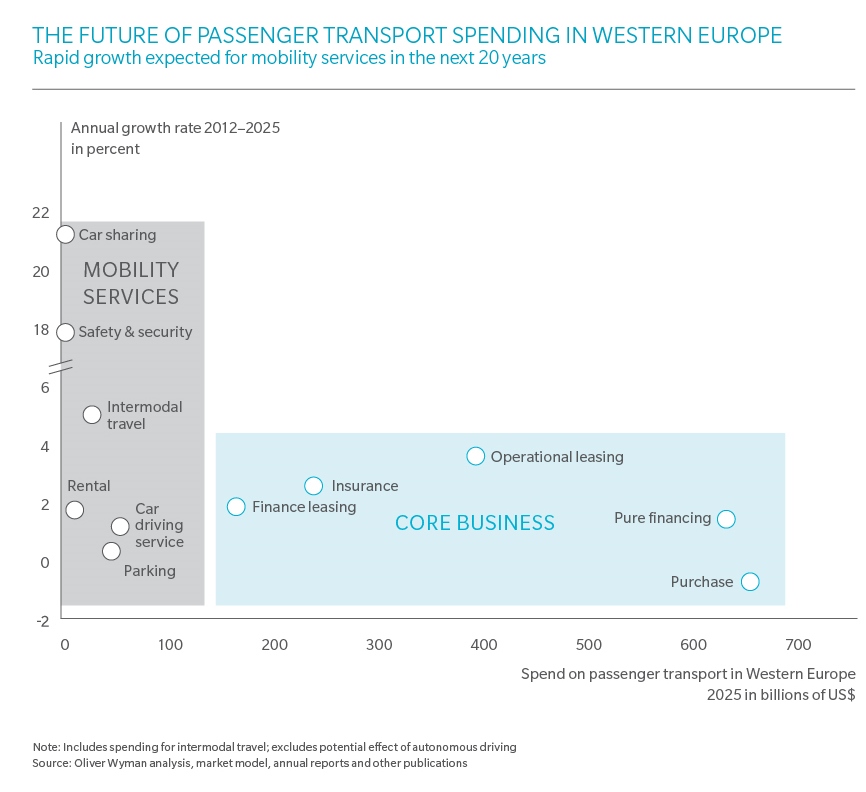

Over the past decade, many car manufacturers have significantly extended their mobility offers as well as their marketing efforts to promote these programs. This move has been in response to a big shift in customer preference from owning to using. Demand for mobility and transport services is expected to grow more than six percent a year in the passenger car and freight markets between now and 2025. Mobility offers range from dealer rentals for workshop replacement vehicles to free-floating car-sharing models and long-term commercial rentals. Most mobility businesses in operation today started out as stand-alone units with substantial entrepreneurial freedom, with their market offering, operations, and management kept separate from the automaker’s core business. While initially this distance was vital to enable these units to catch up and compete against non-captive competitors and win new customers, these businesses now generally have matured to the point where they need to become more closely aligned with car manufacturers’ core businesses.

Market Offer Integration

Integrating the mobility arm within the automaker’s core business can be tricky. Students who have registered for services at a car-sharing site are seldom pleased to receive offers to test drive a midsize sedan from the mobility unit’s parent company. They often have no idea the businesses are linked. It’s just as risky to the company’s profits and brand image to have the mobility unit target mature traditional car buyers with, for example, long-term rental offers.

That being said, there are a number of options that can be complementary. A customer who owns a car might also require temporary use of another vehicle; for example, when he is traveling, when she has to make an unplanned trip and doesn’t have easy access to her main vehicle, or when the customer wants an alternative to public transportation. Combined offers also can be highly suitable for people who own vehicles that they use infrequently, such as a sports car. On the other hand, mobility vouchers for a convertible might be appreciated by someone who typically drives the family minivan.

Is there a risk of cannibalization between the business segments? Not really, if managed with care. For instance, it could make sense to offer a leasing plan to a person who is a frequent user of the company’s car-sharing program. In addition, through customer life cycle management, the company can focus on how best to appeal to a customer as he moves from one mobility segment to another, due to budget and lifestyle changes. Regardless of the scenario, it is vital to provide the person with the ability to easily access information about the different options available through integrated websites and customer portals, as well as seamless customer account access.

Operational Integration

How far the actual operating models should be integrated will vary. Of course, a mobility business unit needs to capitalize on the synergies provided by its larger parent. These synergies should at least match the conditions offered by a non-captive rental rival. Often, however, despite being a part of the overall company, mobility units receive lower discounts than large external customers. This is shortsighted, since preventing customers from moving to an intermediary can help maintain market power and customer access. It also helps safeguard downstream profits from financing, after-sales, and remarketing. Another factor to consider is that some non-captive mobility providers are both competitors and important customers for the parent company’s vehicles. Situations like this require a delicate balance to both build a strong captive mobility position as well as to keep non-captive sales channels open.

The operational integration between a mobility unit and the core business must be managed pragmatically. The closer the mobility unit gets to the core, the better synergies should be in areas such as joint marketing, financing, and service. The risk of getting too close to the core is that mobility units often require different talent as well as the agility of a smaller unit. There will always be mobility units that need to keep a greater distance from other parts of the business – such as venture funds that invest in existing mobility start-ups. Exchange of customer data might make sense when seeking to provide the previously mentioned joint offers, but these must be limited based on customer preferences as well as legal requirements.

A potential bold move that the organization could make is bundling its mobility and downstream units. This would give the mobility unit more weight within the organization. Despite their high visibility and strategic importance, mobility businesses often lack the influence to push for their interests within the organization. Joint management can increase decision-making power and enable economies of scope. In addition, bundling of the various mobility units can enable streamlined management of mobility offers. Due to the high speed of development – including short test-and-learn cycles – it is not uncommon for an automaker’s mobility units to compete for the same customers. Closer integration in these situations would encourage better cooperation so that clear roadmaps can be developed that best support the automaker’s mobility value proposition.