Large, long-established firms find it hard to change. That’s okay in a stable business environment when you’ve got time on your side, but when things start to change quickly in the external market, it puts your organization at risk. Hence, the current fixation with “agility.”

Chief risk officers of leading European banks and insurers worry their organizations aren't able to adapt quickly

Rapid advances in digital technology, changing customer behavior, competitive forces, and new regulations threaten today’s established business models and require companies to change at speed. Large-scale businesses need to find a way to change their processes, organizations, and people at pace on an ongoing basis. Nowhere is this need more pressing than in the financial-services industry, which must contend not only with the “digital revolution,” but also with an unending stream of innovation and new regulations. Financial-services firms are responding as one might expect: Many have started ambitious programs to become more agile. One critical area, however, remains a notable exception: the risk functions of banks and insurers. Most have changed over the past 10 years, driven primarily by regulatory demands. But a rise in regulation-based rules and controls has inadvertently reduced the agility of organizations. In some, the risk function has even become a “choke point” to agility.

For decades, the risk profile of a financial‑services firm was relatively predictable. An economic downturn might push credit defaults to unusually high levels. Market prices might move against an insurer’s investment position. A rogue trader might defraud a bank of hundreds of millions of dollars. These are the kinds of risks that risk functions have been working on, guided in part by regulation and in part by experience. In banks, for example, if you wanted to get ahead in risk you worked in the credit division because that was the main risk the organization faced. It was just the way it was.

RETHINKING WHAT IT MEANS TO BE "AGILE" AT FINANCIAL FIRMS

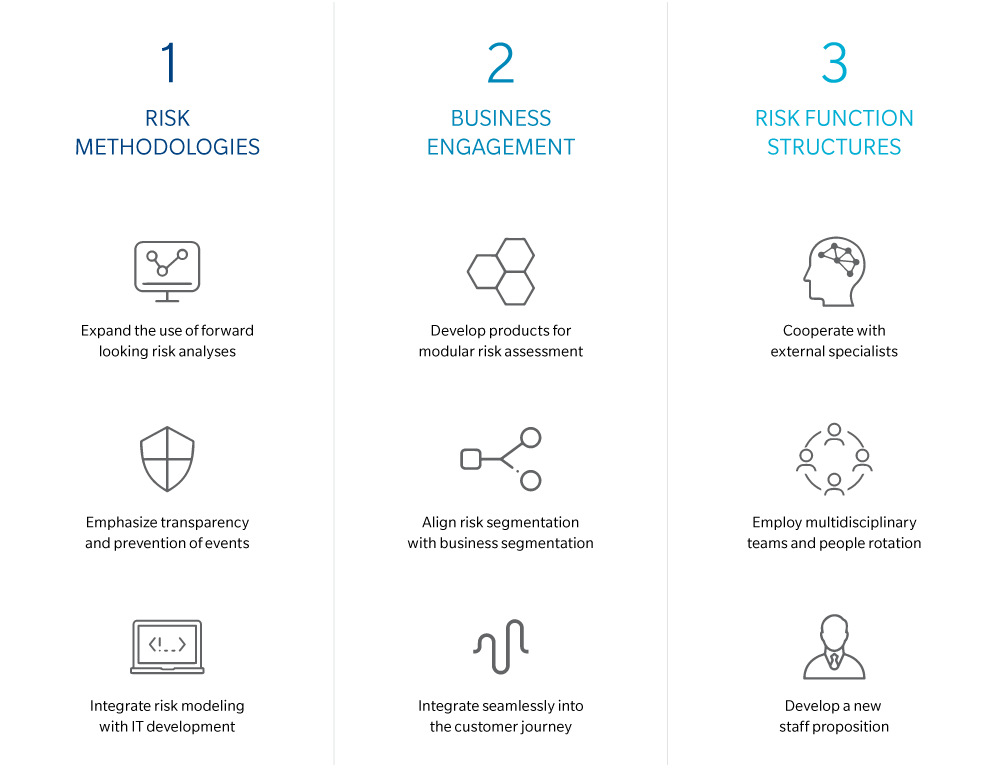

Risk functions need to shift their operating models across three fronts to increase flexibility

Source: Oliver Wyman analysis

Risk Functions At Banks And Insurers Must Become More Agile

Partner David Gillespie on how agility must be part of the risk manager's agenda.

About authors

David Gillespie and Sean McGuire are London-based partners and Martin Lehmann is a Frankfurt‑based principal in Oliver Wyman’s Financial Services practice.