We believe e-commerce penetration of the luxury goods market is likely to increase soon and could reach 25 percent by 2025. The challenge for luxury brands is to participate in the growth of e-commerce and protect market share, while maintaining brand positioning. To succeed, luxury brands will have to deliver an outstanding customer experience, seamlessly combining traditional offline channels and e-commerce.

E-COMMERCE IN LUXURY IS FINALLY STEPPING UP

E-COMMERCE PENETRATION IN LUXURY BRANDS HAS INCREASED SLOWLY UNTIL RECENTLY

Embraced initially by early adopters and pioneer brands like Hermes, online shopping for luxury goods grew at a 16 percent annualized pace from 2005 to 2010 (Exhibit 1). But following that initial burst, growth slowed to single digits between 2011 and 2017 as consumer interest waned.

Exhibit 1: Online personal luxury goods market. Historical 2005-2017 and forecasted 2018-2025, US$ billion

.jpg)

Source: Euromonitor, Goldman Sachs Equity Search, Oliver Wyman analysis

Despite the below-average performance of the online channel for luxury goods, a deeper look reveals a nuanced picture, with different penetration rates across various product categories and regions. Accessories (bags, shoes, and eyewear) generally tend to be the most popular items purchased online, given the absence of fit concerns. But that may be changing (page 35). There is also a wide divergence of e-commerce penetration between different regions: As of 2017, China, the Americas, and Europe have penetration rates of 20 percent, 13 percent, and 8 percent, respectively.

Accessories (bags, shoes, and eyewear) are the most likely luxury goods to be purchased online, as the category enjoys freedom from fit concerns, with e-commerce capturing a 15 percent share of sales and growing at an 11 percent per year average annualized pace between 2012 and 2017. On the other hand, timepieces and jewelry have seen less success in e-commerce channels, with market penetration only reaching 5 percent, as consumers prefer to purchase these higher-priced items through other channels. Some categories previously considered unsuitable for online retail are expected to improve their penetration, as pure online players with innovative retail concepts enter the space. Beauty Pie, which sells luxury beauty products at factory prices through a subscription-based service, is one example of a new, innovative online player.

SHARE OF ONLINE RETAILING – PER CATEGORY OF PRODUCTS VALUES AS A PERCENT OF MARKET VALUE 2017 (ESTIMATED)

Source: Euromonitor, Oliver Wyman analysis Geography has played a role. Disparities in penetration rates can also be observed among different geographic regions, with China leapfrogging the US in 2012 to become the most penetrated global market for luxury retail. Based on 2017 statistics, China, the Americas, and Europe have penetration rates of 20 percent, 13 percent, and 8 percent, respectively. China was initially slow to go online, but e-commerce channels have grown rapidly since the end of 2016 after the growth in mobile phone technology helped expand internet access to more than half the population. Alibaba and Tencent-JD.com dominate China’s e-commerce marketplace, and companies like Alipay and WeChat have made mobile payments seamless for consumers. With 95 percent of purchases made through mobile phones, the e-commerce market in China has been able to engage customers through mobile platforms and lower barriers to purchasing online. With China leading the way, we anticipate other regions will catch up and drive the online luxury market growth.

FOUR DRIVERS ARE PROJECTED TO POWER THE ANTICIPATED RISE OF LUXURY E-COMMERCE

Increased penetration of internet technology and availability of e-concessions

Luxury e-commerce has been made simpler and more seamless through increased accessibility of internet technology. Growth in high-speed fixed and mobile networks, together with cybersecurity solutions, has broadened online channel use. Luxury brands can sign e-concessions agreements with online marketplaces and multibrand platforms to benefit from a department store-like online environment.

Variety and convenience

Because there are no shelf constraints online, variety and choice are practically unlimited; plus, the rise of premium delivery and fulfillment services allow for fast shipping, home delivery, and facilitated returns. Attention to packaging and delivery has vastly improved, with “white glove” services delivery and use of fine packaging adding to the appeal of luxury e-commerce.

