An Oliver Wyman study indicates that the market is finally ready to take off, and it provides clues as to how automakers, dealers, energy providers, and other related players should position themselves. The study – based on two focus groups of 10 people and a web survey with 1,060 respondents – was conducted in France, but its lessons apply to other major markets, too.

Many people are extremely positive about electric vehicles: 76 percent declare an interest. But they are hesitating because of a belief that the cars are not yet ready and will only achieve mass-market status in another five years. Drivers question manufacturers’ promises on range and fear restrictions on the seemingly limitless travel they have grown to expect. And they doubt governments’ commitment to measures supporting electric-vehicle adoption and the rollout of charging infrastructure, suspecting a short-term reaction to recent news about diesel engines.

However, recent progress in batteries and charging infrastructure has brought electric cars close to the performance and economy drivers now demand. The problem is that few people realize this. Most tend to underestimate the latest vehicles’ ranges and to overestimate their overall cost. In particular, the total cost of ownership is surprisingly low, as the upfront price of the battery is outweighed by cheap recharging, while maintenance costs are also relatively low. Thirty-eight percent of respondents say they did not know about these low costs and that they have changed their perceptions after being informed of them

RECHARGING A CAR BATTERY COSTS ROUGHLY €5

PERSUASION IS NEEDED

Electric cars are a consumer revolution with a difference. Some market upheavals are driven by a product with new capabilities – think of the smartphone. Others come from technologies that improve on an existing task – consider music/ video storage formats.

But battery-powered vehicles are different in that they do not do much more for their owners than traditional cars. Instead, the motivation is to reduce pollution and greenhouse gas emissions. To succeed, their performance and price must be competitive with existing options.

Currently, electric cars are more expensive: For a new, midrange traditional car costing €18,000 in France, the electric equivalent is about €32,000 – or €26,000 after government subsidies. Consumers underestimate these costs: They think an equivalent e-car costs an extra €2,800 after government subsidies are thrown in, and they do not expect the prices to align until after 2025.

However, people overestimate the cost of recharging. Typically, recharging a battery costs roughly €5. But consumers think it to be much higher, anywhere from €20 up to €50. Over the first four years, the total cost of owning and running a new, midsize electric sedan is estimated to be 3.4 percent less than that of a diesel, according to UFC-Que Choisir. While the electric model will depreciate nearly €3,000 more than the diesel car, this is more than outweighed by cheaper fuel. As the cars get older, the electric versions become even better value, because of the fall in depreciation costs and the relatively low cost of maintaining an electric vehicle.

Perceptions of the driving distance on a single charge are also incorrect: Most people guess 250 km, when it is more than 300 km for midrange vehicles. Drivers say they want a distance of 500 km per charge, even though most rarely drive that far, and fast-charging stations on motorways will be available. As a result, electric vehicles are still seen as an option for niche or specialist users. In fact, the UFC-Que Choisir study shows, greater cumulative distances are the key to getting value from an electric vehicle, so rural drivers benefit more than urban.

VIDEO

LACK OF INFORMATION

The lack of knowledge has several causes. New products typically are embraced by early adopters, who blaze the path for the rest. Currently, there are clusters of pioneers around the world: In Norway, for example, 48 percent of new cars sold in 2018 were electric. But overall, few people have any experience with electric vehicles. Just 47 percent of our respondents know someone who drives one and only a third have ridden in one.

The lack of familiarity makes people hesitant over – or even opposed to – electric vehicles. Accustomed to filling up with diesel and gasoline, drivers have trouble understanding the management of electricity as a fuel – how and where to recharge. They want their own charge point at home, but are under the impression that installing one will be complicated. Questions from our focus groups include, “Do you need a second electricity account?”, “Can I plug into a normal socket?”, “Where can I buy a charger?”, “Can the same socket be used for different cars?”, and “What if other people plug into my charger?” Dealerships are seen as the most credible source of information on batteries, while utilities are viewed as the best providers of charging services.

