During the last 10 years, non-financial risk management has become more complex to manage. With increased regulatory scrutiny, rapid shifts in technology, and new cyber and data theft exposures, financial institutions need to rethink their approach to managing non-financial risks and improve resource allocation.

Given multiple pressures, the industry has traditionally responded by building out non-financial risk management capabilities. In an effort to cover all bases, they have hired more people, introduced additional controls, and developed new processes. This has resulted in larger non-financial risk functions with greater responsibilities, but not necessarily ones that are best organized to meet these challenges. Non-financial risk areas often operate in silos, however, the silo approach has resulted in both ineffectiveness and inefficiency.

In our new paper, we present findings on how the industry is changing, and discuss the limitations of current approaches used by financial institutions. You will learn about key strategies and actions institutions need to consider for managing today’s non-financial risks, and find solutions to help broaden talent skillsets and improve teaming.

Non-Financial risk areas often operate in silos, however, the silo approach has resulted in both ineffectiveness and inefficiency

The path to convergence and integration

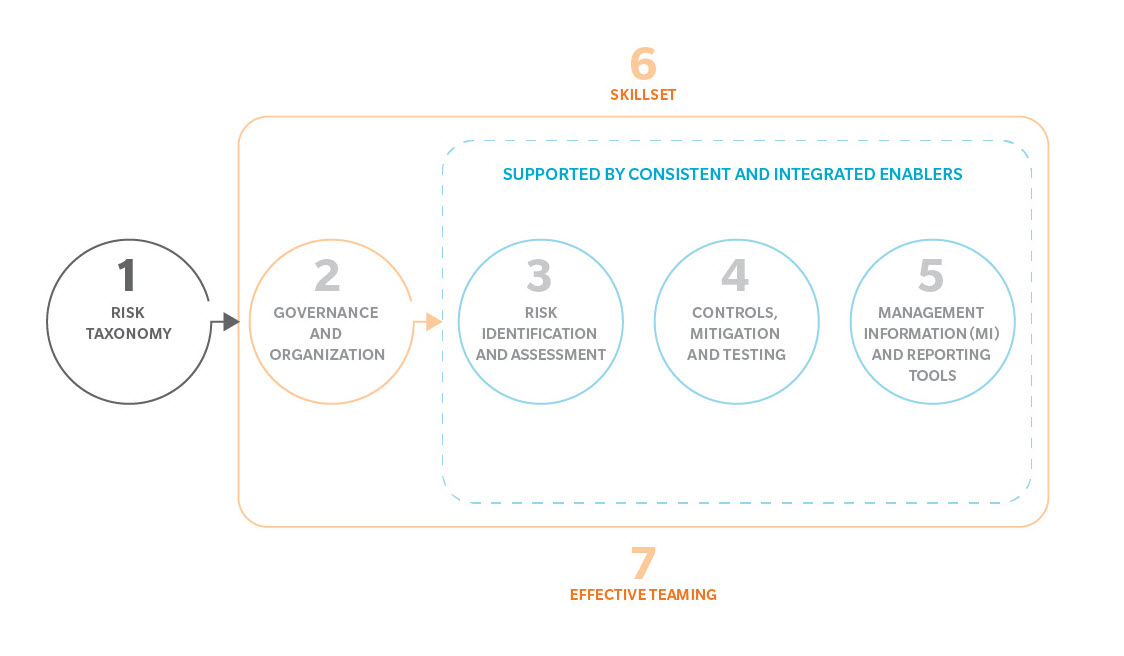

The shortcomings of a silo approach significantly constrain the effectiveness and efficiency of non‑financial risk management. To help reduce the pain points, we recommend integrating seven components.

Seven components of an integrated approach

NON-FINANCIAL RISK MANAGEMENT