This article was first published on April 2, 2020.

COVID-19 has created unprecedented business and regulatory disruption in a condensed period. There are massive changes to how financial institutions operate, what regulators and supervisors expect, in addition to significant economic impacts on society, businesses and individuals.

The pandemic’s effects have triggered extensive government action including the largest ever peacetime stimulus package in the US — the Coronavirus Aid, Relief and Economic Security (CARES) Act.

Our new paper helps Compliance teams set up a dynamic process for identifying emerging and intensifying risk.

Compliance teams need to quickly pivot and consider the risks and challenges created by these rapid and radical changes

THE NEW NORMAL

Compliance, like other functions at most financial institutions, are now fully engaged in managing the day-to-day firefighting. However, in periods of disruption, new risks can appear quickly, and existing risks can materialize into real problems as control structures no longer operate optimally.

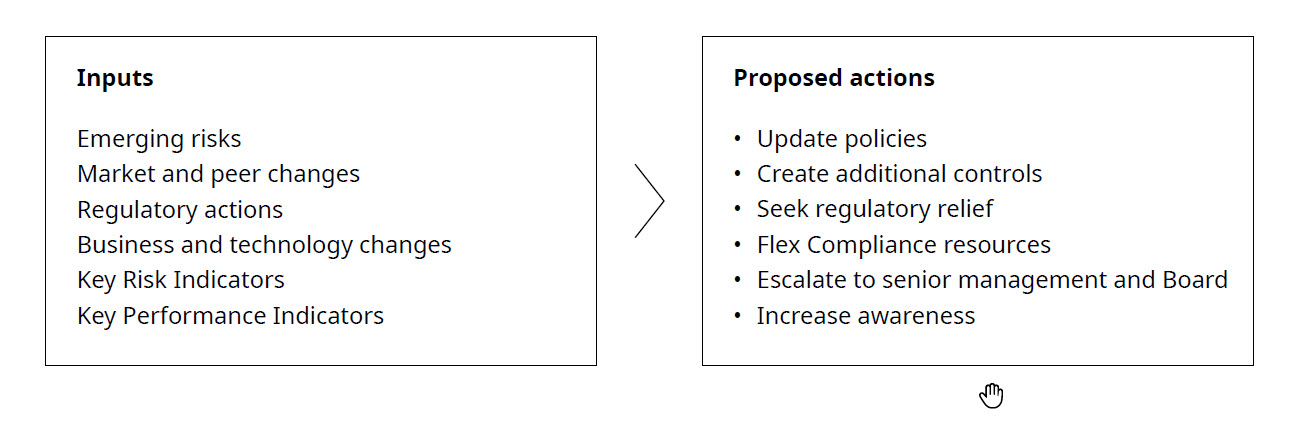

Compliance teams need to quickly pivot and consider the risks and challenges created by these rapid and radical changes. It is imperative for Compliance to perform a frequent and dynamic (non-formalistic) risk assessment in order to quickly understand the new circumstances and address the risks in a holistic way. This process involves a deliberate assessment of risks based on changes in the environment (for example, business, technological and regulatory) and a nimble way for the Compliance program to manage the changing risks through expedited actions (for example, seeking relief from regulators, updating policies and controls, and escalating issues).

While it is challenging during a crisis to pull together teams and relevant information for informed and structured conversations about new and emerging risks, it is ultimately more costly to rely on ad hoc decision-making in rapidly changing circumstances that, with the benefit of hindsight, do not look well considered.

DYNAMIC RISK AGENDA (EXAMPLE)

GET STARTED.

During these uncertain times, it is critical to be practical and focus on what matters. Compliance will be called upon to make decisions quickly and will need to be flexible in the way it deploys its team and works together with the business. Deploying a frequent and dynamic risk assessment can greatly assist with the ability to respond. Clear and rapid pathways for communication and escalation are also critical as this becomes a new normal.

While regulators have provided relief in many areas to financial institutions during this period, it is essential that Compliance continues to frame its interactions with the business in a manner that supports the firm’s overall culture of compliance. By adapting quickly and planning for the new and emerging risks and challenges, Compliance teams can help mitigate risk and support business strategy for organizations to successfully navigate this crisis.

RELATED INSIGHTS

-

Read More

Read MoreInsights Growing Expectations (And Risk) for Financial InstitutionsData Privacy

-

Read More

Read MoreInsights Each year, most financial institutions spend significant time and resources on the compliance risk assessment process. However, many executives still feel that they repeat the same labor-intensive process for marginal benefit.Compliance Risk Assessment