IDENTIFYING THE FIRST CUSTOMERS

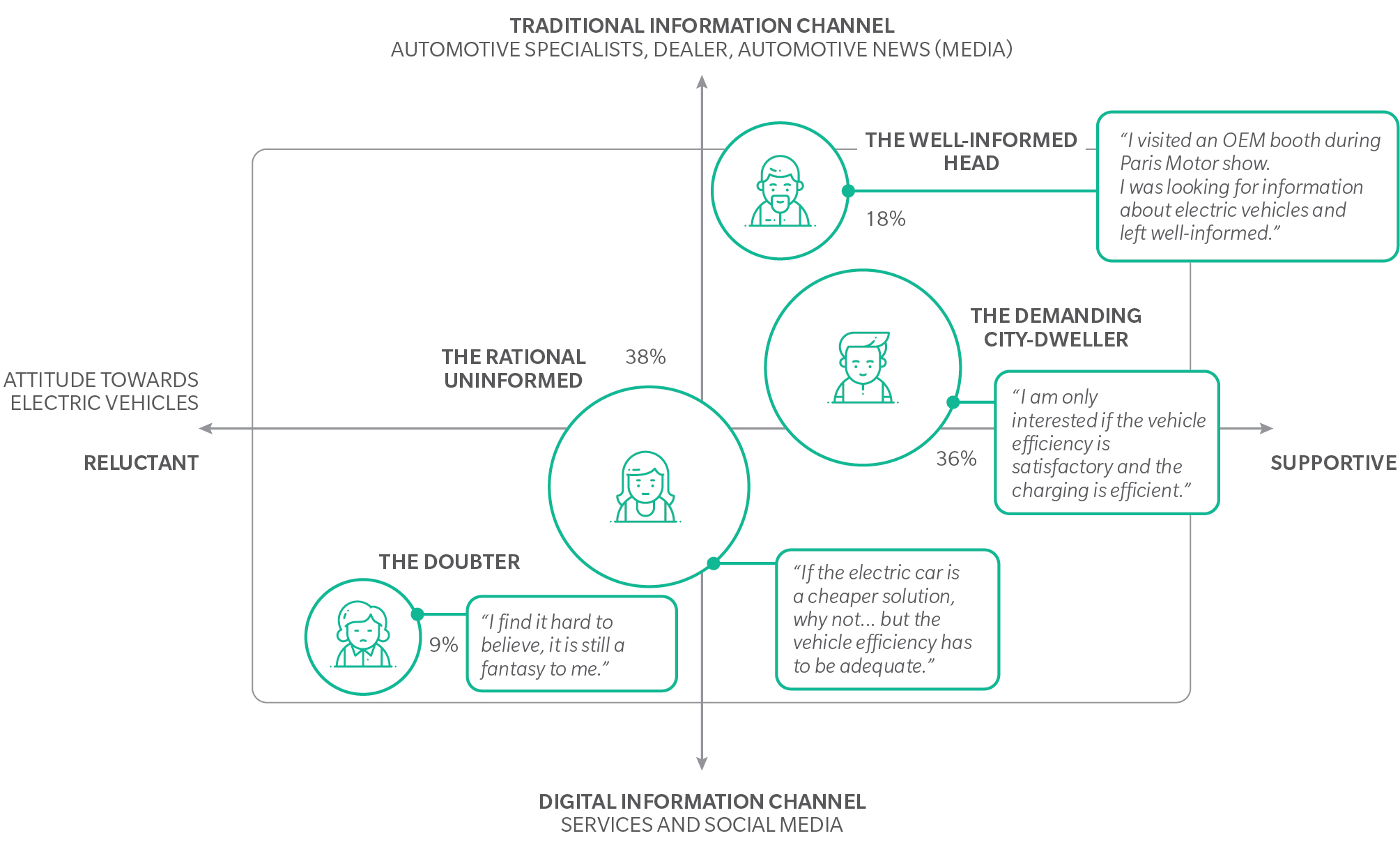

Some consumers are easier to persuade than others. Our survey identified four types of consumers: (See Exhibit1.) In one category are the “doubters” who are unreceptive to arguments about economic performance and mistrust marketing pushes and the “rational uninformed” who view cars as a means for mobility and are open to persuasion but have reservations about battery range and the total cost of ownership. The other consumer groups – the “well-informed family head” and “demanding city dwellers” – are interested in the economies of electric cars and are generally receptive but worry about range and charging infrastructure. Electric vehicle players need to move fast. Consumers trust power suppliers and established car brands for electric vehicles, especially those manufacturers making an effort to commercialize the technology. Several big automakers have recently announced they are ramping up production. Some are also experimenting with new ways of marketing for electric vehicles, including targeting groups of potential customers. They are setting up dedicated sales channels and offering use of a car as a service rather than just a one-off sale. Public policy is making a push too, as numerous cities impose low- or zero-emission zones. Electric vehicles are becoming more than just the car of tomorrow – they are quickly turning into the car of today.

EXHIBIT 1: THE RESPONSES TO THE QUESTIONNAIRE REVEALS FOUR PROFILES WITH DIFFERENT NEEDS AND EXPECTATIONS

Source: Oliver Wyman analysis