As is the case in other parts of financial services, regulation has placed added financial burdens on banks, increasing their financial resource requirements and operating costs and threatening the economics of corporate banking. At the same time, digital competitors from the FinTech space and multi-dealer trading platforms are snapping at banks’ heels and looking for opportunities to unbundle the traditional value chain in which banks closely linked themselves with clients and investors.

Much has been written about this dual challenge of regulation and FinTech creating a doomsday scenario for corporate banks. This needn’t be the case. While there are clear threats visible across the value chain, by their nature, positioning and heritage, corporate banks holding the keys to remain the prime provider of core corporate banking services to the real economy. However, there is no reason for complacency. To remain relevant, corporate banks need to deliver excellence across the value chain – in the near term to preserve returns, while in the medium-term to protect their incumbent position from new types of competitors.

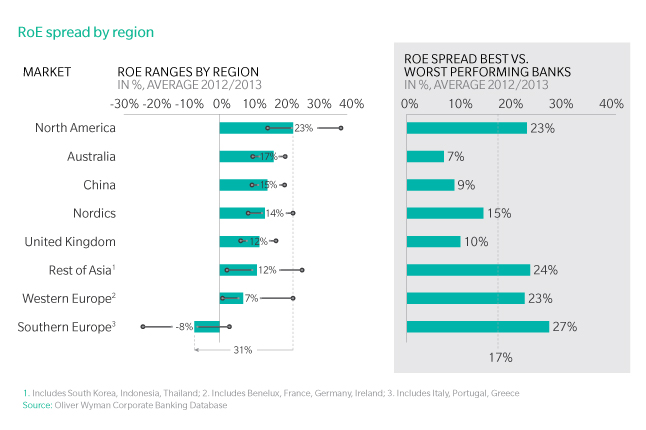

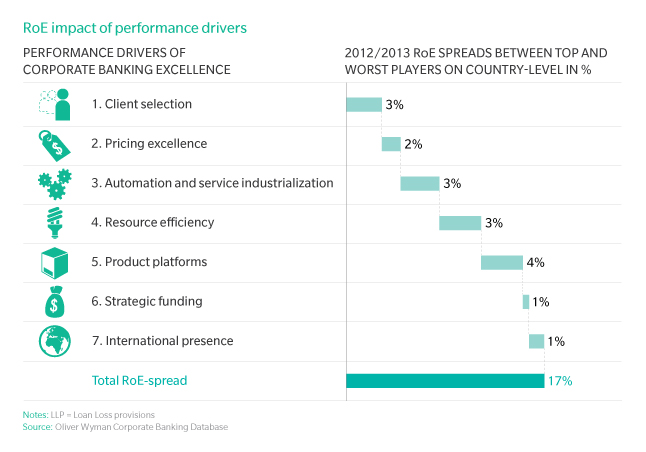

On average the sector currently returns 13% pre-tax RoE, with about 40% of banks returning 15% or above and the rest below, with low loan loss provisions in many parts of the world a major driver. This compares favorably with other segments of banking, particularly post-crisis investment banking and capital markets, but the differences in performance are wide. And while the achievable performance is strongly impacted by a bank’s home market, achieving excellence is a significant driver of returns. We see that the “spread to excellence” is worth 17 RoE-points. This can more than equalize any “location disadvantage”.

This report documents best practices across seven drivers of excellence which leading banks around the globe are implementing, and comments on the associated management challenges.

Corporate Banking Performance

Corporate Banking performance is spread widely across and within markets. To explain the difference between best and worst performing banks in one market, we have quantified the RoE impact of seven drivers of excellence:

Becoming excellent is as transformative as adopting a healthier lifestyle in that you need determination, perseverance and discipline.Thomas Schnarr, Partner