Enhanced customer experience online

The maturing of internet technology, along with the entry of new pure players and the digital development of luxury brands, has helped revolutionize the online customer experience. The introduction of innovative solutions leveraging artificial intelligence and machine learning, such as predictive algorithms that create profiles of user preferences, enables luxury brands to establish intimacy and create an exceptional and personalized experience for the customer. Mobile apps have enriched this experience by supporting the online channel while complementing offline channels. Additionally, the rising influence of social media sites – such as Facebook, Twitter, and Instagram – is playing a critical role in the evolution of online shopping, especially among younger generations.

Consumption shifts

Internet retail has been considered an arena more suited to low- to mid-priced brands for a long time. Recent evolutions have changed this situation, and consumers are now demonstrating increased willingness to purchase luxury goods from online platforms, especially if authenticity is guaranteed. The luxury consumption shift toward digital is also a generational shift, as Millennials and Generation Z, familiar with digital platforms, will represent a larger share of the addressable luxury market, with increasing earnings over time.

The development of pure e-commerce players is boosting luxury e-retailing

The rise of online-only platforms, which account for almost 55 percent of online luxury retailing, under various business models, has driven online luxury retail (Exhibit 2). From multibrand e-retailers that buy products from brands to resell, to online marketplaces that provide online platforms to brands without holding inventory, the new e-commerce players have advanced and reshaped the online luxury market. These new players provide consumers with access to a wide selection of brands and products and allow buyers to compare different offerings on a single platform.

Consequently, brands are building partnerships with luxury e-commerce platforms to benefit from the e-commerce upside and complement in-house competencies. For example, Burberry has partnered with luxury platform Farfetch to expand Burberry’s online sales reach from 44 countries to 150, including Mexico and Brazil and countries in Southeast Asia. Farfetch offers around-the-clock delivery within two to seven days, free returns, and a pickup service. In 2017, LVMH launched 24 Sèvres, a multibrand e-commerce site. 24 Sèvres features more than 150 labels, including 20 from LVMH’s own stable, targeting 75 markets worldwide.

In Asia, brands can get access to large customer bases and adapt to new purchasing behaviors by joining a network such as Alibaba’s. Burberry and Lancôme have opened Tmall storefronts, which are part of a network of services interconnected by the Alipay integrated payment solution. In October 2018, Richemont announced a strategic partnership with Alibaba to bring the online luxury retail offering of Yoox Net-à-Porter (YNAP) to Chinese customers. Alibaba is to provide technology infrastructure, marketing, payments, and logistics to support the joint venture (JV), while YNAP is to make use of its strong relationship with leading luxury brands.

Exhibit 2: Share of online luxury retailing by types of retailers

.jpg)

Source: Oliver Wyman analysis

TO BE ON THE WINNING SIDE OF THE E-COMMERCE REVOLUTION, LUXURY BRANDS MUST TACKLE EIGHT CHALLENGES

Along with its opportunities, e-commerce poses challenges that luxury brands must address and cannot afford to overlook, both for their brand equity and market position (Exhibit 3). We have identified eight key challenges, ranging from risk mitigation tactics to strategies for tapping into e-commerce growth.

Exhibit 3: Eight challenges for luxury brands

Source: Oliver Wyman analysis

DEFEAT COUNTERFEIT AND PREVENT BAD EXPOSURE

Already subject to counterfeit items and reselling, luxury brands need to be even more vigilant to prevent criminal behavior through e-commerce channels that could contribute to the proliferation of fake products and unlawful reselling.

Online sales through third-party online platforms have been a thorn in the side of many luxury brands. Chanel recently won a multimillion-dollar trademark infringement lawsuit against more than 25 Amazon sellers peddling branded knock-off goods (such as fragrances and handbags) on the e-commerce platform.

Careful control over e-commerce channels applies not only to counterfeit detection but also more generally to any product misrepresentation likely to hurt brand equity. Luxury brands need to select the right e-commerce platforms to fit their needs and maintain close oversight of their distribution network.

