This report was written in collaboration with WilmerHale.

There is serious risk of organizations underestimating the level of effort required to implement the SEC swap dealer rules due to a misperception that this is only a small incremental addition to the existing program. The purpose of this article is to provide guidance on how to approach the journey to implement the SEC swap dealer rules, and to serve as a catalyst for action

The Securities and Exchange Commission (SEC) security-based swap dealer (SBSD) rules have finally been issued, and a large amount of work will be required to comply. The good news is there is a foundation to build on, given that Commodity Futures Trading Commission(CFTC) swap dealer programs are now relatively mature at most organizations. However, there is serious risk of organizations underestimating the level of effort required to implement the SEC swap dealer rules due to a misperception that this is only a small incremental addition to the existing program. The purpose of this article is to provide guidance on how to approach the journey to implement the SEC swap dealer rules, and to serve as a catalyst for action.

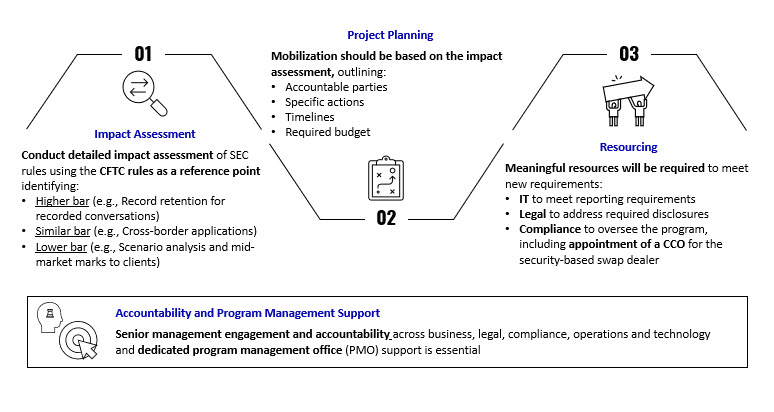

At the outset, it is critical to ensure appropriate senior management engagement across business, legal, compliance, operations and information technology (IT) functions. Dodd-Frank fatigue is a real risk, and competition for scarce resources in the current environment is fierce, so appropriate resourcing for this effort likely will be a challenge. Accordingly, responsible stakeholders (for example, compliance and legal teams) must develop a clear narrative for senior management and provide a realistic assessment of what will be necessary to implement the new rules despite these headwinds. It is important for senior management to understand this is not a “compliance only” exercise, where all that is necessary is an updated compliance manual. The effort will require business sponsorship, meaningful IT resources to meet the new reporting requirements and legal resources to address the new required disclosures. It may also require additional staff in compliance to oversee this program, including the appointment of a chief compliance officer (CCO) for the SBSD program and resources to support the CCO. As some firms learned the hard way with respect to the CFTC swap dealer rules, poor project planning and shoddy implementation can result in substantial enforcement cases and fines (for example, numerous trade reporting cases). Firms must act now to actively avoid these mistakes with respect to implementing the SEC SBSD rules, which ultimately pose similar risks.

It is also essential that firms mobilize a project structure to accommodate the governance, people, processes and technology necessary to accomplish the broad variety of requirements of these rules in a timely fashion. In addition to appropriate representation from senior stakeholders, dedicated project management oversight is essential for a project of this breadth and complexity. The project governance must ultimately be accountable to a senior management body (for example, an executive committee, senior change forum) for appropriate visibility, escalation paths and funding. We observe that some firms have been slow to mobilize given the timelines provided by the SEC (for example, registration date of October 2021), especially in comparison to the CFTC implementation timelines, which were much more aggressive. Certain key elements of many firms’ compliance programs also will require planning and engagement with the SEC. For example, the internal capital model approval process can take quite a long time, and the number of firms now needing to obtain model approval is bound to test the SEC’s resources. The SEC has warned prospective registrants to reach out to the SEC staff “as early as possible in advance of the registration compliance date to begin the model approval process (see note 1)." Note that once a model is approved (or conditionally approved), firms will need time to tailor technology, recordkeeping, reporting and capital computations to the requirements of the approved model.

Implementation of the SEC swap dealer rules will require a detailed impact assessment at the rule provision level, boiling down the requirements to determine the policy, process and technology impacts. Firms are not working from a blank slate and can use their current CFTC swap dealer program as a reference point and drive actions based on the key differences. Some of the SEC rules will set a higher bar (for example, record retention for recorded conversations), a similar standard (for example., cross-border application) or a lower bar (for example, offering scenario analysis and mid-market marks to clients) than the CFTC rules, which may be a useful way of articulating the program of work to senior stakeholders. The impact assessment then should feed a detailed action plan with accountable parties, specific actions and timelines and should enable the development of a budget for the project. This article is intended to serve as a reference tool for kicking off the gap assessment and project planning work.

NOTES:

1. Capital, Margin, and Segregation Requirements for Security-Based Swap Dealers and Major Security-Based Swap Participants and Capital and Segregation Requirements for Broker-Dealers, 84 Fed. Reg. 43872, 43901 (August 22, 2019).