While the fundamental role of a Central Counterparty Clearing House (CCP) as a neutral and independent risk manager has not changed, the benefits associated with counterparty risk management and transparency have become core to financial market stability and operations. Post-crisis regulations have recognised and sought to build on the stabilising role that CCPs played during the Crisis and the systemic benefits that they have long provided.

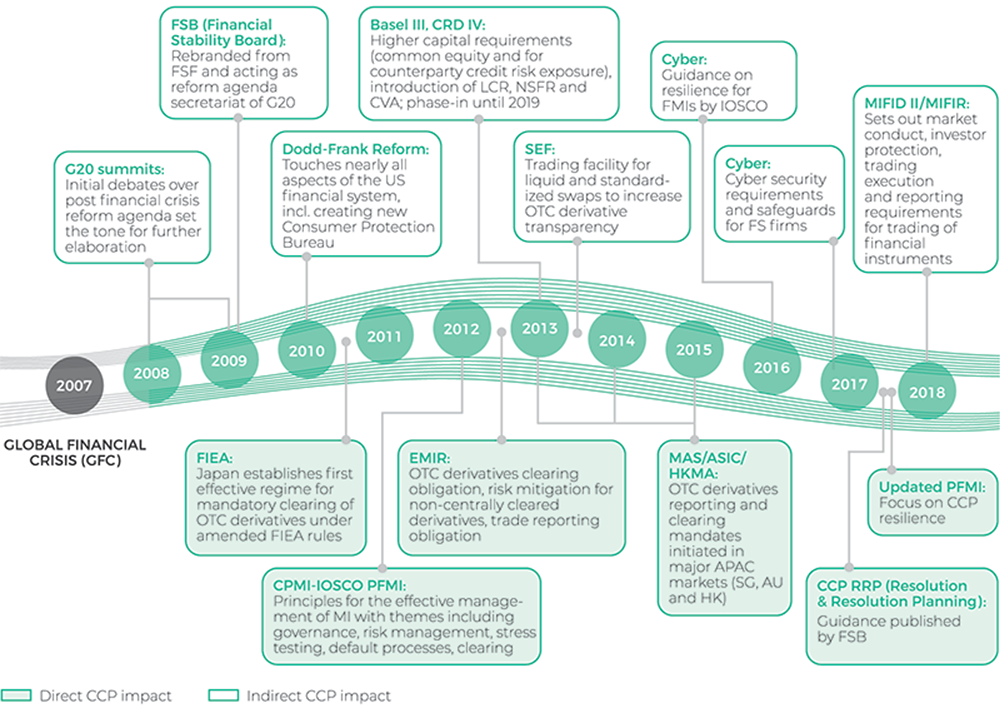

Commitments to increase transparency and promote stability of financial markets, made and reiterated at 2009 and 2011 G20 summits, were carried forward by International standard setting bodies (FSB, IOSCO, CPMI and BCBS), and subsequently implemented by regional and national regulators. This was done with the introduction of a series of policies, regulations, standards, and frameworks aimed at promoting the use of central clearing and enhancing the resilience of CCPs.

Overview Of Some Of The Post-Crisis Regulatory Reforms Impacting CCPs And Their Stakeholders

There is consensus that strong progress has been made in meeting G20 objectives, with a significant shift to central clearing of OTC derivatives and ongoing investment by CCPs in their risk management and core processes while bolstering financial resources. But there is still work to be done for supervisors, CCPs and clearing members alike, to maintain a robust financial markets ecosystem that delivers on its core ambitions.

Recommendations For Supervisors

For supervisors this means finalising the central clearing agenda and fully implementing the clearing obligations, addressing the range of factors that may impede the use of clearing services.

These include minimising cost barriers to clearing, e.g. those that result from the interplay of CCP and banking regulations, such as the approach to the leverage ratio. Supervisors also need to focus on ensuring implementation of agreed principles and avoiding unnecessary market fragmentation.

Recommendations For Central Counterparty Clearing House’s

For CCPs, the focus remains on core risk management capabilities (credit, liquidity, operational risks and default management), and exploring ways in which to further enhance the accessibility of clearing.

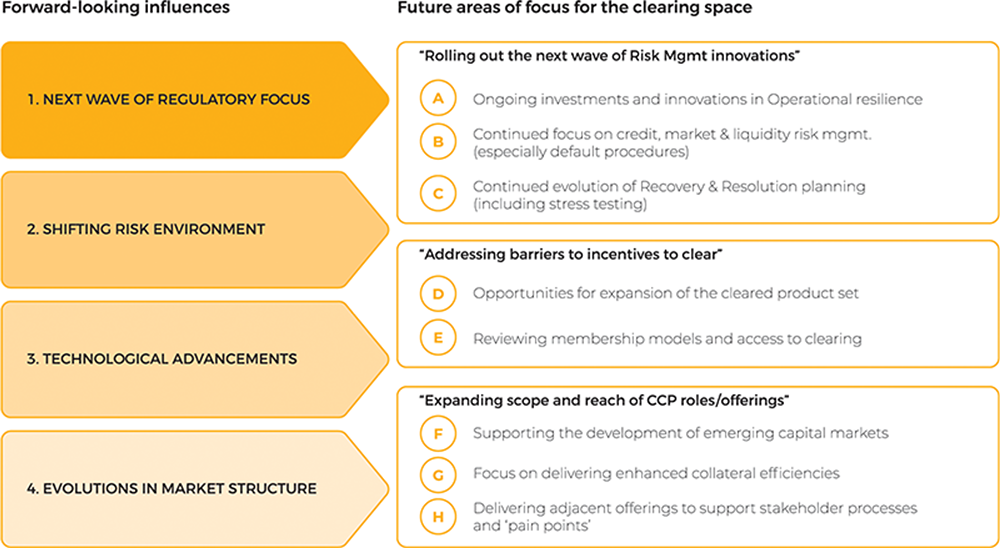

This activity will occur against a backdrop of an evolving market structure influenced by a range of dynamic regulatory, technological, and systemic developments.

Solving identified challenges and delivering on opportunities will require engagement across a broad set of stakeholders and supervisors. The specific future focus areas for CCPs will vary depending on their levels of risk maturity, the products they clear, and the regulatory framework within which they operate (amongst other factors).

As the regulatory focus gradually shifts from implementation of post-crisis regulation towards enabling growth and market development, it will be critical to avoid negative impacts on the finely calibrated incentive structures in place across the central clearing ecosystem; it should be assessed whether, on balance, the regulatory objectives are appropriately met and properly implemented.

Summary Of Future Areas Of Focus For The Stakeholders In The Clearing Ecosystem

This report suggests an ideal outcome is one that:

- Promotes financial stability and integrity and ensures that the lessons from the crisis have been learnt and understood.

- Recognises that sustainable economic growth relies on financial stability.

- Ensures CCPs’ central role as neutral and independent risk managers via a faithful and full implementation of the G20 central clearing agenda.

- Safeguards the CCP incentive structures on the basis of risk management standards.

- Results in cross-jurisdictional and regulatory dialogue and coordination mechanisms to tackle “ecosystem level” challenges and implementation of agreed standards.

- Supports continued collaboration between CCPs and their members / end-clients to deliver innovations and solve ad-hoc and structural challenges.

- Produces enhanced understanding of the interconnectedness of the clearing system and associated implications (incl. risk assessments, R&RP).

More information

For more information about the future of clearing, download the full version of the report.