China Spotlight

FIGHTING BACK WITH ARTIFICIAL INTELLIGENCE

The visible difference between online and traditional retail is the presence or lack of a physical store. The more-significant divide could be online retailers’ massive accumulation and use of data.

When someone buys a T-shirt in a physical store, the retailer simply records the item, its price, the date and time of the purchase, and how the customer paid. When someone buys the same T-shirt online, the retailer will know all of the above and… the purchaser’s name, email, billing address, even the neighborhood where he or she lives. The online retailer will also know and record the purchaser’s size, product preferences, and items rejected during the search that led to a final choice. In addition, the retailer may also learn what other products are commonly bought at the same time, and may even get the buyer’s social media profile, if this was used to link to the shopping site. If the item was a present, it may also have been possible to gather many of the same details about the recipient.

As retail moves into the artificial intelligence (AI) era, online retailers have a significant head start. Their current processes have allowed them to gather data by default, amassing data gold mines from each component of the online ecosystem. Understanding the value of this information, they have for years been using analytics to optimize processes in all aspects of retail: demand generation, the purchasing decision, payment, and fulfillment. AI in the future will take the use of analytics beyond mere task automation and into realms of decision-making and problem-solving – at first by providing support, and later evolving the ability to perform these tasks automatically. Such capabilities could accelerate further the online erosion of physical retail – a potentially existential threat. Without concerted action by traditional bricks-and-mortar players, the already significant online retail digital advantage will only widen, increasing the pain that high-street retailers have suffered in recent years.

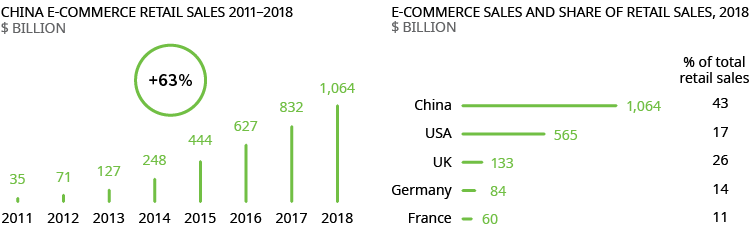

Exhibit 1: China e-commerce growth

Source: Euromonitor

For a glimpse of the possible consequences, look at China, which has shot to the global forefront of online retail, with e-commerce accounting for over 40 percent of retail sales in 2018 (Exhibit 1). While the equivalent figure for the United Kingdom was 26 percent, online sales were far less significant in other major markets: 17 percent in the United States, 14 percent in Germany, and 11 percent in France.

