This article was first published on May 13, 2020.

The impact of Coronavirus (COVID-19) on the Australian small and medium enterprises (SME) insurance industry is already being felt. According to Insurance News, an estimated reduction of approximately 30-40 percent in new business enquiries, 10 percent in renewals, and an increase in policy cancellations by up to 50 percent has already taken place.

This is unsurprising as SMEs face an extended period of subdued cash flows, and will be looking to right size their coverage in-line with the new operating reality (for example, shop owners needing less liability insurance). The lucky few that have been able to pivot their businesses online are faced with new risks, such as greater cyber risk associated with online payments that have been hastily setup.

While there remains a period of uncertainty and the exact impact unknown, the responses from carriers and brokers to date (premium deferrals, refund of unused premiums) are prudent. Our belief is that carriers and brokers should be prepared for the recovery, and pre-empt possible permanent changes in SME insurance needs.

SMEs that can will be digitizing their business practices to limit the impact of the virus (for example, fitness instructors streaming classes, restaurants taking advantage of food delivery, and pharmacies digitizing their orders). These SMEs are likely to adopt the new ways of working into other aspects of their business, such as administration. As a result, there is a high likelihood that customers will emerge from the pandemic demanding a better insurance experience. We see this happening primarily on two fronts:

Greater availability of digital channel to complement existing face-to-face channels: Not only for lower order administrative tasks, such as amending cover limits, but potentially also higher value tasks such as taking up new insurance covers.

Greater product personalisation and flexibility: Savvier policyholders are likely to seek greater alignment of their coverage to their business. The nature of this will vary for different types of cover. For example, reducing public liability as greater sales volumes shifts from physical stores to online, which could also be done dynamically. Whereas, trade credit will be less dynamic but more predictable in-line with seasonality of business volumes.

These are not new challenges to the industry, with carriers across the globe regularly grappling with the need to digitize and modernize their business practices, but often choosing to stay the course due to prioritization of other initiatives. Large broker platforms are already deep into a digital arms race, ramping up investments in digital to broaden their offerings to enable network growth.

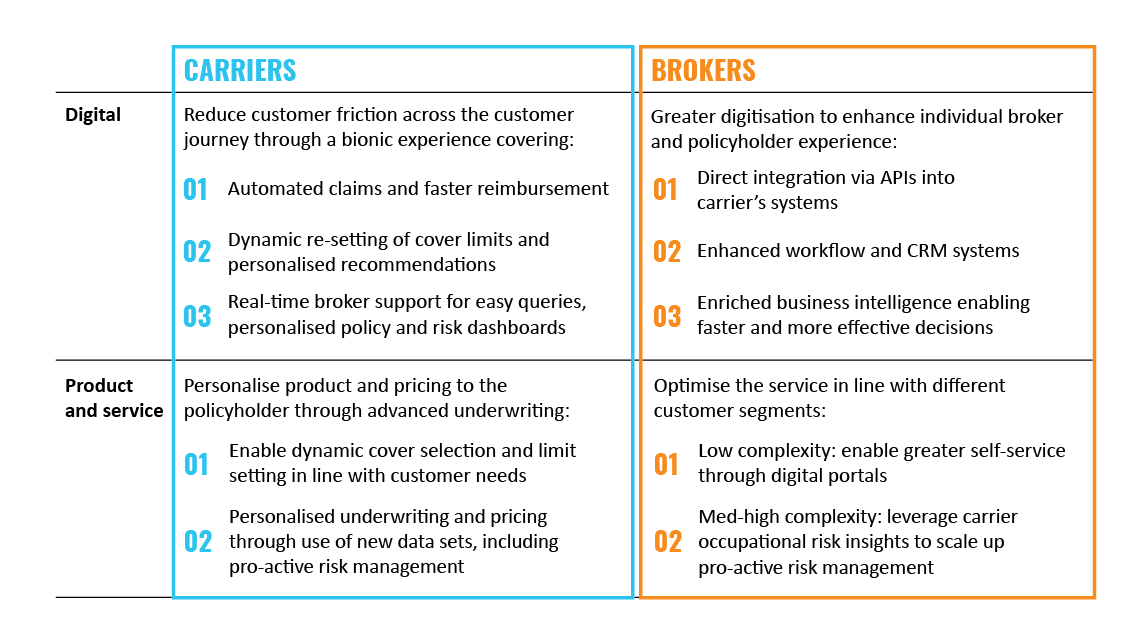

But as the COVID-19 haze lifts and the full economic impact is felt (brokers are expecting reduction in top line revenue by as much as 20 percent1), we believe carriers and brokers will have no choice but to keep pace with shift in customer behaviors, while optimizing their businesses. This is likely to happen on two fronts. First, digitizing their business and operating models to be more resilient in downturns; and second, ensuring they have flexible propositions (product and service) to more seamlessly respond to customers’ changing needs.

We propose a series of levers on both fronts for brokers and carriers, some of which will require greater collaboration between both.

1 Macquarie bank analyst research, April 2020

Although the impact of the pandemic is yet to be known, it is likely to usher in a new set of behaviors from SMEs that will mean a shift in how they consume insurance going forward. The winning formula to respond may necessitate greater collaboration between carriers and brokers, built on shared understanding of customers and working together to test and learn new insurance solutions.