In a famous case involving counterfeit goods, Coty discovered that one of its resell partners, Parfümerie Akzente, was selling its products on third-party e-commerce websites without its consent. The case was referred to the European Court of Justice who ruled in favor of Coty, finding that luxury goods companies can prohibit their authorized distributors from selling goods on third-party internet platforms, as:

“ The quality of luxury goods is not simply the result of their material characteristics, but also of the allure and prestigious image, which bestows on them an aura of luxury. That aura is an essential aspect of those goods.”

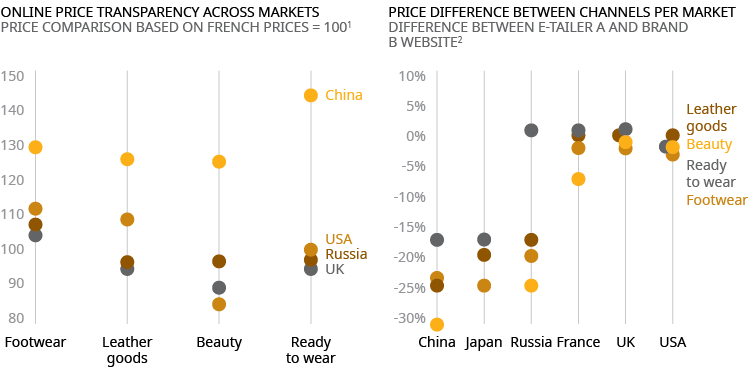

DEFEND MARKET SHARE AND AVOID CANNIBALIZATION BY SOLVING THE ONLINE LUXURY PRICING EQUATION

Although price is the primary motivating factor for buying luxury goods online, premium consumers also value fair prices, something that can be easily ascertained, given the high degree of price transparency on online platforms (Exhibit 4). Shipping costs and delays (if there are any) will likely not justify for a consumer a price discrepancy for the same product across multiple channels. Some luxury brands, such as Dior or Cartier, display different assortments to avoid easy comparison: for example, the launch of special online editions like the Panthère de Cartier watch, which has just extended its exclusive partnership distribution with Yoox Net-à-Porter Group, or products/categories available only in stores, like the Dior Ready-to- Wear offer.

Managing economics and profitability across online platforms has become a real challenge for luxury brands and is becoming more complex when coping with multiple geographies. A strong online pricing strategy is key to being successful in e-commerce.

Exhibit 4: Significant price differences between regions and channels are visible online

1) Data scrapped from Luxury Brand B country websites as of May, 18th 2018

2) Data scrapped from E-tailer A and Luxury Brand B websites as of May, 18th 2018

Source: Oliver Wyman analysis

ATTRACT NEW CUSTOMERS AND DEVELOP CROSS-SELLING

Building holistic customer intelligence to improve intimacy is a powerful way to attract new customers and develop cross-selling opportunities. For luxury brands to better know their customers and create unique customer experiences and offers, brands need to gather enough relevant consumer data across various sources and then exploit them by creating consistent links and harnessing the power of analytics (Exhibit 5). Burberry uses big data and artificial intelligence (AI) to drive sales. Using its customer 360 program, Burberry collects voluntarily shared data through loyalty and rewards programs, customer purchase history, and social media activity to offer personalized product recommendations online and in-store. Diane von Furstenberg, which adopted Qubit Aura, an AI-powered product recommender based on user behavior, attributes 11 percent of revenue being driven by personalization.

Exhibit 5: Examples of data sources and information that brands can leverage

Source: Oliver Wyman analysis

LEVERAGE SOCIAL MEDIA

Nowadays, a significant share of purchases are influenced by consumers’ digital experience, and most online customers turn to social media for help with buying decisions; the luxury goods industry is no exception to the growing influence of social media on online purchasing.

