This article was first published July 31.

Editor's note: Oliver Wyman is monitoring the COVID-19 events in real-time, and we have compiled resources to help our clients and the industries they serve. Please continue to monitor the Responding To Coronavirus Hub for updates.

2020 has been a rocky road for automotive leasing, with original equipment manufacturers (OEMs) and their captive arms as well as large fleet leasing providers particularly feeling the pressure. COVID-19 has brought significant losses to an industry that has been fraught with problems for several years, such as outdated residual value models, volatility within used car markets, and additional residual value impacts from new e-mobility technology.

In new car sales, we estimate the year-on-year decline in Europe and North America lies between 17 and 26 percent. In the used car market, the situation is very similar: in Europe and North America – the most important leasing markets – the downturn until May has been around 22 percent in Europe and 33 percent in North America compared to 2019, but since then used car sales have recovered quicker than expected, mostly due to the lack of production of new cars as a result of the global lockdown. The average used car price went down by three to six percent in Europe by now and recovery still is not in sight. In contrast, COVID-19 caused an average price drop of up to 12 percent in the United States, but since June, used car prices have recovered due to a short supply of new cars produced from April to June and continued demand supported by governmental stimuli such as Economic Impact and extra unemployment payments, Payment Protection Programs, loan payment deferrals and other programs. Nonetheless, the stimulus effects will be finite and unless there is a stable economic recovery, demand may decline leading to falling prices again.

In the past, historic shocks have taught us that used car price dips typically recover slowly to pre-shock levels without external stimuli. This means that used car prices, and thus the residual values, will (in the case of Europe) remain at or probably return (in the case of the United States) to a lower level compared to pre-crisis levels for the long term and will only improve once economic uncertainty has widely been mitigated. In addition, there are structural problems for lessors: the rigid contract terms of leasing providers and the lack of used car offerings in the leasing segment. This prevents captives and fleet leasing providers from flexibly monetizing off-lease cars in usage-based business models (instead of "pushing" them into a used car market that is no longer absorbable, and, by doing so, destroying value on sight).

While a certain residual value loss per asset is already priced in ex ante through risk provisions and agreements between OEMs, captives, and dealer organizations, additional Covid-driven residual value losses will rise again to similar levels as during the financial crisis of 2008/2009 due to the slump in the used car market. At that time, additional residual value losses were in total between four and eight percent and caused major damage to the automotive space resulting in some OEMs to temporarily holding their leasing offers. This time residual value losses could be even higher due to a significant increase in leasing contracts: crisis-related residual value losses in Europe and the United States could reach approximately US$ 6-8 billion in the next 12 months.

On the other hand, we see that the demand for mobility is changing in the market. Demand for innovative sharing- and hailing-based mobility services is falling, for example up to 80 percent decrease for ride-hailing. Likewise, cars or e-scooters are being rented less. COVID-19 is making the business models of mobility services increasingly difficult, and social distancing is increasingly leading to individual mobility.

However, the uncertain economic situation is accelerating the shift from vehicle financing to vehicle leasing, both the classic 36-month variant and increasingly the short-term form, better known as car subscription. These car subscriptions are replacing the classic leasing and rental offers as well as less successful mobility offers such as car sharing. In latest car subscription study, up to 38 percent of the participants are now interested in car subscriptions (by contrast, in 2019 these figures were only around 28 percent).

Four Counter Measures

So, which counter-measures should car captives and fleet service providers adopt? We see four courses of action: increase flexibility, rethink utilization models, invest in better analytics, and redesigning marketing processes.

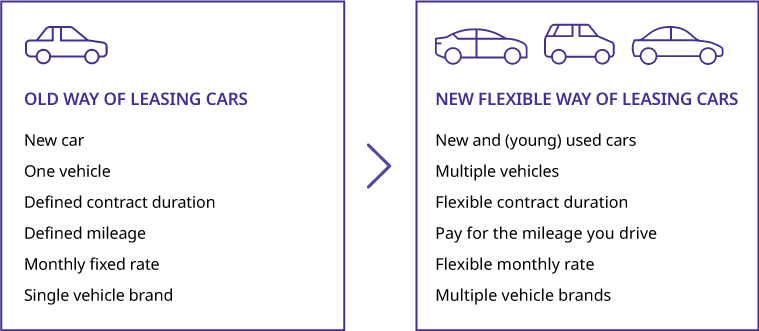

Increase flexibility – Up to now, rigid deadlines and used car sales processes, such as remarketing, have caused many issues. Based on economic criteria and quantitative key performance indicators, leasing conditions must now be made more flexible. For example, lease customers should be allowed to keep the vehicle for longer, by applying cheaper leasing rates and other incentives, especially if it is foreseeable that selling the leasing vehicle can only be realized at higher losses. Naturally this needs to be measured on an case-by-case basis in order to create economic benefit by adjusting expiring contracts.

Rethink utilization models - In addition to classic remarketing, lessors must establish and offer further utilization models for leasing returns, such as used car leasing and used car subscriptions, in order to have alternatives for usage-based driven monetization. Usage based offers like used-car subscription and used-car leasing offers could match clients looking for flexible models with limited ability to afford bigger investments.

Invest in analytics – Even when using advanced analytics technology to assess residual value models, the COVID-19 situation has shown that quarterly or monthly assessments are not enough. Businesses must invest in real-time data-driven insights so they can understand which option – remarketing or usage-based monetization of used cars – is currently the most profitable per each vehicle. Also, clients need to be better assessed in a forward-looking manner to anticipate any potential payment default and be better prepared to mitigate it with appropriate offers such as delayed payments.

Redesign remarketing processes - Since the regional used car markets can be very heterogeneous, especially in times of crisis, the sales processes must have the appropriate market intelligence to place their leasing returns in the best possible way. In addition, they also need genuine, end-to-end digital sales processes to reduce lot time of used cars at the dealer, dependencies of classic wholesale auction platforms and allow for direct business-to-customer sales of used cars to sell the used cars directly, at the right time, in the right market and with the best possible price.

So, from a short-term perspective auto leasing companies need to adopt data-driven customer understanding and flexible pricing to find ways to defer off-lease car sales by extending leasing contracts and improve remarketing skills, especially regarding online channels and direct sales.

On the longer term, auto leasing companies need to redesign their business model and foster residual value risk resilience by adopting more flexibility regarding the asset holding period and usage-based monetization of their on-balance vehicles. This requires a broader set of options, permeability of silo-ed pools to allow for higher utilization and the analytics to define the next best usage (NBU) for each vehicle on the balance sheet.

Exhibit: Flexible Leasing Scheme

More flexible and innovative leasing contract models enable higher realization of the vehicle lifetime value

Source: Oliver Wyman