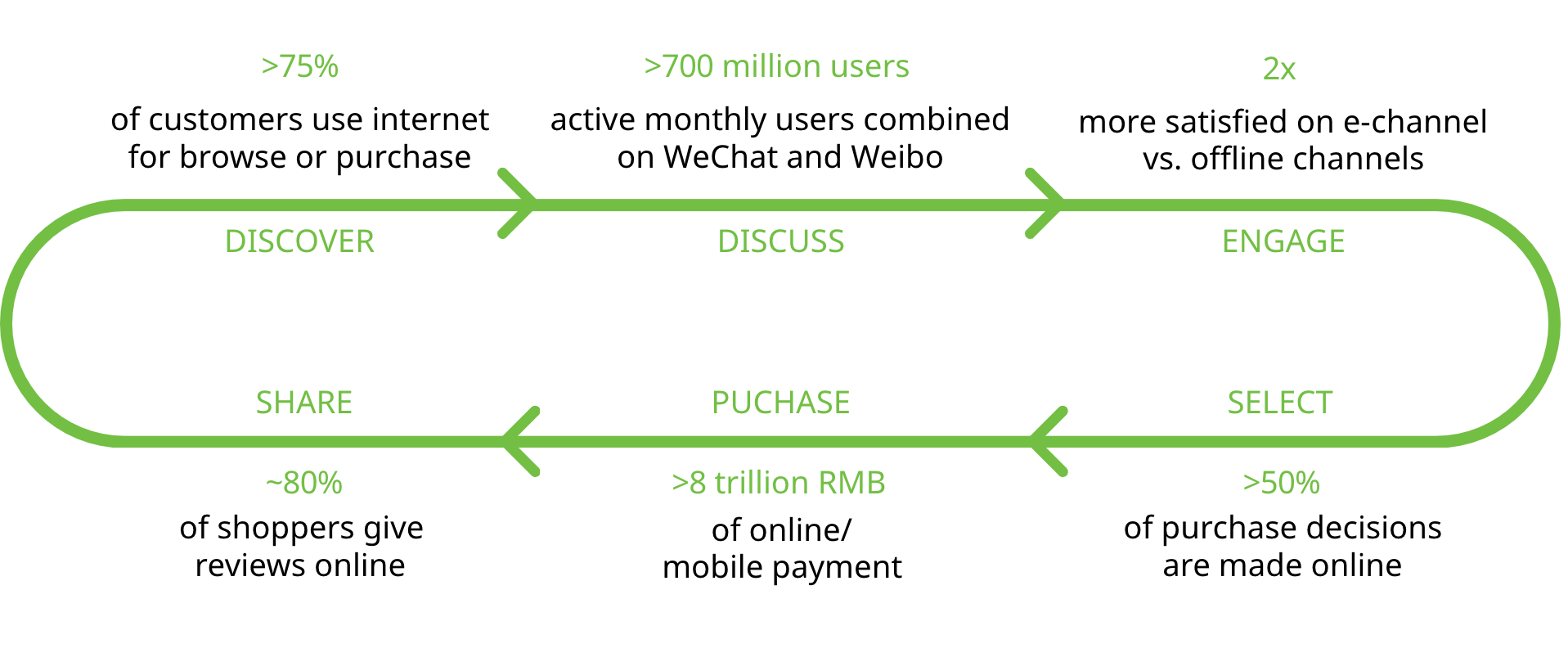

Linked to this rapid online-driven digitization is the rapid emergence of digital-native retail giants such as Alibaba and JD.com. They have been buying – as well as developing themselves – units to cover every link in the chains of retail activity, including digital payment apps, delivery companies, and social media units to generate demand (Exhibit 2). Most that is most concerning for traditional retailers, the online empires are buying up chains of brick-and-mortar stores, complementing the digital efficiency of their online businesses with physical-store characteristics: Customers can seek advice from store assistants and see products before buying them. As a result, there is a growing sense of urgency among Chinese retail companies about digitization and AI. In a recent survey there, more than three out of four executives said the industry would see “real disruption” from AI in the next five years.

But there is still hope. Our recent experience indicates that physical retail, by aggressively embarking upon ambitious AI programs, can not only meet this threat but also change the game in terms of economics. By doing so, we have seen some physical retailers improve margins by up to 10 percentage points. In operations, the gains come from smarter in-store processes, back-office automation, and better supply chain management. Commercial decisions have been improved through superior management of categories, suppliers, prices, and promotions. If only some of these improvements are made, financial improvement can still be dramatic, especially when seen against a starting point of traditionally razor-thin average net profit margins.

Exhibit 2: Typical online journey of a Chinese consumer

Source: Oliver Wyman analysis

WHAT CAN AI DO FOR RETAILERS?

In the past, AI was often considered a tool that only technology companies were capable of exploiting. In China, retailers wanting to use AI usually aligned themselves to one of the two retail empires. Now, any company willing to invest may access the benefits of AI, giving them the potential to boost margins significantly.

The most basic AI algorithms can perform repetitive tasks that previously needed human intervention. These include the ability to scan a paper invoice to extract numbers and the items they refer to, and voice assistants’ recognition of commands in human voices to perform basic tasks.

A smarter level of AI uses a combination of data and logical reasoning to make informed decisions. AI needs data – unlike a human, who can make decisions based on experience. But, given data, an AI-equipped computer can go far beyond what humans are capable of: It can process greater quantities of data of a larger number of different types and do this much faster. The more data an AI system has, the more remarkable are the tasks it can perform, which is why online retailers are now ahead in their application of AI. But traditional retailers can also mine data assets related to shopping habits, such as those they have gathered from loyalty programs.