Some luxury brands are keenly aware of the power of social media and have made significant investments: Burberry, for example, dedicates at least 60 percent of its marketing budget to digital media. Luxury brands are using influencers to promote their products, with significant impact being seen in China, thanks to “key opinion leaders.” Watchmaker Jaeger-LeCoultre’s brand awareness more than doubled after its campaign featuring the internet celebrity Papi Jiang was posted on its Weibo and WeChat accounts. However, leveraging social momentum to drive social awareness and sales requires companies to target the platform that will generate the highest returns on investment in terms of engagement and broadened brand exposure, without losing sight of the other types of platforms where competitors could become predominant. And recent misadventures from Prada show that social media is a dangerous space for luxury brands.

DELIVER THE ULTIMATE EXPERIENCE

The key to delivering a great customer experience is to combine physical footprint with a well-executed online strategy to provide a premium omnichannel experience. This means mastering five must-haves that are essential to transposing the luxury brand universe onto the online world:

1. Offer user-friendly navigation.

2. Display functional product pages.

3. Ensure a flawless payment experience.

4. Personalize the experience a notch above the rest in terms of both technology and know-how – from personalized content based on client preferences and latest research/ activity or access, to premium services for high-value customers.

5. Transport and inspire consumers with editorial content and storytelling that elicits an emotional response, providing customers with the images, fashion events, and gift ideas to inspire them.

Beyond online must-haves, the luxury experience should integrate both offline and online channels in a complementary way. New technologies are contributing toward revolutionizing the “phygital” experience, and many luxury brands have begun to take advantage of them. Fred House reinforces the in-store experience through digital with its initiative L’Atelier FRED. In its Parisian flagship store, the jewelry house invites its customers to design a completely personalized version of its emblematic Force 10 bracelets among the multitude of combinations, using a case composed of a screen and a table. The “phygital” experience goes further, with a smartphone app to capture the specific color of an object or photo and to use it for the bracelet.

Dior’s virtual reality runway-show headset and Selfridge’s augmented-reality concept stores bring unique and interactive customer experience to their stores. Farfetch’s Augmented Retail program encompasses several technological changes, such as customer recognition, an RFID-enabled clothing rack, a mobile payment experience, and a data-collection platform to connect information and services. Chanel signed a strategic partnership with Farfetch (where the luxury brand has taken a minority stake) and plans to use the platform’s knowhow to work on digital innovations linked to customer services.

Running an online channel also means luxury brands must be able to offer reliable delivery services that ensure consistently high-end packaging and customer care. In June 2017, JD.com launched a new premium logistic “white gloves” service, where couriers in suits and white gloves deliver packages in electric cars as opposed to scooters. Through this new offering, JD.com aligns its service with its luxury standards to offer a consistent customer experience and compete against other well-positioned players such as Tmall.

DEFINE THE RIGHT E-COMMERCE MODEL FOR YOUR LUXURY BRAND

The online luxury goods market is finally taking off, with competition accelerating and complexity intensifying. Luxury brands need to define a clear digital strategy and make the right decisions to benefit from growth opportunities and to protect their market share and brand equity. Beyond simply taking the online ecosystem and environment int consideration, digital strategy involves the much broader and greater “phygital” consumer experience: the immersive and visionary experience that the luxury brand is best capable of providing. Brands will have to skillfully reconcile offline and online channels to revolutionize not just e-commerce but the physical store experience as well, which will remain the main ambassador for luxury brands.

Most luxury brands have started to explore e-commerce and are testing different approaches, trying to find the right model. To determine the right e-commerce model, luxury brands need to start with three sets of questions:

1. Definition of market needs

- What are your local customers’ motivations to buy online?

- What is the current online market offer per geography? What is the competitive landscape?

- In each market, what are your customers’ preferences in terms of choice and services?

2. Definition of platform(s)

- Is your brand awareness strong enough to generate traffic through your own e-commerce site?

- What degree of control do you wish to maintain of your brand expression?

- What go-to-market paths should you combine?

- What partners do you believe can provide the right trade conditions?

3. Definition of operations

- Do you have the relevant scale to manage operations internally?

- What core activities should be kept in-house to ensure quality?

- Is there any advantage in leveraging e-commerce players’ scale and expertise?