This article was first published on May 1, 2020.

On April 30, 2020, the Federal Reserve revised and expanded the $600 billion Main Street Lending Program for small and medium-sized businesses affected by COVID-19. The minimum qualification rules and loan offerings have been modified to help businesses participate and avail credit at below market rates. The objective of the program is to offset a contraction in the availability of credit for such borrowers.

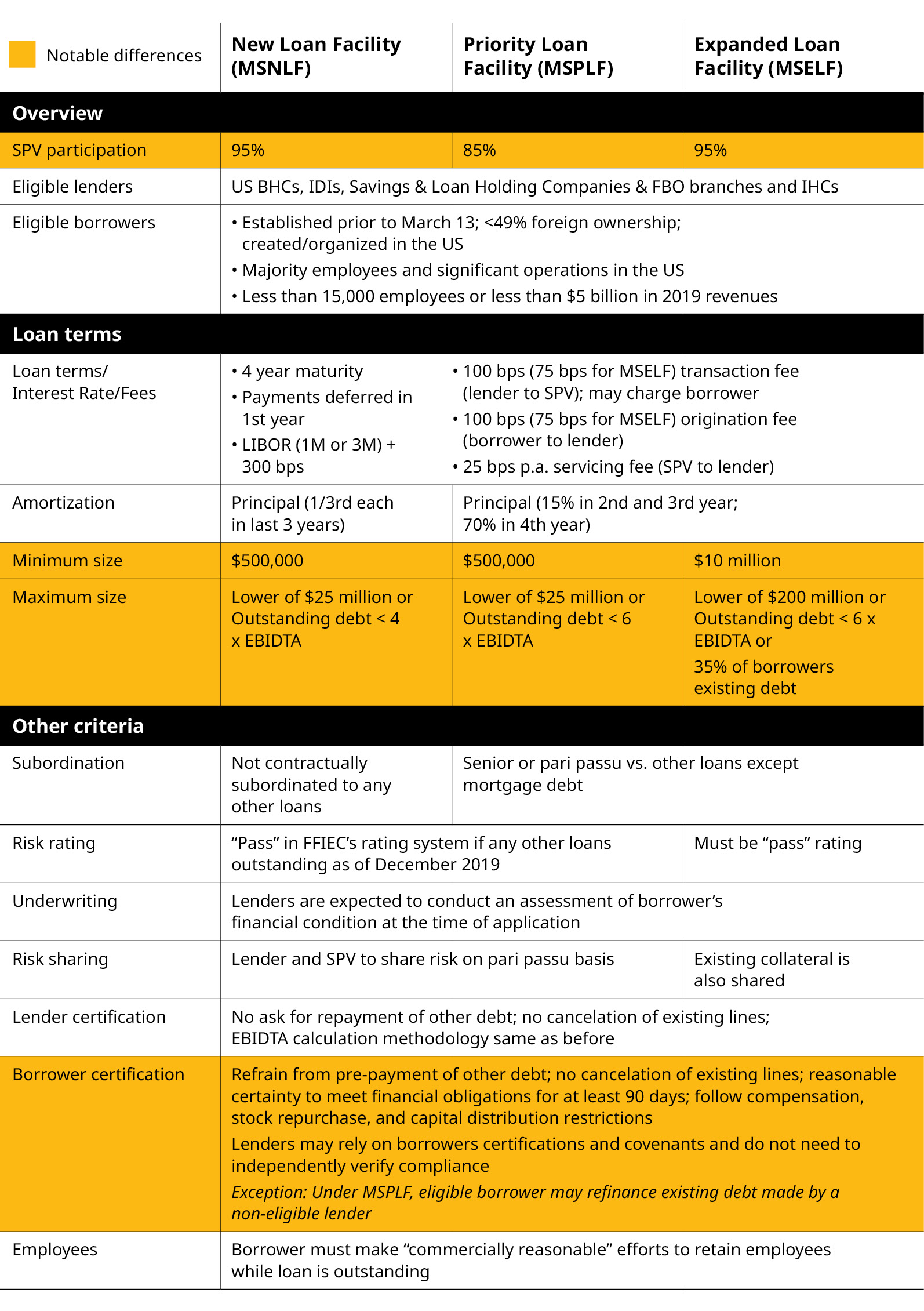

To implement the program, the Federal Reserve will finance a special purpose vehicle purchase (SPV) to purchase 85-95 percent of participations in loans originated by banks to small and medium-sized businesses—up to $600 billion dollars. These loans will be provided under three facilities: Main Street New Loan Facility, Main Street Priority Loan Facility and Main Street Expanded Loan Facility. With the Main Street Lending Program, loan payments can be deferred during the first year but must be repaid, and are thus not forgivable unlike the recent Paycheck Protection Program.

