quick wins needed to effectively manage compliance, including how to develop a risk-based compliance program, increase engagement with the overall business, and fully align other non-financial risk functions.

Compliance as a strategic partner rather than a naysayer will be important to communicate clearly and gain critical buy-in from the business

BACKGROUND

The financial crisis highlighted the staggering financial and reputational impact compliance failures can have on institutions. Since 2008, regulators globally have sought to raise the bar for compliance risk management—imposing stricter standards on how financial services companies manage their obligations. Recently, there has been significant focus on compliance practices at insurers, in addition to new laws and regulations related to sales practices, market conduct, privacy, and individual accountability. This, coupled with changes in customer expectations, business mix, and technology have only further increased the challenges insurers face to manage their compliance risks.

WHAT'S NEEDED? STRATEGIC CHANGES

In our experience, Compliance functions at insurers tend to be less mature than those at other regulated financial institutions. Similarly, insurers typically have fewer resources dedicated to compliance risk management and less influence and impact within their organizations than at other types of regulated financial institutions.

As a result, insurance companies need to take a hard look as to whether their Compliance functions are keeping pace with this heightened degree of complexity, scrutiny and change. In this paper, we recommend that insurers make three strategic changes to more effectively manage existing and evolving compliance risks.

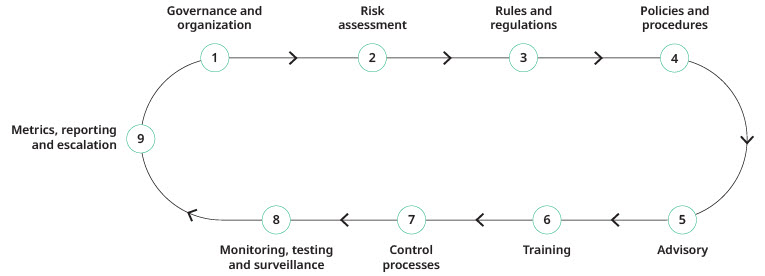

OLIVER WYMAN RISK MANAGEMENT WHEEL

As insurance companies invest in the development of more “risk-based” compliance risk management programs., these changes can be implemented across the typical compliance risk management framework.

GET STARTED.

We believe that it is essential for insurers to begin a journey towards a more effective model for Compliance within their organizations.

Enabling this transformation requires insurers to obtain strong support from senior management, clarify the first-line and second-line ownership of compliance risks, and upskill the Compliance team. While such a transformation will likely occur over multiple years, many quick wins can start to be implemented right away to progressively set the tone on the way forward.