Location, Location, Location

Foreign automakers typically establish regional R&D centers in North America as part of their global distribution strategy, for the purpose of closer-to-market development and testing. Oliver Wyman’s analysis found that it’s typical for each automaker to have four to seven R&D sub-centers in the US, with some coverage of Latin America and Canada. The largest hubs and often regional R&D headquarters tend to be in the Midwest (Michigan and Ohio); these can account for two-thirds or more of the typical organization’s workforce. Prime locations for other functions include the Silicon Valley/Bay Area of California for advanced research; Los Angeles for planning, sales, and design; and places with wide seasonal climate variations, such as Arizona and Colorado, for the purposes of testing.

This type of distribution corresponds both to the need to locate near certain components of the value chain as well as where talent can best be found. Interestingly, in the North American sphere, there has not yet been a move to establish larger engineering centers in lower-cost Mexico. This runs counter to historic European trends, such as the setting up of R&D units in the Czech Republic. The reasons likely include perceived educational differences and the current buildup of advanced research activities in Northern California (e.g., electric vehicles and software). This may be short sighted – and may originate from the typical functional silos within automakers and the often related misalignment of global growth plans by function.

Organizational Setups

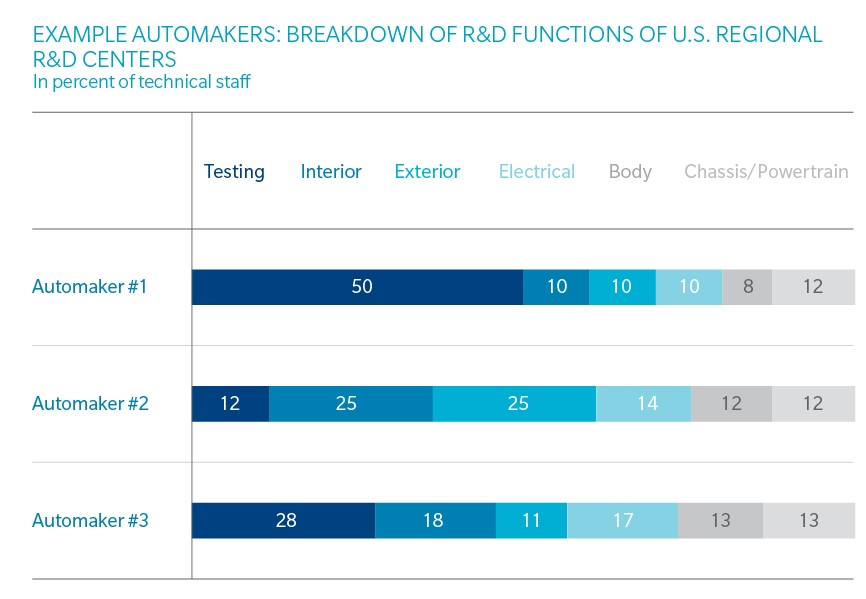

From an organizational perspective, North American R&D units comprise mainly technical staff (85 to 90 percent) – engineers, technicians, and technically skilled labor. Functional variations tend to be small. In general, chief engineers/project leaders manage the development of specific (regional) vehicle models and report to a vice president, who then reports to the head of the regional R&D organization. Some organizations, however, are starting to move to a system-based setup. In these cases, one team is responsible for all development phases (such as design, testing, and quality control) for one subsystem (such as interiors) across all vehicle models. While this addresses the increasing number of platform architectures and advanced engineering requirements, it can be challenging, as making it work requires a higher level of global coordination across functions.

It’s a positive sign that most of the regional R&D centers are structurally “flat,” with relatively few management-level staff, suggesting a wide span of control (five to six direct reports) and a clear division of roles. This set-up can generate inefficiencies, however, requiring additional technical administrative staff to act as liaisons between technical staff located in different North American sub-units and overseas facilities. How these liaisons are managed, e.g., number and activities, defines the difference between an effective and a bloated, ineffective regional R&D organization.

All of the analyzed automakers utilize local personnel both in management and staff positions, along with expatriates (expats) from the home country in key positions. Expats may hold management or technical roles or act as advisors to local senior management; they are less likely to be middle managers. The longer an R&D organization has been around – and thus has had time to show its value, engineering quality, and reliability – the more likely the company is to move away from expats and allocate more responsibility and authority to local employees.

Regional R&D Leadership

The R&D organizations Oliver Wyman looked at feature a variety of leadership styles – from US-based with some input from overseas headquarters, to a much more direct-to-headquarters reporting style. R&D senior leadership typically consists of expats with long tenure who have been groomed internally. This assures organizational, process, and political tie-ins with the automaker’s global R&D organization.

All of the firms analyzed recognize the importance and the challenges of leading a large regional R&D organization and so have put in place R&D heads with at least 10 to 15 years of varied experience, typically as chief engineers with budgeting, project/program management, human resources, and decision-making exposure. These executives also usually have spent three to five years in a senior leadership position at global headquarters and have had other international assignments early in their careers. This emphasis on putting the right person in the job heads off issues seen at some other automakers, where R&D leadership is based on generic rotational schedules. In those cases, the respective regional R&D organizations then tend to mature at a slower pace and take longer to maximize their potential.

Product Development Process

The analyzed R&D organizations handle development for their assigned vehicles in two major ways: Either a regional R&D center has full development responsibility, or responsibility remains overseas at the global R&D headquarters. Another key difference involves the influence and skill set of the local product planning group, especially whether it can conduct extensive cost analysis and develop full engineering specifications prior to a program’s approval.

In cases where program ownership remains overseas, those automakers also typically handle final vehicle program approval directly at the CEO or executive committee level. Where there is more local autonomy, program approval processes are handled through the executive level of the US-based organization. While it can be reasonable to tie the approval process to level of autonomy, a better rationale might be to base program ownership on regional needs/customer demands, taking into account the maturity and performance record of the R&D center. Per research, no automaker performs regular comprehensive comparative maturity assessments of its regional R&D centers to strategically develop the global R&D network. Oliver Wyman believes this is a shortfall and minimizes or delays the building out of a true global R&D network and access to a global talent pool.

Going The Distance

While similar in their realization and generally well led, foreign-owned regional R&D centers in North America have the potential to enhance their standing and development responsibilities. Moving to more of a structural focus on sub-systems (rather than vehicle models) pays tribute to overall product development trends. But these organizations might flourish even more if given increased autonomy in line with their capabilities and potential to drive demand specific to the North American market. Of course, this will require regular comprehensive comparative maturity assessments of all regional R&D centers by the automaker to understand the baseline and determine any development actions that need to be taken. In addition, to fully tap into local skill sets and talent pools, regional R&D centers should be given the mission to interact with local academic institutions – as this is one area where all regional R&D centers in North America of foreign automakers appear to fall short.