We are hearing from our clients about the myriad of benefits and challenges of the program and, of course, keeping an eye on the abundance of media attention on this topic. As there are several decisions that lenders will need to take upfront, mainly around their credit risk appetite and the underwriting processes, we have put together a series of considerations and immediate actions for lenders.

KEY QUESTIONS FOR LENDERS TO CONSIDER

How much more credit risk are lenders willing to take? (click here)

- Do we lend only to our existing clients ("good before-good now" or "good before-questionable now")?

- Do we lend only in select sectors that are more likely to recover and exclude some sectors altogether?

- Do we lend based on borrower’s prior and current risk rating? Can we “pre-approve” based on risk rating and known conformity to the Main Street Lending Program limits—Total "debt" to the "earnings before interest, taxes, depreciation, and amortization" (EBITDA) based on 2019 EBITDA?

- What underwriting guidelines should we set? Do we relax these guidelines vs. regular underwriting standards?

- How do we determine that the borrower will return to positive cash flow and postive earnings, and be bankable post this crisis?

- Should we lend (with support from the Federal Reserve on a large portion of the loan) to prevent a default in the near-term and hope for future recovery?

Is there a need to simplify and speed up the credit underwriting process? (click here)

Lenders should consider the following questions:

How should we streamline our credit underwriting and approval process to ensure speed, scale and access to our clients, in a way consistent with the program’s objectives?

- In addition to 2019 financial statements, what other information do we need? What type of updated information do we need to assess the borrower’s current financial condition?

- Do we need to run the risk rating again? Recent financials may not be reflective of the current stress.

- Do we need a detailed review of financial statements or can we perform a quick spot check?

- How can we accelerate the eligibility verification and attestation process?

- How can we ensure there is an audit trail for loans made by us under this program?

- Should we conduct an audit on our process to ensure we are compliant?

In less impacted sectors, how should we balance the Main Street Lending Program vs. bank loans to good risk clients? (click here)

Lenders should consider the following questions:

- For clients with strong risk profiles and less COVID-19 impact or less COVID-19 related uncertainty, how should we approach the question of whether to lend under the Main Street Lending Program?

- Should we present all lending options to clients and let them choose?

FIVE IMMEDIATE ACTIONS FOR LENDERS

Lenders must mobilize a discrete set of “must-do” activities with a high degree of coordination across the organization.

1. UNDERSTAND THE ECONOMIC IMPACT OF THE PROGRAM (click here)

- To understand the economics of the Main Street Lending Program, lenders should consider differences with typical bank loans and its impact on lending capacity and loan-level economics.

- Lenders should assess credit risk appetite to identify key risks associated with the program and build a risk appetite (for example, exposures, industries, borrower credit and liquidity profile pre- and post-COVID).

- To understand the related considerations for the lender and borrower, lenders should assess the impact on existing portfolio and incremental capital requirements, as well as the restrictions that apply on the borrower.

2. SHORE UP OPERATIONS AND PROCESSES (click here)

- Develop swift and automated process: Develop an agile credit application/approval process; automate decisioning wherever possible; consider pre-approvals for select industries and loan amounts.

- Define criteria for loan verification and compliance: Develop attestation templates and automate data interfaces with third-parties and the government for information collection.

- Ensure LIBOR loans have fallback language which can be implemented post-cessation.

3. PROACTIVELY MANAGE COMMUNICATIONS (click here)

- Manage executive communications by developing a “business-case” and agree on firm’s risk appetite.

- Extensively provide training to the relationship managers based on the revised processes and underwriting standards. Also provide guidance on helping clients to navigate the various funding alternatives available.

- Prepare for external communications by developing FAQs and talking points for relationship managers to communicate with clients; set up a subject matter expert (SME) panel for targeted Q&As; and consider pre-approvals for certain clients.

5. MOBILIZE A CREDIT WAR ROOM (click here)

- Tailor existing credit governance by identifying critical actions and accountable executives for the Main Street Lending Program-specific items.

- Centralize response and decision making by considering credit view across the full lending portfolio (existing, renegotiated, Paycheck Protection Program, and Main Street Lending Program).

HOW OLIVER WYMAN CAN HELP LENDERS

We have unparalleled expertise in credit risk and hands-on experience dealing with the financial implications of COVID-19. Our suite of tools can be used to help lenders forecast macroeconomic, sector-specific, and name-level outlook. Please reach out for more information.

MAIN STREET LENDING PROGRAM TERMS (as of April 30, 2020)

There are several subtle nuances across the three facilities—New Loan Facility (MSNLF), Priority Loan Facility (MSPLF), Expanded Loan Facility (MSELF)—in terms of special purpose vehicle purchase (SPV) participation, loan size and borrower leverage.