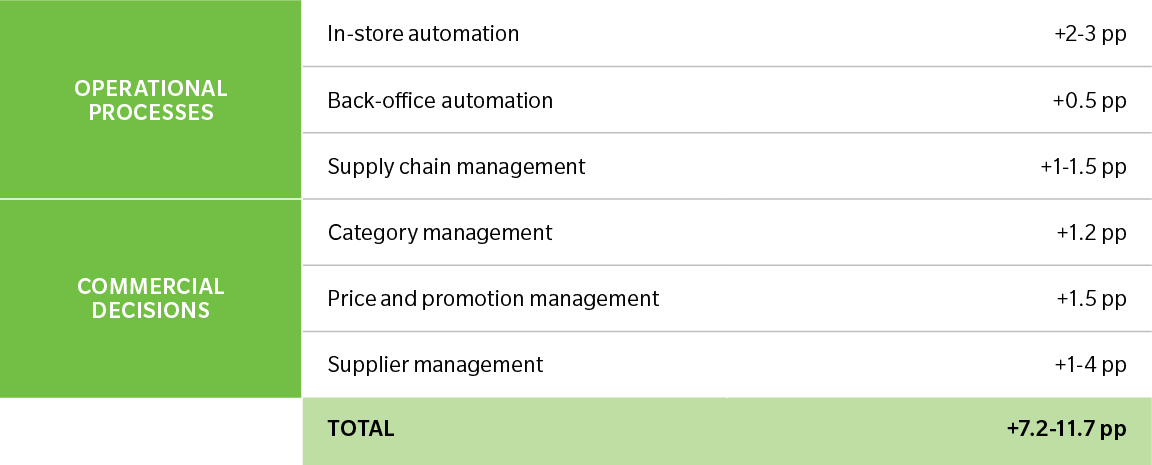

Far from being in the realm of science fiction, AI is happening now. We think AI can help retailers both to increase their sales and reduce their costs, boosting margins in operations by up to 4 percentage points, and on the commercial side by up to 6 percentage points (Exhibit 3). However, these figures represent just the basic potential for improvements that are achievable over the coming five years or so. Longer-term possibilities include the creation of personalized experiences for customers, forecasting potential sales of a new product, and robotics to automate physical tasks.

Exhibit 3: Summary of potential margin uplift from AI

Source: Oliver Wyman analysis

OPERATIONAL PROCESSES

AI can replace or support workers in repetitive, low-value tasks such as shelf replenishing, freeing up staff to provide top-quality service: They can operate delicatessens, offer tastings, and answer customer questions, giving the store a human touch that will encourage people to return.

IN-STORE AUTOMATION

Frontline staff in retail stores are preoccupied with four mundane tasks: replenishment, check-out, repackaging, and store maintenance. AI tools can help at least with the first two of these. Automatic checkout goes beyond the self-checkout systems common in supermarkets, as it recognizes items placed in a basket without the customer or a staff member having to do anything. The simplest systems register when a customer removes items from shelves and then deducts the total from a digital payments system. Some retailers are now rolling out systems based on radio-frequency identification (RFID), which uses electromagnetic fields to automatically identify and track tags attached to objects. More advanced systems register purchases using cameras combined with image-recognition software. The first stage of shelf replenishment is to predict demand. AI tools can run calculations on factors such as weather changes and thus forecast changes in demand and inventory requirements for clothes and beverages in real time. Trends in clothes and makeup products – and the combinations they are bought in – can be anticipated by examining popular Instagram accounts. Predictions will improve over time, as the system learns from its previous attempts at prediction.

The next stage, stacking shelves, can be time-consuming if a staff member must rummage through boxes looking for the right items and figuring out where they fit on a shelf. But AI can instruct a warehouse exactly where to stack boxes in a truck so that they are automatically unloaded in the right order. Human shelf stackers then don’t have to search or think so much. Depending on the retailer, in-store automation could contribute between 2 and 3 percentage points to the company’s margin by making possible a smaller, tech-enabled frontline workforce.

BACK-OFFICE AUTOMATION

A number of back-office tasks can be automated using AI-based tools. Invoices can be read by machines and then paid without the need for human action, even when they are on paper and do not conform to any particular format. Early mistakes can be part of a learning process, as the system constantly improves itself. Business performance can then be calculated and updated in real time, rather than just at the end of set periods.

This advanced level of automation will drive a reduction in the headcount of entry-level accountants and other back-office staff, and also enable senior management to react faster to changing business conditions. As back offices at headquarters typically account for around 1 percent of a retailer’s costs, there is a high chance that AI can raise the company’s margin by 0.5 percentage points.

SUPPLY CHAIN MANAGEMENT

Many players have already digitized their largest distribution centers, so the flow of stock from factory to distribution center to retailer is automated: Orders are placed automatically, and robots move pallets around warehouses. Other retailers have outsourced many of their distribution operations to specialists.

AI can further reduce supply chain costs. In the past, humans made decisions over the best way to transport goods, namely whether to do a single large shipment in a large truck or make several smaller deliveries, and whether to make direct deliveries to stores or go via a large, regional distribution center. Now, digital analytics can figure out the cheapest, quickest routes and take into account a wider range of factors than a person can. While supply chain costs are generally equivalent to just 2 to 3 percent of sales, AI in this area could potentially boost a retailer’s margin by around 1.0 to 1.5 percentage points.

COMMERCIAL DECISIONS

AI can churn through data in a fraction of the time of a human being and far more accurately. Head-office staff can then devote their time to decisions that only humans can make – those involving intuition and emotion, such as aspects of stores’ location, design and presentation.

CATEGORY MANAGEMENT

Decisions on the products to offer within a category have been mostly guided by the gross revenues and margins they generate. AI can help make smarter decisions by analyzing past transactions to see the propensity of customers to switch between products in the same category. If a product can easily be substituted for a lower-cost equivalent, then the retailer can make the switch and earn a better margin. For example, boxes of tissues come in multiple brands that offer relatively small differences in quality. By analyzing purchase data from a sample of customers in this category, retailers may be able to identify brands with lower brand loyalty and replace them with a private-label version to earn a better margin. In our past projects, the newest, state-of-the-art algorithms to make better product choices yielded increases of up to 6 percent in like-for-like sales, boosting the company’s overall margin by 1.2 percentage points.

PRICE AND PROMOTION MANAGEMENT

Most retailers still design their promotions around intuition and negotiation with the product makers. However, promotions have complex effects. A special discount on Brand A shampoo will likely boost a retailer’s sales of both that shampoo and other related Brand-A products – now and in the future. But the promotion will come at a cost and might also hurt the retailer’s sales of Brand-B products. AI can help reveal the true impact of promotions. Doing so starts with measuring the impact of a promotion against a more accurate baseline that incorporates seasonality. In some cases, retailers will identify promotions with a negative overall impact – that is, when the promotion does not lead to other sales that compensate for the costs. Our past projects indicate that a sophisticated promotion algorithm can increase the company’s margin by 1.5 percentage points over the course of one or two years.

SUPPLIER MANAGEMENT

Contracts with suppliers, containing buying terms and conditions, are usually based on factors such as products’ historic margin performances. AI can sift through data on different variables to provide evidence of what drives this performance, as well as the commercial importance of the supplier to the retailer and vice versa. It can thus help retailers to manage suppliers systematically and suggest the best negotiation tactics. There are significant variations in the effectiveness with which different retailers manage their suppliers. We think applying AI in this area could increase a retailer’s margin by 2 to 4 percentage points.

HOW TO GET STARTED WITH AI

Nearly half the executives responding to our Chinese survey said they are willing to invest up to 5 percent of sales in AI1. However, there’s a common belief that introducing AI capabilities to a business is complicated. Technical challenges include obtaining data of sufficient quality, writing the code, and generating actionable output. The simplest way to start is to ask the right questions, work with an experienced partner to develop the right technical tools, and be aware of challenges involved in training and hiring a workforce to work with AI. We suggest a three-step process (Exhibit 4 See PDF).

STEP 1: SET AN OBJECTIVE FOR TRANSFORMATION

Retailers have limited resources, so they must pick the areas in which to deploy AI. The most important factor is the organization’s “crown jewels” – that is, the special capabilities that give it a competitive advantage and that it would not want to outsource to a third party. These distinguishing capabilities should already be clear from a retailer’s overall corporate strategy and the dynamics of the markets it operates in. They are candidates for investment in AI, so that the organization can double down on its core expertise and set business objectives for the results.

The critical questions are:

- What are the crown jewels that need to be protected and developed?

- What kind of impact could AI have on them?

- What are the business objectives for AI?

STEP 2: DECIDE A STRATEGY

The business objectives decided in Step 1 should be the basis for a strategy to use data and AI.

The critical questions are:

- What is the right AI strategy for the organization?

- What is the right corresponding data strategy?

- Should the organization build or buy its AI capabilities?

We believe there are four sets of capabilities that retailers should consider for their AI strategy, as well as the six, more-specific, solutions suggested previously in this report:

Commercial effectiveness: Excellence in a retailer’s core trading functions, such as its product range and management of suppliers, prices, and promotions.

Operational efficiency: Superior management of supply chains – that is, logistics planning, warehousing, and transportation – and labor resources.

Product development: Accurate targeting of consumer demands.

Experience innovation: Knowing customers well enough to deliver a personalized experience throughout their shopping journey.

For a premium retailer of fresh products, the key might be to select the best natural products and make sure they get to shoppers in the best possible state. A value retailer might optimize pricing and promotions to enhance its competitive advantage. Both will need to understand marketing analytics and stock the right products for their respective sets of customers.

STEP 3: DESIGN A TARGET OPERATING MODEL

In an AI-enabled organization, the “machine” takes over some tasks from the workforce, and it is common to fear that humans will simply be replaced by AI. However, we firmly believe that machines will never completely replace existing occupations and job categories. Instead, there are more likely to be task substitutions, as workers are freed up from old tasks to focus on new ones. In the United States, one new high-tech position should create 4.9 supporting positions, according to a World Economic Forum (WEF) study. Globally, AI will result in a net gain of 58 million jobs between 2018 and 2022, the WEF estimated.

What will change are the skill sets required by humans who work alongside AI processes. When retailers consider their target operating model, they should be concerned less with how many of their workforce they will need to let go, and more with the changes in the work they need their staff to do.